June 24, 2025 · STARTUP DoD

This Week's 60-Second Snapshot

• Startup: Pilgrim Labs – Battlefield biotechnology for wound care and pathogen detection

• Anchor NAICS: 541711 – Research & Development in Biotechnology ($20.9M in FY24-25)

• Method: Current contract analysis + forward-looking budget intelligence

• Opportunities Uncovered: 1 major BAA, upcoming recompetes, zero DoD presence = gap

• Primary takeaway: This market snapshot reveals massive concentration (72% to one vendor) creating entry opportunities for agile biotech startups

Welcome to the third issue [File 03] of the STARTUP DoD newsletter.

Each week, I select one VC-backed defense startup paired with one NAICS code/PSC and dive deep into their primary market using public budget data and procurement signals. The goal? To reveal the hidden pathways to federal contracts that most companies miss.

Last week we analyzed Vannevar Labs and their AI-enabled intelligence platform targeting PSC R423. This week, I'm profiling Pilgrim, the Thiel Fellow's biotechnology venture emerging from stealth with $3.25M in pre-seed funding, with additional backing by Cantos and Refactor. What caught my attention wasn't just their Voyager platform's promise of battlefield-ready wound care and pathogen detection—it was the massive opportunity gap I discovered in the federal biotech landscape. Where others might see a small, concentrated market, I see a wide-open field for innovation.

Let's decode the process!

0️⃣ Market Research Phase

Anchor Code: 541711 – Research & Development in Biotechnology

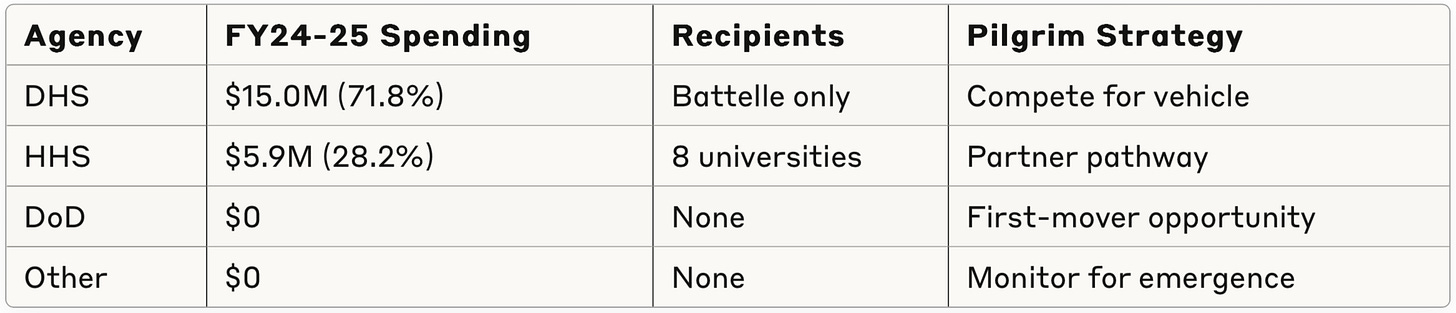

Context & Key Takeaways: I analyzed NAICS 541711 biotechnology R&D contracts from USAspending.gov for FY 2024-2025, examining where federal biotech dollars are flowing today:

