July 02, 2025 · STARTUP DoD

This Week's 60-Second Snapshot

• Startup: CX2 – AI-enabled electronic warfare platform for spectrum dominance

• Anchor PSC: 5865 – Electronic Countermeasures, Counter-Countermeasures, and Quick Reaction Capability Equipment ($4.78B in FY24-25)

• Method: Analyzed USAspending.gov contract data + SAM.gov active opportunities + FY26 defense budget documents

• Opportunities Uncovered: 3,800+ active sources sought requiring systematic filtering, 4 new FY26 budget programs, multiple subagency entry points

• Primary takeaway: Market concentration creates opportunity—no single contractor controls more than 21% of spending, while 65.8% flows through task orders requiring IDIQ access (based on PSC 5865 analysis)

Welcome to the fourth issue [File 04] of the STARTUP DoD newsletter.

Each week, I select one VC-backed defense startup paired with one NAICS code/PSC and dive deep into their primary market using public budget data and procurement signals. The goal? To reveal the hidden pathways to federal contracts that most companies miss.

Last week we analyzed Pilgrim Labs and their battlefield biotechnology platform targeting NAICS 541711. This week, I'm profiling CX2, the 8VC Build Program's fourth defense platform emerging with $46M in funding and combat-proven technology. What caught my attention wasn't just their Ukraine-validated electronic warfare system—it was the massive opportunity I discovered in the federal EW landscape. Where others might see an impenetrable market dominated by primes, I see strategic entry points for innovation.

Let's decode the process!

0️⃣ Market Research Phase

Anchor Code: PSC 5865 – Electronic Countermeasures, Counter-Countermeasures, and Quick Reaction Capability Equipment

Context & Key Takeaways: When I started digging into PSC 5865 electronic warfare contracts, I expected to find a typical defense market—moderate competition, some innovation gaps, predictable buying patterns. What I discovered instead was extraordinary: a $4.78B market experiencing seismic shifts (based on FY24-25 USAspending.gov data through latest reporting). The data revealed something counterintuitive—while the top 5 contractors control nearly 74% of spending, the real story is in the contract vehicle patterns.

With 65.8% of awards flowing through task orders rather than standalone contracts, the market might be telling us something critical: if you're not already on an IDIQ vehicle, you're locked out of two-thirds of the opportunity. But here's where it gets interesting for CX2—the median contract size is just $188K (based on PSC 5865 analysis), meaning companies can build momentum through multiple smaller wins rather than betting everything on mega-contracts. It's a market where vehicle access and consistent execution matter more than landing one massive program.

Geographic Concentration of PSC 5865 Spending

Geography matters in federal contracting. Where contracts cluster reveals both competitive intensity and overlooked opportunities:

The FY 2024-2025 snapshot reveals a concentrated yet shifting market:

Total Market Size: $4.78B across hundreds of contract actions

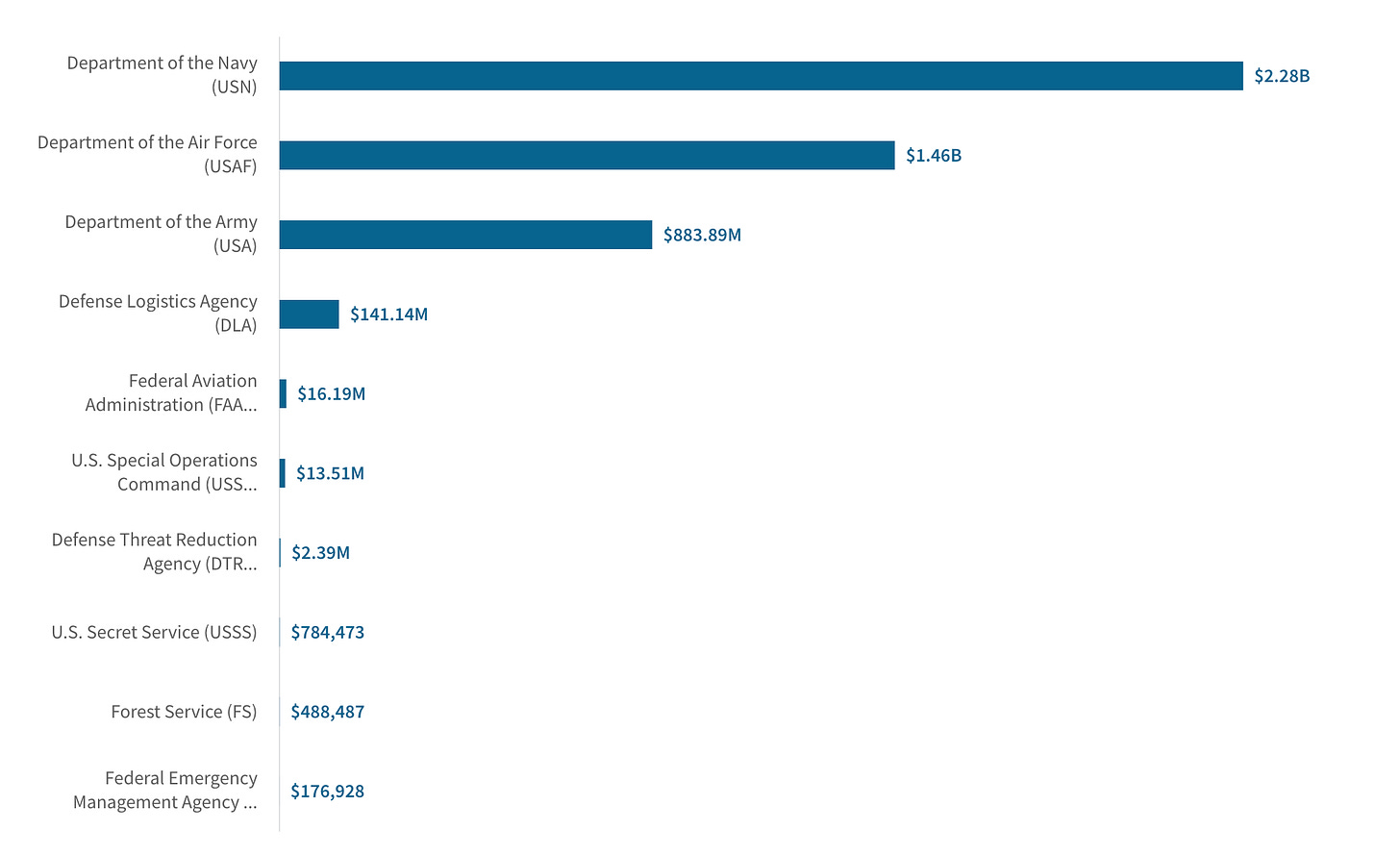

DoD Dominance: $4.78B (99.6%)—compared to just $16.19M from FAA

Contract Mix: 335 task orders (65.8%) vs. 174 standalone contracts (based on PSC 5865 analysis)

Median Award: $188K (but top 10% exceed $50M) (based on PSC 5865 analysis)

Geographic Reality: Top 5 states capture 67% of dollars

📊 Data Methodology Note: All figures derived from USAspending.gov PSC 5865 dataset downloaded June 29, 2025. The data reflects active contract obligations spanning 2024 through June 2025, providing a comprehensive view of current market dynamics. Note that USAspending.gov reporting can lag 30-90+ days behind actual contract awards, so the most recent months may not yet reflect all obligated funds. This analysis captures FY24 and available FY25 data as reported through the system's latest update.

Why This Matters: The dominance of task orders (65.8%) means you can't just respond to public RFPs—you need to be on the underlying contract vehicles first. The $188K median reveals a market of many small awards that can be stacked strategically. Most critically, the Q4 surge pattern shows when to time your proposals for maximum impact. For companies that are registered in Sam.gov but have not yet acquired any federal contracts, understanding these patterns will be essential for breaking into the market.

Ways to Leverage This:

Vehicle First Strategy - With 2/3 of money flowing through IDIQs, prioritize getting on SeaPort-NxG (Navy), RS3 (Army), or ITES-3S (DISA) vehicles through subcontracting

Geographic Arbitrage - Target the 33% of contracts outside CA/VA/MD. Program offices in secondary locations often have fewer bidders and faster decisions

September Sprint Planning - Historical data shows 31% of annual PSC 5865 obligations drop in September (based on PSC 5865 analysis). Submit proposals by August 15 to catch this wave

1️⃣ Actionable Defense Roadmap

Context & Key Takeaways: Based on available federal contract data, CX2 appears to be pre-federal contract status, so developing a roadmap needs to be realistic about building federal past performance and contract vehicle access. What’s great? CX2's Ukrainian partnership through Skyfall—with DIU endorsement as an approved supplier and inclusion in U.S.-Ukrainian partnership programs—combined with 1.5 million combat missions provides battlefield validation that few companies can match.

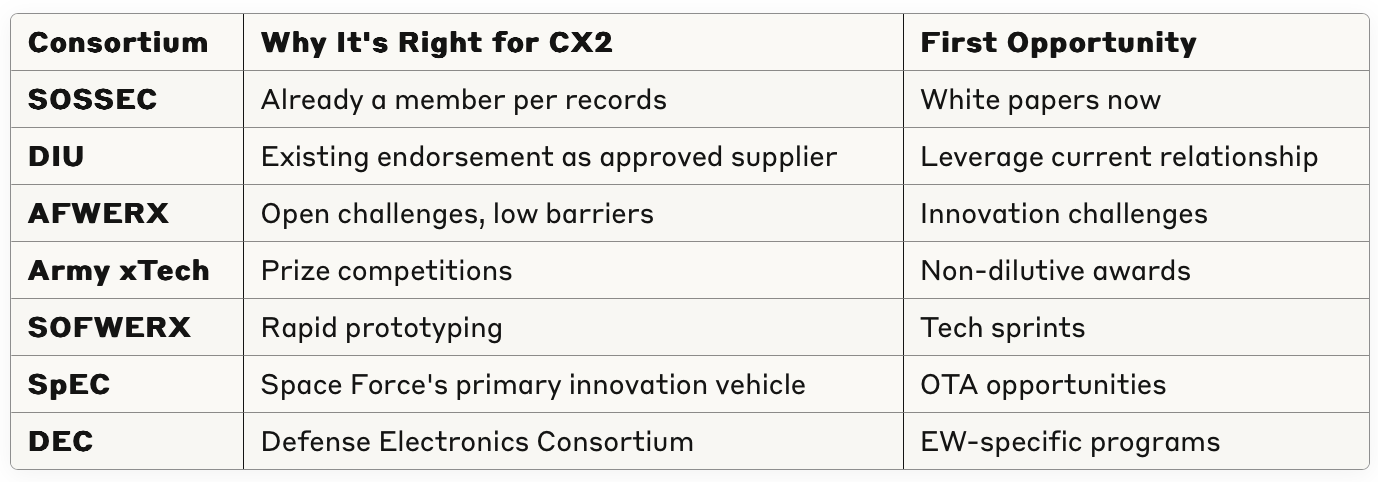

The challenge? Converting that combat credibility into contract vehicles and past performance. The data shows 65.8% of EW dollars flow through task orders, so CX2 can't just bid on standalone RFPs. They need a systematic approach: start with OTAs and SBIRs (which don't require past performance), leverage their DIU connection, then graduate to IDIQ vehicles through strategic partnerships.

