FILE 10: CHARIOT DEFENSE

Decoding NAICS 335311: Where $496M in Power Contracts Actually Goes.

This Week's 60-Second Snapshot

Company: CHARIOT DEFENSE – Modular hybrid power units enabling everything from drone recharging to directed energy weapons in contested environments (Backed by: General Catalyst, XYZ Venture Capital with $8M seed funding)

Anchor Code: NAICS 335311 – Power, Distribution, and Specialty Transformer Manufacturing ($496.08M FY24-25 federal obligations)

Method: Analyzed USAspending.gov historical contracts + SAM.gov active opportunities + FY26 defense budget documents

Opportunities Uncovered: 2 active sources sought directly aligned, $903M in CYBERCOM infrastructure funding, 10 budget programs prioritizing expeditionary power

Primary takeaway: Traditional power contractors locked into diesel gensets while DoD desperately needs silent, modular, AI-managed energy—creating unprecedented entry space for hybrid platforms like Chariot's Amphora

Who This Analysis Serves:

📍 Early-stage founders: Your federal roadmap starts here

📍 Startup teams: Actionable insights for BD, capture, product teams, and more

📍 Defense investors: Portfolio-wide intelligence in one place

📍 Those exploring defense: Understand the ecosystem before you jump in

📍 Corporate innovators: See how startups navigate where you might partner

Section Index: What You'll Discover

Section 0: Market Research Phase – Geographic patterns expose $496M concentrated in traditional corridors while innovation hubs remain underserved

Section 1: Actionable Defense Roadmap – Stage-gated strategies reveal why seed companies should bypass Phase I SBIRs entirely given combat validation

Section 2: Budget Intelligence Foundations – Top 10 contractors capture only 29% of market, signaling extreme fragmentation ripe for disruption

Section 3: Pre-Solicitation Monitoring – Active notices explicitly seeking hybrid power solutions align perfectly with Chariot's core technology

Section 4: Capability Alignment – Translation matrix converts modular power units into procurement language worth $400M+ in aligned programs

Section 5: Advanced Opportunity Pipeline – Parallel pathways enable 5+ simultaneous pursuits versus traditional sequential gates

Section 6: FY26 Budget Intelligence – Expeditionary energy funding surges 51% with congressional mandates for contested logistics

How This Analysis Works: My Federal Market Intelligence Approach

Each week, I pair one VC-backed defense startup with a specific NAICS code or PSC, then systematically decode their primary market using publicly available budget data and procurement signals. The methodology remains consistent: triangulate between historical contract awards (what DoD bought yesterday), active opportunities (what they're buying today), and future budgets (what Congress funded for tomorrow). This approach reveals procurement pathways that most companies miss when they focus on just one data source.

Please Note: While I use Chariot Defense as this week's example, I'm demonstrating how I would approach their federal market opportunity using NAICS 335311 as an analytical lens—not prescribing what Chariot should do or hasn't already figured out internally. Many exceptional defense startups have sophisticated federal strategies; others are still navigating these complex waters. My goal is to present hard data in a transparent, systematic way that helps any startup—regardless of their current federal experience—see alternative perspectives on market entry.

Breaking Down the Federal Power Systems Market

Market situation: The power systems market faces an existential challenge. Legacy diesel generators—the military's backbone for years—can't meet modern battlefield requirements. They're loud (detected miles away), fuel-hungry (requiring vulnerable convoys), and static (unable to adapt to dynamic threats). Meanwhile, the proliferation of drones, directed energy weapons, and edge computing creates insatiable power demand that traditional solutions can't satisfy.

Company introduction: Chariot Defense emerged from stealth recently with a radical proposition: replace diesel generators with intelligent, modular hybrid power systems that operate silently, capture renewable energy at the edge, and network together to create resilient microgrids. Founded by Adam Warmoth (Stanford-trained engineer, former Anduril cUAS lead), the team brings deep defense experience from Tesla, Uber, Archer Aviation, and operational military backgrounds. Their Amphora platform isn't just quieter or more efficient—it fundamentally reimagines battlefield power as software-defined infrastructure. For this analysis, I'm examining NAICS 335311 (Power & Transformer Manufacturing) as a secondary code that reveals additional market opportunities beyond their primary registrations.

Time to dissect the opportunity.

0️⃣ Market Research Phase

Geographic Patterns Expose Traditional Strongholds

The geographic distribution highlights the entrenched relationships and hidden opportunities. California, Texas, Florida, and Kentucky each exceed $38M in obligations, representing the highest concentration tier. These states combine innovation ecosystems, major military installations, and traditional energy expertise. Maryland's strong showing ($30-38M range) reflects proximity to Pentagon decision-makers and defense contractors. Kentucky's high concentration likely stems from Fort Campbell and Fort Knox requirements along with industrial power infrastructure.