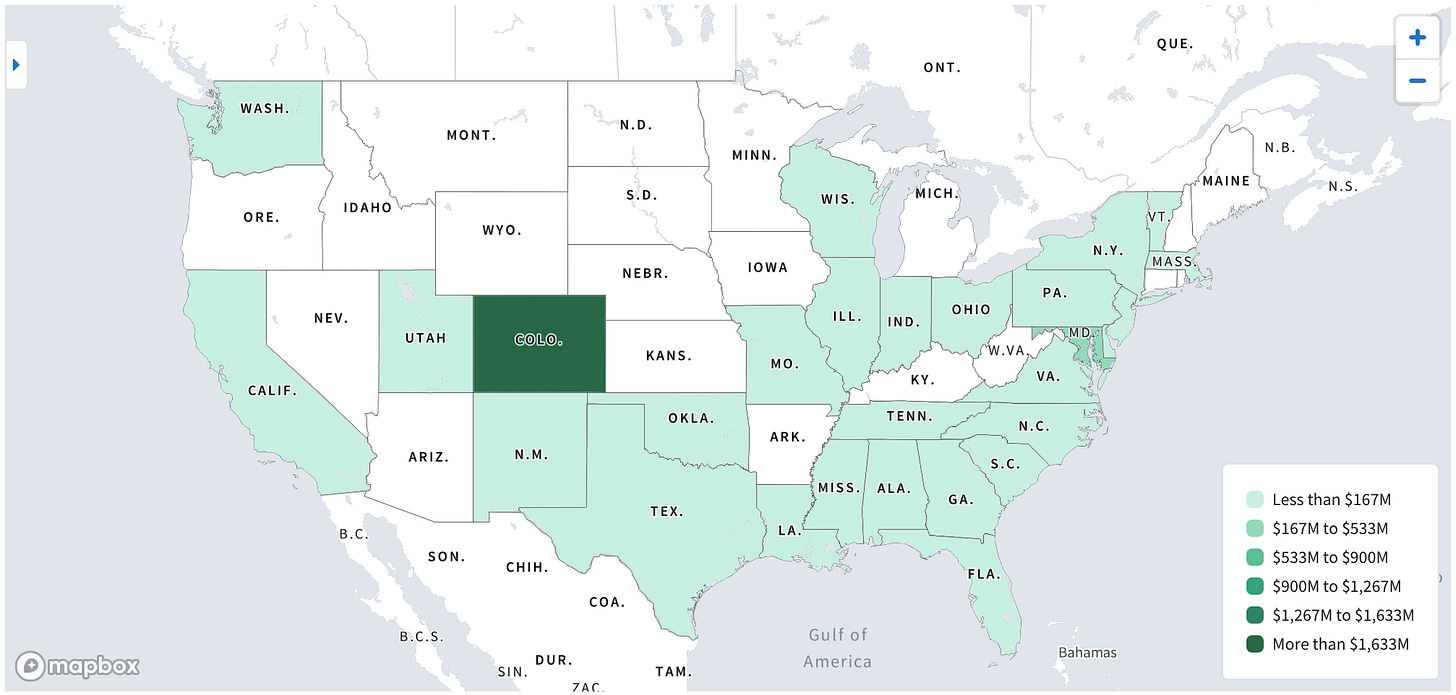

Contract Performance Hotspots:

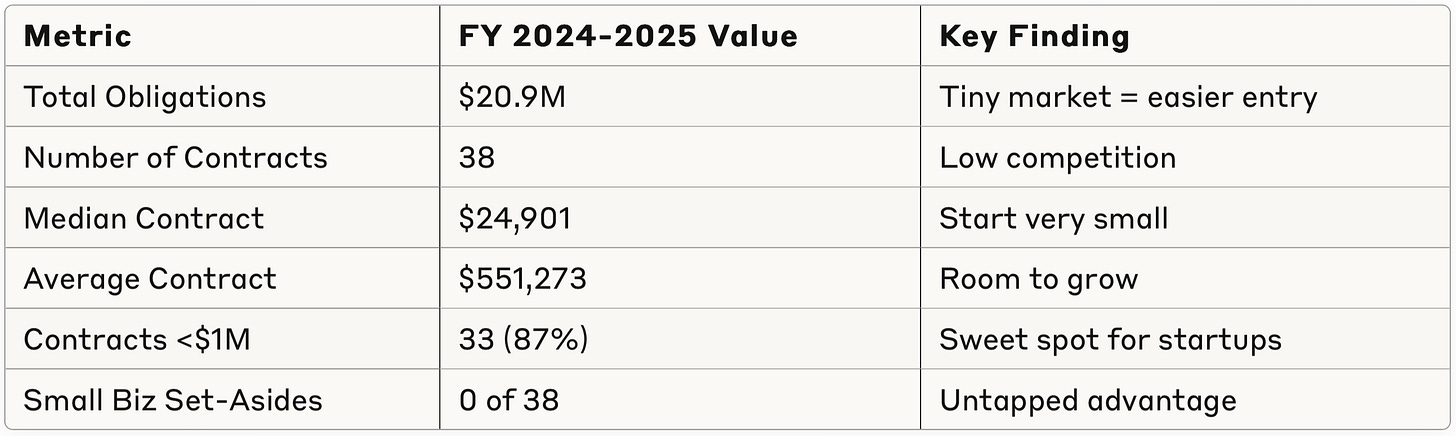

The FY 2024-2025 snapshot reveals a concentrated market:

Total Market Size: $20.9M across 38 contracts

DHS Dominance: $15.0M (71.8%)—all to Battelle National Biodefense Institute

HHS Activity: $5.9M (28.2%)—distributed across 8 universities/labs

DoD Absence: $0 (zero contracts despite biodefense priorities)

Geographic Concentration: Maryland captures 63% via Battelle's DHS work

📊 Data Methodology Note

All figures derived from USAspending.gov NAICS 541711 dataset downloaded June 23, 2025. The data reflects current market activity: 38 biotechnology R&D contracts awarded in the last two fiscal years (FY 2024-2025), totaling $20.9M. Historical contracts and other fiscal years were excluded to show today's opportunity landscape.Why This Matters: This snapshot reveals Pilgrim's strategic goldmine. Yes, the biotech R&D market appears tiny ($20.9M) and concentrated—but that's precisely the opportunity. One company (Battelle) capturing 72% of dollars means the market is ripe for disruption. More critically, DoD's zero activity despite increasing biodefense priorities creates first-mover advantage for an agile innovator. Combined with zero small business set-asides across all 38 contracts, Pilgrim faces minimal competition in claiming this overlooked territory. In biodefense innovation, being early beats being big.