Market Entry Strategy – Start with DIU's approved Ukrainian drone program, then expand to Navy/Army through OTA prototypes

Vehicle Positioning – 65.8% of awards were task orders; begin as subcontractor to build past performance

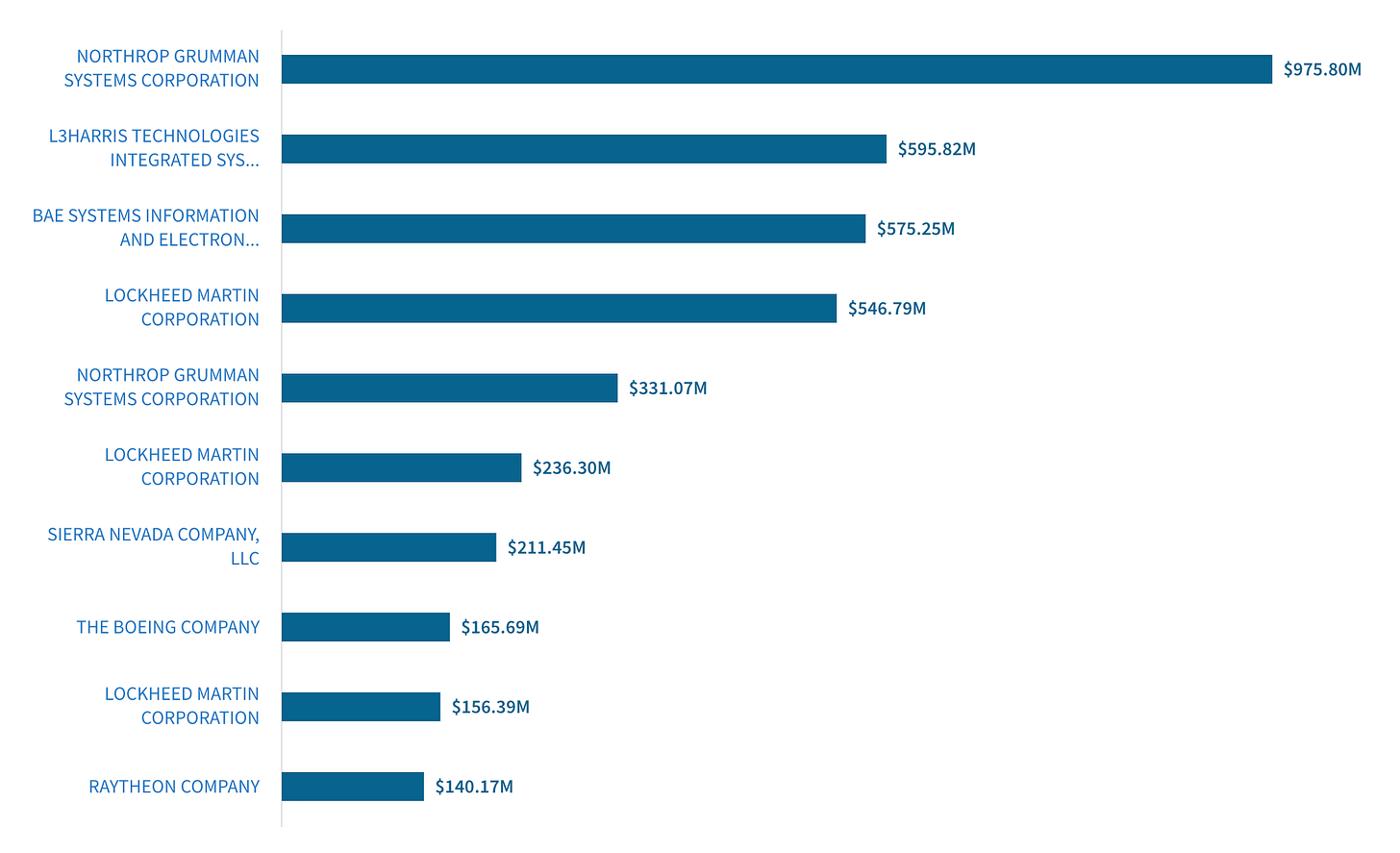

Competition Analysis – Northrop dominates at $975.80M, but market fragmentation shows disruption is possible

Differentiation Lever – Combat-validated AI from 1.5M Ukrainian missions vs. untested legacy systems

Timing Optimization – Q4 surge pattern shows 31% of annual spending; plan for July-September push

Why This Matters: CX2 faces a Catch-22: you need past performance to win contracts, but you need contracts to build past performance. The Ukrainian combat validation breaks this cycle—it's proof that matters more than paperwork. The DIU recognition of their Skyfall partnership opens doors that would normally take years to unlock. But without proper vehicle positioning, even the best technology can sit idle on the shelf.