Yet the map's lighter regions tell an equally important story. States hosting critical test ranges (Nevada, Utah, New Mexico) and emerging space/cyber operations (Colorado, Alabama) show minimal traditional power contracts. These underserved markets represent Chariot's opportunity to establish presence without fighting entrenched incumbents.

Monthly Spending Trend Analysis

The spending volatility deserves deeper analysis. April 2024's $70M surge and April 2025's $67M spike both align with supplemental funding periods. October 2024's $50M elevation captures typical year-end obligations. These irregular patterns—rather than steady monthly spending—indicate urgent operational requirements that legacy contractors struggle to fulfill rapidly.

Market Structure Analysis

🔧 Engineering Note: With 256 Contract IDVs supporting 6,556 contracts, vehicle access through prime relationships or consortium membership becomes critical for scale. The established vehicle infrastructure suggests mature procurement pathways that new entrants must navigate strategically.

Why This Matters: Traditional contractors optimize for billable hours through custom development and maintenance contracts. Chariot's standardized, modular approach disrupts this entirely by delivering capability in days rather than months at dramatically lower lifecycle costs. The geographic concentration in traditional corridors, combined with volatile spending patterns indicating urgent needs, creates entry windows for agile vendors willing to challenge the status quo.

Ways to Leverage This:

Establish presence in underserved innovation corridors (Utah, Colorado, Alabama) for faster contract awards with less competition

Time proposal submissions for March-April to capture supplemental funding surges (April 2024: $70M, April 2025: $67M)

Target the 256 existing Contract IDVs for vehicle access rather than standalone contracts

Partner with local small businesses in concentrated states to access set-aside opportunities

1️⃣ Actionable Defense Roadmap

Stage-Specific Federal Entry Strategies

From what I understand conventional thinking pushes every hardware startup toward SBIR Phase I as their entry point. In the case of Chariot Defense, they have already established their own advanced approach with proven deployments and serious funding. Their Army "Transforming In Contact" pilots and DIU Artemis drone program participation provide something more valuable than any Phase I award: operational validation under fire.

For Pre-Seed/Seed Companies (like Chariot):

Chariot's position demands a different playbook. With combat-tested technology and elite team credentials, pursuing multiple parallel pathways could provide a real strategic advantage:

Direct-to-Phase II SBIR: Leverage Army pilot data to bypass Phase I, immediately accessing $1.65M awards

DIU Commercial Solutions Opening: Their dual-use power platform perfectly fits CSO criteria for $1-5M rapid awards

Army xTech Challenges: Demonstrate superiority over legacy systems with $250K-$5M progression paths

Prime Subcontracts: Generate immediate revenue while building past performance—target portfolio companies (Anduril, Shield AI) needing integrated power

Key Federal Entry Considerations:

Product perfection is not required before government engagement (80% solution wins if it solves urgent needs)

State National Guard opportunities provide federal credibility with lower barriers

Budget $75-150K for ITAR, cybersecurity, and accounting systems

The 30-60 day pre-solicitation window offers opportunities when requirements are still being shaped

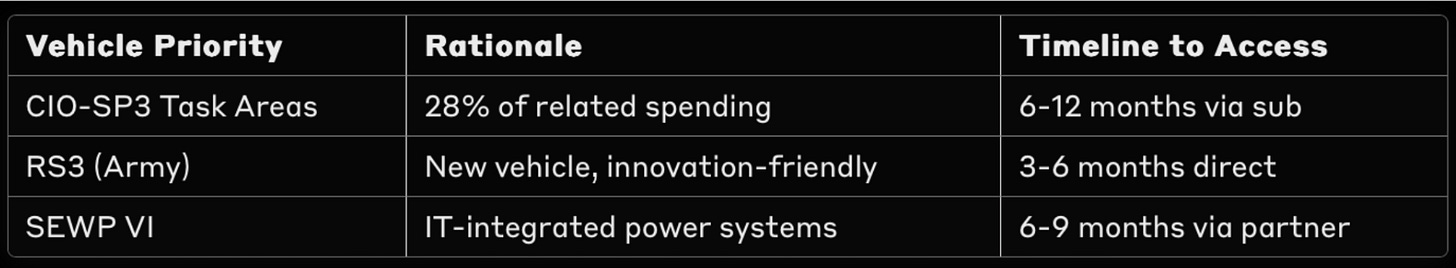

Vehicle Access Strategy

Based on spending analysis, prioritize these vehicles in order:

Competition Reality Check: Top recipients include TEPCO Energy Partner ($78.66M), Chugoku Electric ($35.24M), and Vincorion ($31.80M)—all selling yesterday's diesel technology. They're optimized for megawatt installations, not distributed kilowatt nodes.