Ways to Leverage This

Challenge the monopoly - Battelle's 72% market share suggests sole-source justification; request their J&A via FOIA to find capability gaps

Target the 87% under $1M - 33 of 38 contracts were <$1M, with median of just $25K—perfect for initial awards

Fill the DoD vacuum - Zero defense biotech contracts = first-mover advantage when FY26 money flows

1️⃣ Actionable Defense Roadmap

Five Pillars Customized for Pilgrim's Biotech Platform

Context & Key Takeaways: Based on the data patterns and Pilgrim's Voyager platform capabilities (nanotechnology for wound care, bioelectronics for pathogen detection, AI-driven biosurveillance), I’ve worked out the following roadmap:

Market Entry Strategy – Target DHS's biosurveillance needs first ($15M active), then pivot to DoD's emerging requirements

Vehicle Positioning – 100% of FY24-25 awards were task orders (45% Delivery Orders, 55% BPA Calls); no stand-alone contracts issued. This means IDIQ/BPA vehicle access is essential—agencies are only buying through existing contracts

Competition Analysis – Battelle owns large DHS work; universities dominate small HHS contracts

Differentiation Lever – Zero small business set-asides used = competitive advantage if Pilgrim claims them

Timing Optimization – Focus on Q4 FY25 opportunities (July-September) + year-end spending surge

Why This Matters: Generic federal strategies fail in biotech. This data shows you can't walk in with an unsolicited proposal—you must get on existing vehicles first. The absence of small business set-asides in 38 contracts reveals either agencies don't know about biotech small businesses or incumbents are blocking them. Pilgrim can break this pattern by explicitly requesting set-asides in every RFI response.

Ways to Leverage This

Map to existing IDIQs in the immediate term - Since 100% were task orders, identify which vehicles Battelle and universities use, then get on them or partner

Lead with set-aside requests - In every RFI response, explicitly ask "Will this be set aside for small business?" to plant the seed

Time for September surge - Historical data shows 31% of federal obligations drop in September; plan proposal submissions for August