Ways to Leverage This:

DIU Fast Track - Leverage existing DIU relationship and supplier status for prototype opportunities (60-90 day timeline)

Consortium Entry - If possible, join SpEC and SOSSEC in the immediate term; CX2 already appears in SOSSEC member list

Strategic Subcontracting - Partner with emerging mid-tier players for innovation opportunities

2️⃣ Budget Intelligence Foundations

Context & Key Takeaways: The spending data tells a story of concentration and opportunity. While Northrop Grumman commands 20.4% of the market ($975.80M), the real insight is in the fragmentation—no single company controls more than 21% of spending. This is unusual for defense markets, where winner-take-all dynamics typically prevail. Even more interesting: L3Harris appears twice in the top 10 (as separate entities), suggesting ongoing integration challenges that create gaps for nimble competitors.

The quarterly spending pattern reveals another critical insight—Q4 2024 saw a massive surge to $1.6B+, indicating either supplemental funding or year-end obligation pressure. For CX2, this fragmentation is a gift—there's no entrenched monopoly to break, just strategic positions to claim.

Quarterly PSC 5865 Spending Patterns

One key to federal success is timing. EW spending follows predictable patterns that smart companies exploit:

Competitive Landscape Analysis: Top 10 PSC 5865 Recipients FY24-25

Understanding who wins—and how much—reveals where opportunities hide. The market fragmentation tells a story of vulnerability:

Top 10 Recipients (FY24-25)

Drilling Down into PSC 5865: Sub-Agency Distribution Exposes Real Buyers

Following the money to its source reveals your actual customers. Not all services buy equally—and that imbalance creates opportunity:

Subagency Opportunities Table:

Important Context: This analysis covers ONLY PSC 5865 contracts from FY24-25. A comprehensive federal EW analysis would require examining all related Product Service Codes (PSCs) and NAICS codes.

Why This Matters: The fragmented market structure (no contractor >21%) combined with task order dominance (65.8%) creates a unique dynamic—you can't unseat incumbents through direct competition, but you can insert yourself into their value chains. The $188K median contract size (uncovered in the USAspending data pull) means CX2 can build past performance through smaller awards before competing for major programs. Most importantly, Army's underrepresentation (only 18.5% of spending) suggests they're hungry for innovation.

Ways to Leverage This:

Target the Underdog - Army PEO IEW&S has budget but fewer incumbent relationships; pitch directly

Ride the Coattails - Partner with Sierra Nevada as an emerging player—they need innovative subsystems

Time the Surge - Data indicated that 31% of contracts drop in September; submit everything by August 15 to catch the wave

Geographic Strategy - Consider establishing presence in emerging hubs (Texas/Illinois) for lower competition

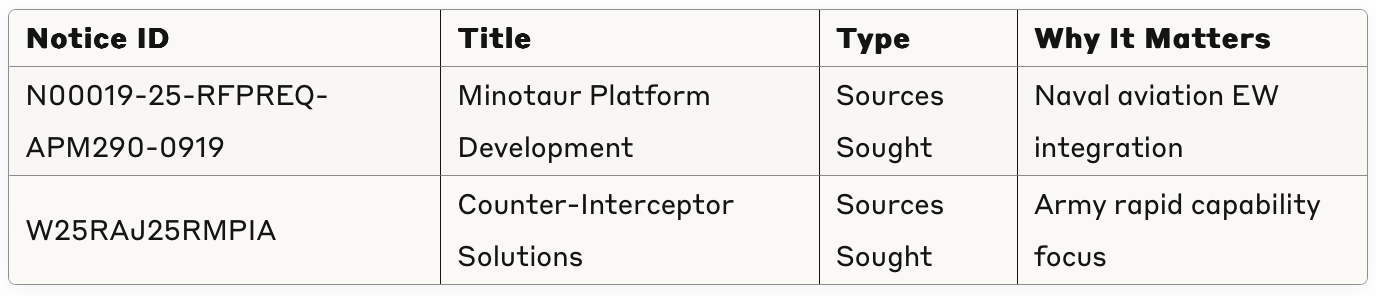

3️⃣ Pre-Solicitation Monitoring

Context & Key Takeaways: Sources Sought notices are the government's way of asking "can anyone solve this problem?"—and your response literally shapes the requirements. From over 3,800+ active opportunities on SAM.gov, the challenge isn't finding opportunities—it's filtering for relevance. The table below shows examples of EW-related notices that were active at the time I pulled the list, but this landscape changes daily.

Smart companies don't chase individual notices; they build systematic monitoring processes to catch the right opportunities among thousands. Combined with the FY26 program elements totaling $7.6B in EW-related funding, these notices represent the seeds of multi-year programs. Miss the right ones and you're not just losing one opportunity—you're locked out of entire program cycles.

One of My Search Methodologies:

Filtered 3,800+ active SAM.gov opportunities for defense/military keywords

Applied EW-specific search terms (electronic warfare, spectrum, RF, jamming, counter-UAS)

Cross-referenced with PSC codes 5865, 5821, 5840, 5895

Note: The landscape of active opportunities changes daily, requiring continuous monitoring

Example EW-Related Sources Sought Opportunities:

Note: These examples were active at time of data collection but may have closed. The federal opportunity landscape requires daily monitoring.

Adjacent Capability Areas (From FY26 R-1 Budget Analysis):

Note: Total of $7.6B includes Space Force Long Range Kill Chains which encompasses broader capabilities beyond pure EW.