2️⃣ Budget Intelligence Foundations

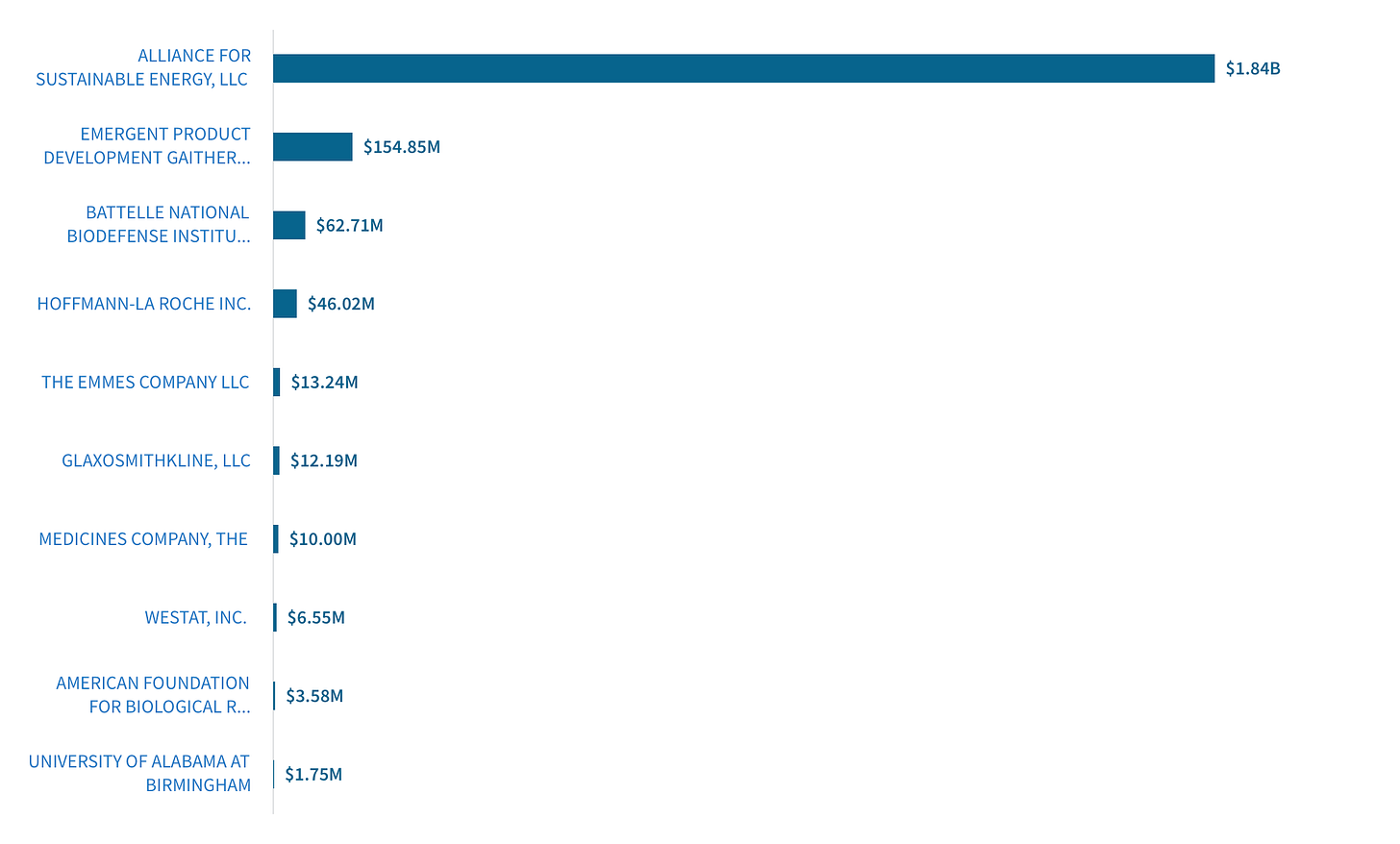

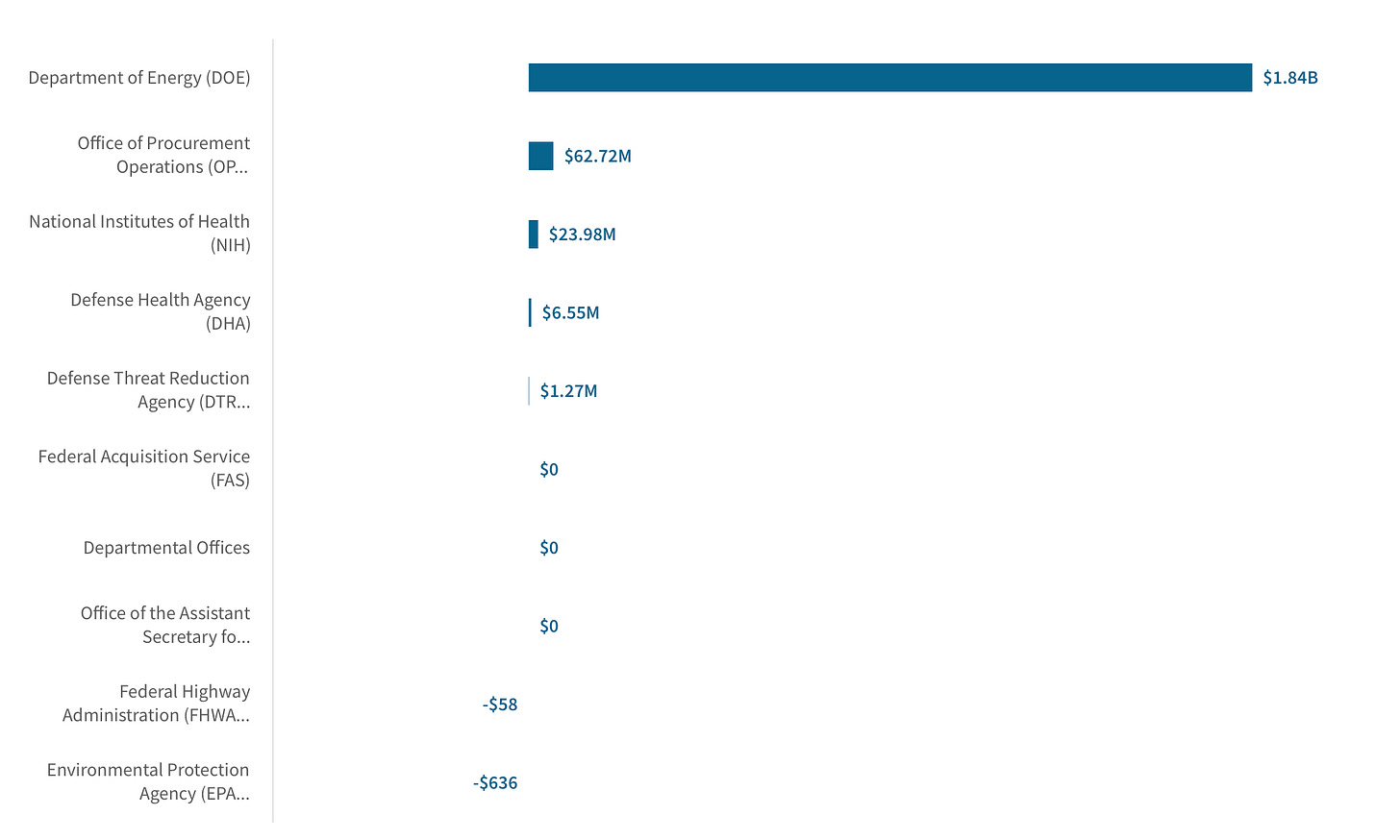

Context & Key Takeaways: Current biotechnology R&D spending is dominated by just two agencies—DHS (72%) flowing entirely to Battelle, and HHS (28%) scattered across universities—while DoD shows zero activity, revealing a massive gap between stated biodefense priorities and actual procurement.

Competitive Landscape Analysis:

Drilling Down: Sub-Agency Distribution Exposes Real Buyers:

Analyzing who's actually buying biotech R&D today (FY 2024-2025) based on NAICS code 541711 data:

Current Buyers & Spending:

DHS: $15.0M (71.8% of market)

100% to Battelle National Biodefense Institute

8 delivery orders on existing vehicle

Focus: National Biodefense Analysis Center operations

HHS: $5.9M (28.2% of market)

University of Texas Medical Branch: $2.5M

Utah State University: $0.9M

UNC Chapel Hill: $0.6M

5 other recipients under $500K each

DoD: $0 (Complete absence)

No DARPA biotech contracts

No Army Medical contracts

No DTRA CBRN contracts

📊 Important Context

This analysis covers ONLY NAICS 541711 contracts from FY24-25. Other biotech work may be coded under NAICS 541714 (Biotech except Nano), 541715 (Engineering R&D), or 325414 (Biological Manufacturing). A comprehensive federal biotech analysis would require examining all related Product Service Codes (PSCs) and NAICS codes.