Future Opportunity Indicators:

Army's new Agile RDT&E portfolio: $690M across counter-UAS and EW

Space Force budget surge: 56% increase with focus on resilient communications

Defense Innovation Unit Fielding: $281M for rapid commercial integration

Why This Matters: Sources Sought responses are your chance to write the rules. When program offices ask "what's possible?" your answer becomes their requirement. But with 3,800+ active opportunities at any given time, the real challenge is systematic filtering and response. The Ukraine combat data gives you unique authority to shape requirements when you find the right opportunities. These aren't just bids; they're strategic conversations that position you as the expert when RFPs drop. The key is building processes to find the needle in the haystack—repeatedly.

Ways to Leverage This:

Build Monitoring Infrastructure: Set up automated daily searches across SAM.gov, and agency-specific sites for EW-related keywords

Response Strategy: Create modular response templates - lead with "In Ukraine, we learned..." followed by specific performance metrics only CX2 can own

Follow-Through: After any submission, request a capabilities brief. CRITICAL: Always ask for confirmation of receipt when submitting Sources Sought or RFIs—many get lost in government email filters

Volume Game: Plan to respond to 3-5 relevant Sources Sought per month; it's a numbers game where quality responses to many opportunities beats perfection on few

4️⃣ Capability Alignment

Context & Key Takeaways: Technology brilliance means nothing if it doesn't solve a specific government pain point. In the case of CX2, it can be extremely challenging to translate their Ukrainian battlefield success into federal procurement language. The good news? Their combat validation against Russian EW systems (Krasukha-4, Zhitel) directly addresses DoD's nightmare scenarios. The data shows current EW systems traditionally updated on quarterly cycles—but with threats evolving every 3 weeks to 3 months in Ukraine, the Air Force is now pursuing a 'moonshot' goal of 3-hour updates.

CX2's software-first approach represents a fundamental shift from traditional quarterly cycles. The critical insight here is about translation—federal evaluators respond to mission impact, not technical features (although obviously important). Leading with "Defeated Russian GPS jamming in 1,000+ combat hours" likely resonates more than "AI-enabled spectrum monitoring." The table below explores how each capability might map to specific program offices and their buying vehicles—understanding customer language often determines success.

Tech → Mission Translation Table

Verified Competitive Advantages:

Ukraine Combat Validation: 1.5M+ operational missions via Skyfall partnership (DIU-recognized supplier)

Funding Stability: $31M Series A raised (May 2025), 24-month runway confirmed

Team Credibility: Nathan Mintz (co-founder) brings proven defense entrepreneurship

Speed to Field: Ukrainian partnership enables rapid development cycles vs. traditional DoD timelines

Contract Vehicle Alignment

Why This Matters: CX2's Ukrainian validation gives them something money can't buy: proof under fire. But that proof needs translation. When Northrop talks about "potential capability," CX2 can show actual combat footage. This asymmetric advantage only works if packaged correctly for federal buyers who think in requirements, not features.

Ways to Leverage This:

One Possible Approach: Create a 2-page "Combat Validation Summary" with specific Russian systems defeated, operational hours, and Ukrainian military testimonials (sanitized for ITAR)

Capability-to-Contract Mapping: Build a matrix matching each CX2 capability to specific active programs and their funding lines (e.g., link counter-drone capabilities to Army's $143.6M Counter-UAS Agile Development PE)

Requirements Gap Analysis: Study recent EW contract awards and protests to identify where incumbents failed—position CX2's capabilities as filling those exact gaps (protests reveal unmet requirements)

Potential Partnership Path: Explore teaming with Northrop (Next Gen Jammer) or L3Harris (CMOSS) for instant credibility and contract vehicle access

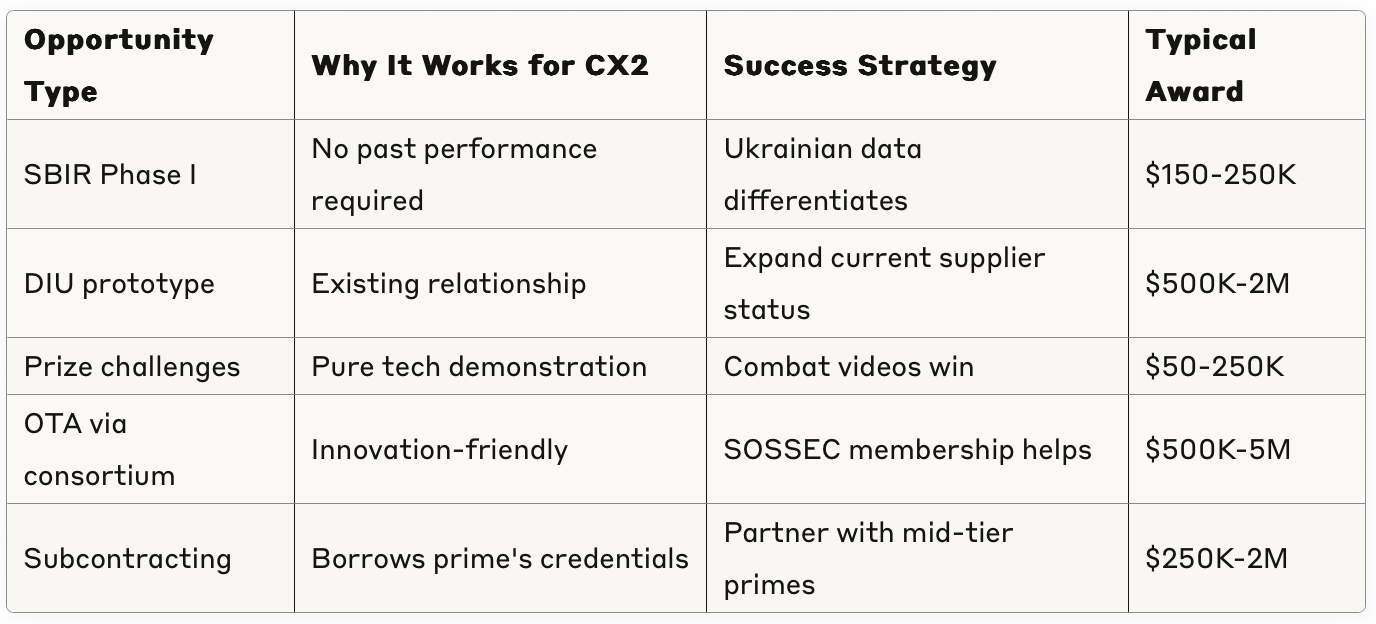

5️⃣ Advanced Opportunity Pipeline

Context & Key Takeaways: CX2's position as an emerging defense technology company requires a strategic approach to federal market entry. The framework below shows how to leverage federal spending data to identify entry points, map budget flows, and position against incumbents who control today's market share. The reality check: most defense startups take 18-24 months to win their first federal contract.

But CX2 has an ace—their DIU-recognized Ukrainian partnership provides battlefield validation most startups lack. Success requires a data-driven approach to market positioning rather than opportunistic bidding.

Strategic Market Positioning Framework:

1. Key Consortium Options for EW Market Entry

2. Market Intelligence Pipeline:

Phase 1: Historical Spending Analysis

Map 3-year PSC 5865 spending patterns by contractor and subagency

Identify contracts with high modification rates (this may indicate performance issues)

Track incumbent contract expiration dates for recompete opportunities

Analyze award protest decisions to understand evaluation criteria

Phase 2: Budget Flow Mapping

Link Program Elements (PEs) to specific contract vehicles and PSCs

Example: PE 0606640A ($127.1M) → PSC 5865/5821 → Army CMOSS vehicle

Track obligation timing to predict when funds become available

Monitor Congressional marks and plus-ups for emerging opportunities

Phase 3: Strategic Positioning

Target underserved subagencies (Army at 18.5% vs Navy at 47.7%)

Focus on contracts under $5M where prime overhead creates disadvantage

Position for emerging requirements (counter-drone, cognitive EW)

Build relationships during pre-solicitation market research phase

Procurement Intelligence for Early-Stage Companies

Why This Matters: Many startups approach federal markets tactically—chasing individual opportunities. But sustainable success requires strategic positioning based on data. By mapping budget flows, tracking incumbent performance, and identifying market gaps, CX2 can position where competitors are weak rather than where they're strong. The DIU relationship provides credibility, but data-driven market analysis shows where to apply that credibility for maximum impact. Think of it as precision targeting rather than carpet bombing the federal market.

Ways to Leverage This:

Budget Analysis: Download R-1 documents and map EW-related PEs to historical contract awards—this reveals future opportunity flows before RFPs drop

Incumbent Vulnerability Mapping: Pull 3 years of PSC 5865 awards by contractor and identify where modifications exceed 50% of original value—these are pain points

Subagency Targeting: Analyze spending by subagency to find those with EW budget but fewer entrenched vendors (hint: new Space Force organizations)

Pre-Solicitation Positioning: Set alerts for draft RFPs, Sources Sought, and Industry Days—engage during market research when requirements are still fluid