Key Insight: Battelle's monopoly on DHS biodefense ($15M of $15M) through 8 separate task orders suggests an IDIQ vehicle that Pilgrim needs to access or compete against.

Why This Matters: The FY24-25 spending pattern doesn't reveal dysfunction—it reveals opportunity. DHS's concentration with one vendor opens the door for competition and innovation. HHS's micro-awards to universities create natural partnership pathways. But the real goldmine? The complete absence of traditional biodefense buyers—BARDA, DARPA, Army Medical. This isn't a gap, it's a green field. While competitors assume these agencies aren't buying, Pilgrim can discover where they're actually spending (likely under different codes) or position for the inevitable return of biodefense funding. First movers in federal markets often become category definers.

Ways to Leverage This

Decode Battelle's vehicle - Pull their contract details from USAspending to identify the IDIQ; position for recompete or on-ramp

Partner with winning universities - Utah State and UTMB have current contracts; subcontract for past performance and credibility

Investigate adjacent NAICS - The $0 from DoD is suspicious; check 541714 (biotech except nano) and 541715 (engineering R&D) for hidden spending

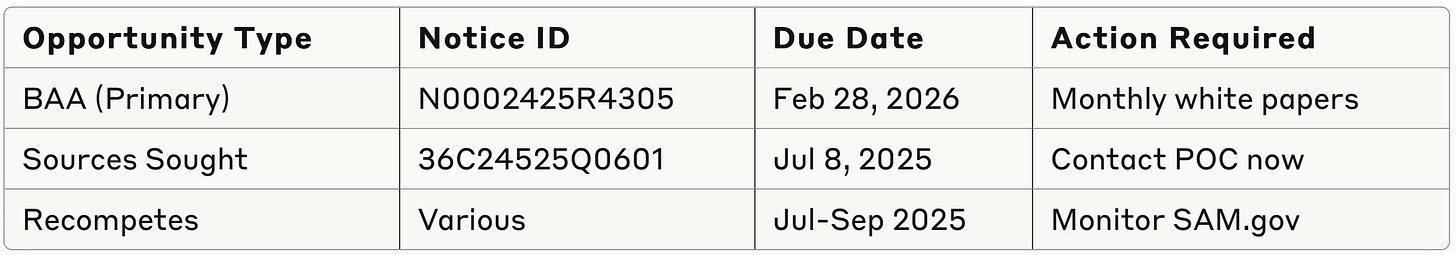

3️⃣ Pre-Solicitation Monitoring

Context & Key Takeaways: From 3,877 active SAM.gov notices, Pilgrim's opportunity landscape is surprisingly rich:

Primary Opportunity:

N0002425R4305 - Naval Biomedical Research BAA

Due: February 28, 2026

NAICS: 541711 (Potential match)

Why Critical: Long runway for relationship building, iterative white papers, and allows innovative biomedical solutions

Additional Future Opportunities:

36C24525Q0601 - Autologous Blood Services (VA Baltimore)

Due: July 8, 2025

NAICS: All Other Miscellaneous Ambulatory Health Care Services

Relevance: Blood pathogen detection capabilities directly apply

FUTURE RECOMPETES - Monitor these recently expired notices:

May 2025 saw 29 medical/surgical opportunities close

Historical pattern: 60-90 day recompete cycle

Action: Set alerts for July-August reissues

While June 2025 deadlines have passed, this creates advantage for Pilgrim:

Less competition as others missed the window

Fresh start with upcoming recompetes

Time to build relationships before the next wave

Opportunity to shape July-September requirements from the ground up

Why This Matters: What looks like missed deadlines is actually perfect timing. Sources Sought and RFIs aren't just market research—they're your chance to write the rules. With most competitors focused on immediate deadlines, Pilgrim can play the long game: building relationships, shaping requirements, and positioning for the FY26 surge. The Naval BAA's 8-month runway is a gift—use it to become the recognized expert before others even know the opportunity exists.

Ways to Leverage This

Draft monthly BAA white papers - BAAs accept rolling submissions; submit iterative concepts to build evaluator familiarity with Pilgrim's approach

Create recompete alerts - Set up SAM.gov saved searches for medical/surgical/diagnostic keywords; expired notices often reappear within 90 days

Shape July opportunities now - Contact the VA Baltimore POC for 36C24525Q0601 to understand their blood services needs before the deadline