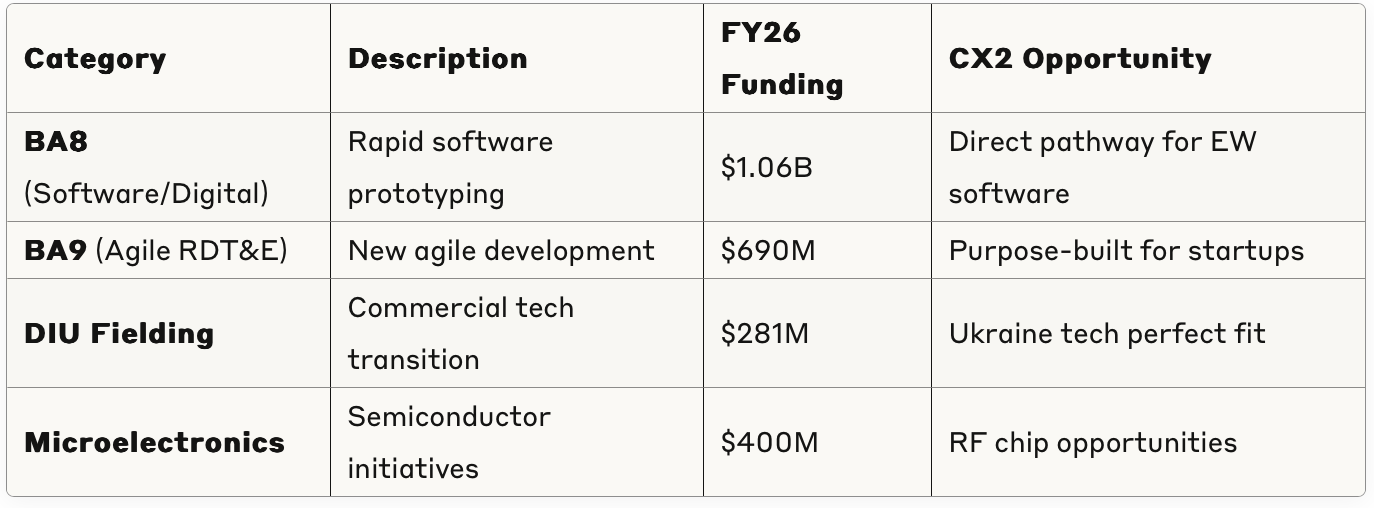

6️⃣ FY26 Forward-Looking Budget Intelligence

Context & Key Takeaways: The FY26 budget documents reveal a generational shift in how DoD buys electronic warfare capabilities. The 260% explosion in Software Pilot Programs ($295M to $1.06B) isn't just growth—it's a fundamental pivot from hardware to software-defined systems.

Even more telling: the creation of an entirely new budget category (BA9 - Agile Portfolio) with $690M specifically for rapid capability development. For context, major new budget categories are rare—often only emerging in response to significant shifts in national priorities, not on a regular schedule.. The last time DoD created something this significant was for cyber operations.

This signals that software-defined EW isn't an experiment anymore—it's doctrine. Combined with Space Force's 56% budget increase and $6.4B for distributed kill chains, we're witnessing the militarization of the electromagnetic spectrum at unprecedented scale.

Federal Agency Distribution of PSC 5865 Spending

FY26 Budget Growth Indicators

The FY26 budget reveals where this concentrated DoD spending is headed—and the numbers signal a fundamental shift:

Service-Specific Opportunities

Understanding where each service is investing reveals targeted entry strategies for CX2:

Critical New Categories

New budget categories often signal where innovation can thrive. These didn't exist 18 months ago:

EW-Specific Growth Areas

Drilling into specific program elements shows exactly where EW dollars will flow:

Why This Matters: The 260% increase in Software Pilot Programs reflects DoD's recognition of lessons from Ukraine—the future of EW is software-defined, not hardware-constrained. While Northrop protects yesterday's $976M in legacy systems, an entirely new market for software-defined capabilities is emerging. The new BA9 category didn't exist 18 months ago; it's specifically designed to fund companies like CX2 that can deliver capability in months, not years. Miss this wave and you're waiting until FY28 for the next one.

Ways to Leverage This:

Messaging Pivot: Every brief should emphasize "software-defined" and "agile"—these are now budget line items

Service Selection: Space Force has money but no incumbents; focus 40% of BD effort there

Program Targeting: Army's four Agile programs ($344M combined) share one PM—one relationship, four opportunities

Timing Intelligence: FY26 funds release October 1, but program offices select vendors in July-August

Capability Framing: Always include: "Unlike traditional systems with quarterly update cycles, CX2 delivers software-defined adaptability matching the pace of evolving threats"

🎯 To Wrap Up

The CX2 opportunity crystallizes into three undeniable truths:

First, timing is everything. The combination of factors—$4.78B in PSC 5865 spending, 260% surge in software pilot programs, Space Force's 56% budget increase, and the new BA9 agile category—creates a once-per-decade market opening. While Northrop protects yesterday's $976M in legacy hardware, an entire new market for AI-enabled, software-defined EW is emerging. CX2's Ukraine combat validation arrives just as DoD prioritizes rapid capability development to address evolving threats.

Second, the data reveals a clear execution path. The market isn't mysterious—it's methodical. With 65.8% of dollars flowing through task orders, you need vehicle access. With Space Force writing new requirements, you shape the future. Every data point leads to the same conclusion: start with non-dilutive funding, leverage your DIU relationship, demonstrate capability, scale strategically.

Third, speed is your asymmetric advantage. In a market where incumbents operate on quarterly update cycles while threats evolve every 3 weeks to 3 months, CX2’s software-first approach isn't just faster—it's revolutionary. This isn't about competing on traditional metrics. It's about changing the game entirely.

And here's the kicker: Everything we just learned here—the $4.78B opportunity, the 65.8% task order dominance, the Q4 surge patterns, the market fragmentation, even the Army's hunger for innovation—came from analyzing just one PSC (5865). One code. Imagine what's hiding in the other thousands of NAICS codes and PSCs, waiting to be discovered. This isn't insider information; it's public data that 99% of companies overlook. Master this approach, and you'll see opportunities your competitors miss entirely.

Your Next Moves:

✅ This Week: Build automated monitoring for EW-related Sources Sought among 3,800+ active opportunities. Your input shapes $7.6B in related programs

✅ Next 30 Days:

Expand DIU relationship for prototype opportunities

Consider submitting 3 SBIR Phase I proposals targeting EW topics

Enter Army xTech competition for non-dilutive validation

Write one white paper to SOSSEC members

✅ Next Quarter:

Target Army's Agile EW program manager (all 4 programs, one decision maker)

Pursue first subcontract with mid-tier prime partner

Prepare for September obligation surge with refined proposals

The Bottom Line: While established contractors defend their incumbencies, the entire electronic warfare paradigm is shifting beneath their feet. Software is eating hardware. Distributed is beating monolithic. Speed is crushing process. The question isn't whether this transformation will happen—the budget documents prove it's already underway. CX2 stands at the intersection of this shift with unique advantages to offer.