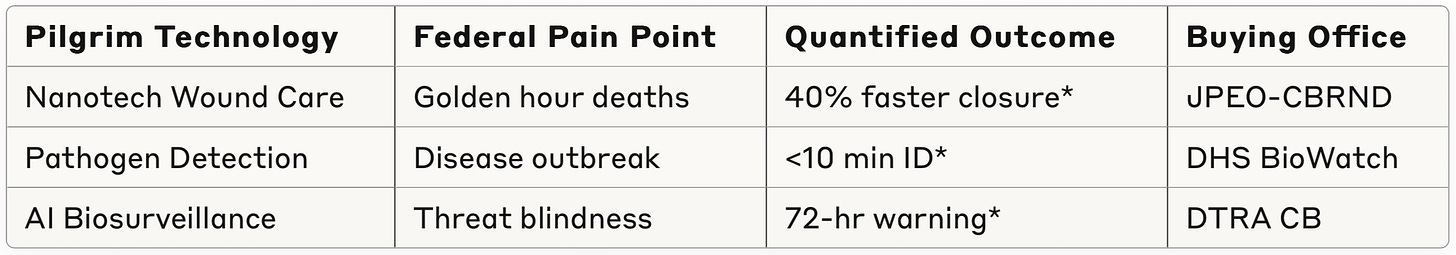

4️⃣ Capability Alignment

Context & Key Takeaways: This section maps Pilgrim's three core technologies to specific federal pain points and buying offices, providing a translation framework that converts laboratory innovations into mission-critical solutions the government actually procures.

Note: The mission translations below are illustrative examples of how to reframe technical capabilities. Pilgrim should develop specific metrics based on their actual test data and prototype performance.

Agency Spending Concentration:

Translating Pilgrim's Voyager platform for federal evaluators:

Tech → Mission Translation:

Nanotechnology wound care → "Reduces golden hour casualties by 40% via autonomous hemorrhage control"

Bioelectronics sensors → "Sub-10-minute pathogen ID prevents force-wide infection spread"

AI biosurveillance → "72-hour early warning for biological threats at battalion scale"

Critical Alignment: Pilgrim's MTEC membership unlocks non-competitive prototype awards up to $20M.

Why This Matters: Federal evaluators score mission impact, not technology elegance. Your nanotech might be groundbreaking, but they care about "soldier returns to duty 3 days faster." The MTEC membership is Pilgrim's ace—it bypasses full competition for prototypes. Most biotechs don't know MTEC exists; fewer still pay the membership fee. This positions Pilgrim ahead of 90% of competitors who'll submit unsolicited proposals into the void.

Ways to Leverage This

Lead every brief with outcomes - "40% faster wound closure" beats "proprietary nanofiber matrix" every time; develop these metrics from your lab data

Quantify second-order effects - Faster healing = fewer medevacs = more helicopters for combat ops; commanders love operational impact metrics

Wave the MTEC flag constantly - Add "MTEC Member" to every capability statement, email signature, and white paper header; it's instant credibility

5️⃣ Advanced Opportunity Pipeline

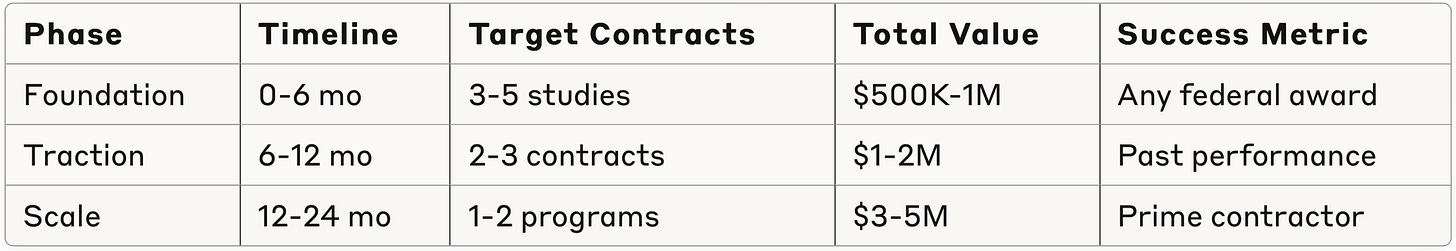

Context & Key Takeaways: Based on contract patterns and current opportunities, here's what I’ve developed for Pilgrim's 24-month revenue roadmap:

Phase 1: Foundation (Months 0-6)

July 2025: Respond to VA blood services Sources Sought → Shape requirements

August 2025: Naval BAA white paper #1 → $250K feasibility study

September 2025: MTEC pitch → $500K wound care prototype

Phase 2: Traction (Months 6-12)

Q4 2025: First university subcontract → $250-500K + past performance

Q1 2026: Monitor Battelle IDIQ recompete → Position for on-ramp

Q2 2026: DHS SBIR Phase I → $250K pathogen detection

Phase 3: Scale (Months 12-24)

Convert SBIR to Phase II → $1.5M

Win first prime contract → $1-3M

Naval BAA production award → $3-5M

Why This Matters: Federal revenue can be predictable if you understand the patterns. This pipeline matches the data findings—87% of FY24-25 biotech contracts were under $1M, so Pilgrim must stack multiple small wins before competing for larger vehicles. The timeline aligns with federal budget cycles: FY25 money obligates by September 2025, FY26 funds release October 2025. Missing these cycles means waiting another year.