For an early-stage federal entrant, the path is clear: leverage your unique advantages (DIU relationship, combat validation), build systematically (SBIRs → OTAs → IDIQs), and maintain capital discipline. You're not trying to boil the ocean—you're building a ladder, one strategic rung at a time.

The data is clear. The pathway is mapped. The window is open.

Time to execute.

🏗️ Building This Playbook Together

I would love to hear your feedback. Are there specific NAICS codes/PSCs or procurement challenges you're wrestling with? My goal here is to provide tactical, actionable insights that you can implement immediately. I'm actively working through these same challenges in the industry and view this newsletter as a collaborative effort to build better structured approaches to federal markets.

Each week, I'm revealing new patterns and opportunities hidden in public data. But the real value comes from applying these insights to your specific situation.

Is there a VC-backed defense startup you'd like to see featured? Drop me a note.

🚀 Need More Than a Newsletter?

If you're a founder, executive, or investor ready to accelerate your defense go-to-market strategy, I do offer hands-on support to navigate these procurement pathways, turning the concepts covered here into actionable plans tailored to your unique technology.

Connect with me:

Work with me:

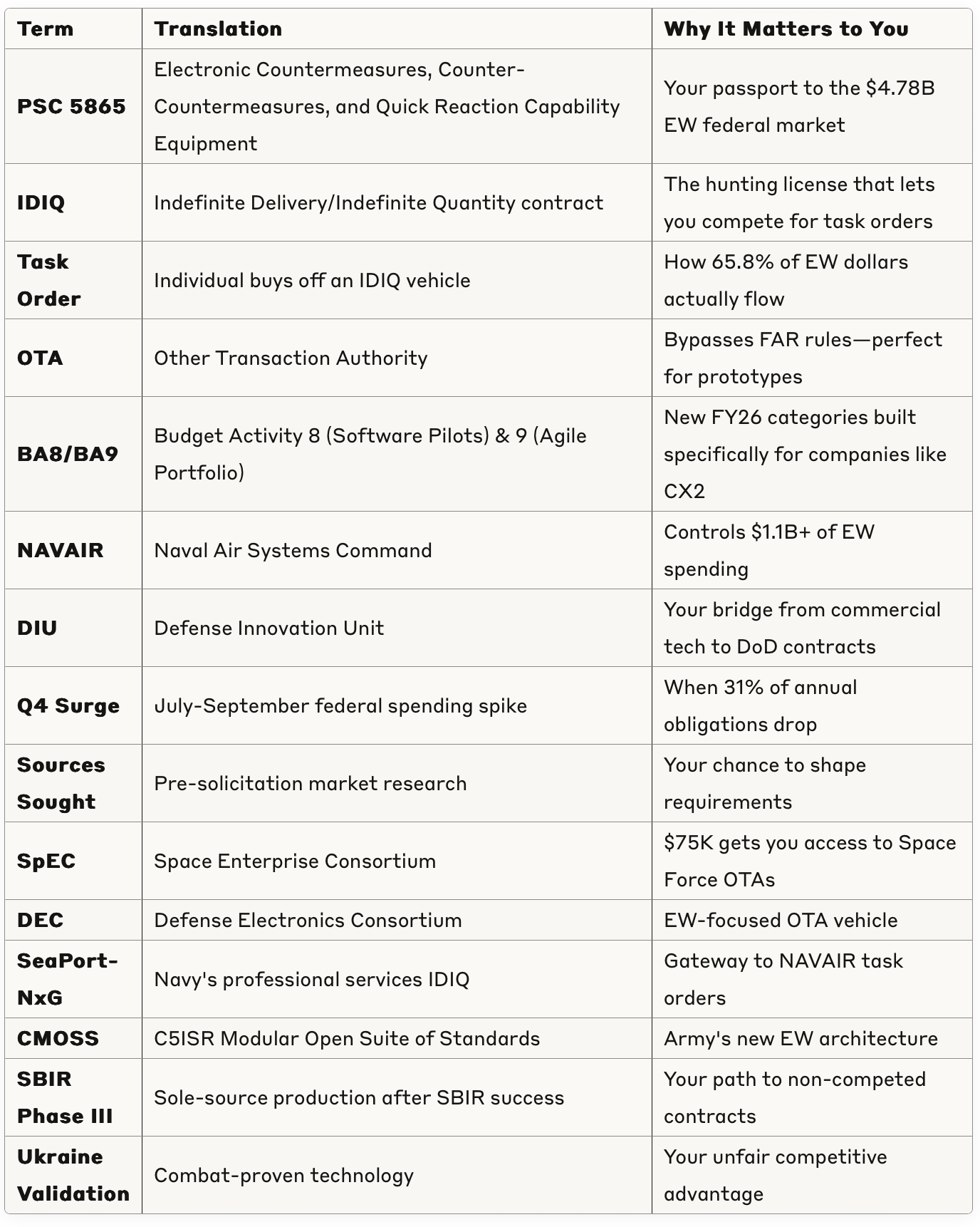

🧩 Descrambling This Week's Industry Jargon

Next week: Another VC-backed defense startup paired with their PSC/NAICS code. Same systematic approach, new market insights. Reply with suggestions!

Data current as of July 1, 2025. Analysis based on USAspending.gov PSC 5865 obligations for FY24-25 (through latest reported data, which typically lags 30-90 days), SAM.gov active opportunities, and FY26 Defense RDT&E R-1 budget documents.