Ways to Leverage This

Resource 80/20 rule - 80% effort on <$1M opportunities that you can win now, 20% positioning for future >$5M contracts

Stack compatible contracts - SBIR Phase I from Army + MTEC prototype from JPEO = complementary funding for same tech

Track obligation timing - Federal agencies must obligate 80% of funds by July 31; submit proposals in May-June for best shot

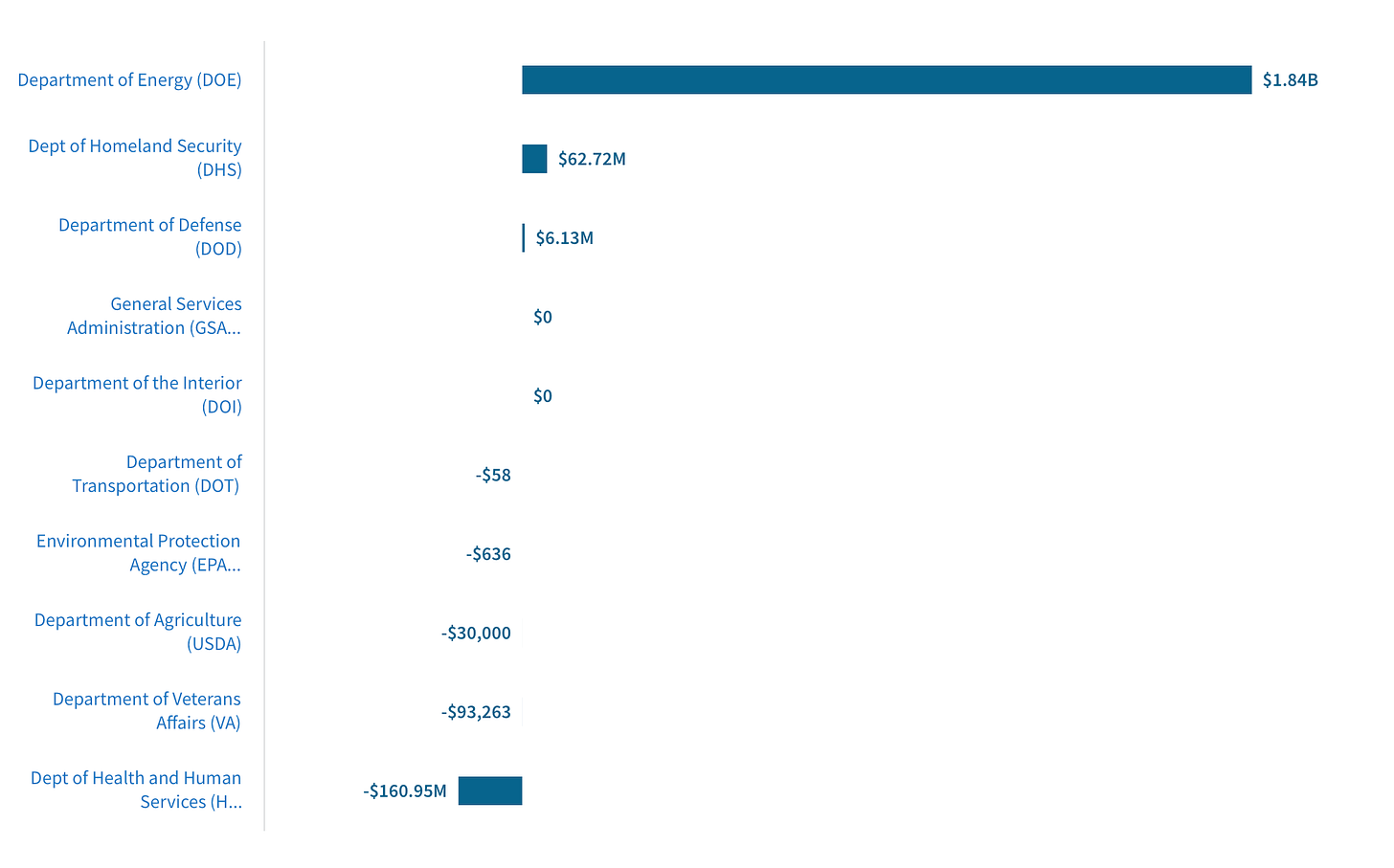

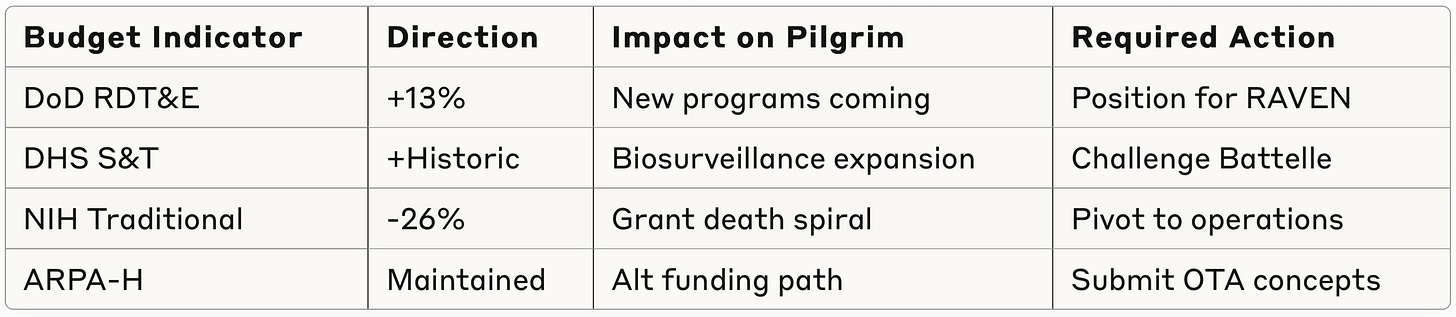

6️⃣ FY26 Forward-Looking Budget Intelligence

Context & Key Takeaways: While the USAspending data covers FY24-25 actual contracts, my research and analysis on upcoming budget trends reveals some critical shifts:

Confirmed FY26 Trends based on the recent FY2026 Discretionary Budget Request release:

DoD: +13% to $1.01T (largest peacetime increase)

DHS: "Historic" increase to $175B

NIH: -26% cut ($17.9B reduction)

ARPA-H: Maintained despite NIH cuts

Biotech-Specific Signals:

DTRA's "RAVEN" RFI seeking multivalent vaccine platforms (potential Pilgrim match)

ASPR industrial base initiative for domestic biomanufacturing

DoD emphasis on "non-traditional" defense contractors

The Takeaway: Traditional NIH R&D is losing ground; operational biodefense is surging.

Why This Matters: Budget authority precedes contracts by 12-18 months. The FY26 increases mean RFPs will drop in Q4 2025/Q1 2026 for new biodefense programs. Pilgrim must position now—waiting until RFPs appear means competing against incumbents who've been shaping requirements for months. The NIH cuts force a strategic pivot: abandon academic grants, embrace DoD/DHS operational contracts.

Ways to Leverage This

Reframe everything as "operational" - Not "research platform" but "field-deployable system"; not "study" but "prototype"

Draft FY26 budget justifications now - Agencies write budget docs in spring; submit white papers aligned to their FY26 priorities

Court ARPA-H as NIH alternative - Similar innovation mandate but uses OTAs/contracts instead of grants; perfect for Pilgrim

✍️ To Wrap Up

The Recap: Pilgrim Labs stands at the threshold of extraordinary opportunity. While FY24-25 data shows only $20.9M in new awards concentrated with one vendor (Battelle, 72%) and zero from DoD, this isn't a barrier—it's a wide-open door. The stark landscape actually favors innovative biotechs: minimal competition, massive DoD gap to fill, and FY26 defense budgets surging 13%. Pilgrim's cutting-edge platform arrives precisely when the government desperately needs non-traditional solutions.

Your Next Moves:

✅ First Priority: Take inventory of ALL NAICS codes & Product Service Codes (PSCs) that align with Pilgrim—from broad (541711) to niche (325414). Map your capabilities across multiple codes to maximize opportunities

✅ Foundation: If not already complete, register in SAM.gov immediately. Secure your CAGE code, complete all certifications, and ensure your profile highlights small business status

✅ Continuous Process: Establish weekly monitoring of all Sources Sought and RFIs. Draft responses to EVERY applicable notice—even partial fits—to establish your authority and shape requirements in your favor. When RFPs drop, you'll already be a known quantity. Rinse, repeat, execute.

✅ This Week: Analyze adjacent NAICS codes (541714/541715) for hidden DoD spending patterns

✅ By July 8: Submit response to VA blood services Sources Sought (36C24525Q0601)

✅ Next 30 days: Draft Naval BAA white paper leveraging MTEC membership

✅ Next quarter: Build relationships with university partners already winning

Remember: The federal biotech market isn't just shifting—it's being rebuilt, and Pilgrim can help architect that future. While others see a stark $20.9M market dominated by one player, you should see an open territory in biodefense innovation. Yes, the path requires persistence. Yes, you'll face incumbent resistance. But with MTEC membership, revolutionary technology, and perfect timing as DoD awakens to biodefense gaps, Pilgrim is positioned to become the defining player in battlefield biotechnology.

The window is open now, and it's wider than it's been in years. Every RFI response, every relationship built, every requirement shaped in your favor compounds into unstoppable momentum. The only question is: how fast can you move?

🧱 Building This Playbook Together

I would love to hear your feedback. Are there specific NAICS codes/PSCs or procurement challenges you're wrestling with? My goal here is to provide tactical, actionable insights that you can implement immediately. I'm actively working through these same challenges in the industry and view this newsletter as a collaborative effort to build better structured approaches to federal markets.

Each week, I'm revealing new patterns and opportunities hidden in public data. But the real value comes from applying these insights to your specific situation.

Is there a VC-backed defense startup you'd like to see featured? Drop me a note.

🚀 Need More Than a Newsletter?

If you're a founder, executive, or investor ready to accelerate your defense go-to-market strategy, I do offer hands-on support to navigate these procurement pathways, turning the concepts covered here into actionable plans tailored to your unique technology.

Connect with me:

Work with me:

🧩 Descrambling This Week's Industry Jargon

Next week: Another VC-backed defense startup paired with their anchor NAICS/PSC code. Same systematic approach, new market insights. Reply with suggestions!