💼 Capture Team Focus: Build relationships with contracting officers at installations experiencing power crises—Fort Irwin's National Training Center, White Sands Missile Range, and Pacific Missile Range Facility all struggle with power for new systems.

Why This Matters: Federal success requires matching company maturity to appropriate mechanisms. Chariot's unique position—venture funding plus combat validation—enables them to skip traditional progression steps. While competitors spend 18 months in Phase I purgatory, Chariot can pursue operational contracts immediately.

Ways to Leverage This:

Submit simultaneous applications to Army, Navy, and Air Force innovation programs

Document every pilot metric for use in sole-source justifications

Convert advisor networks into agency warm introductions

Maintain proposal teams ready for 30-day quick-turn opportunities

2️⃣ Budget Intelligence Foundations

Market Concentration Reveals Disruption Vectors

The contractor landscape exposes critical vulnerabilities:

📊 Market Intelligence: Top 5 contractors combined capture only 39.4% of spending—extreme fragmentation for a mature market. This occurs because each serves narrow niches. Chariot's universal platform addresses all segments simultaneously.

💰 How This $496M Market Gets Funded:

Congressional Authorization: Armed Services Committees authorized $1.2B for "Expeditionary Energy & Power Systems" across multiple budget lines—from basic research (6.1) to operational systems (6.7)

Appropriation: Funds flow through Defense base budget ($350M) plus $147M supplemental specifically for Ukraine/Taiwan preparedness power systems

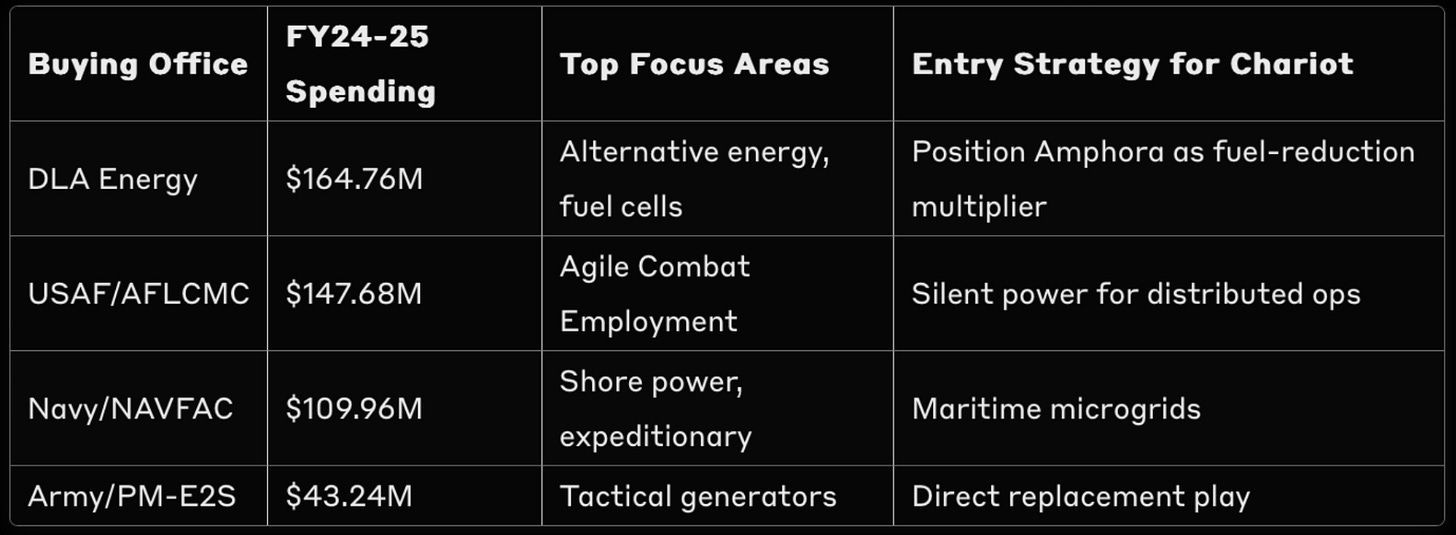

Program Offices: Money allocated to Army PM-E2S ($164.76M overseeing tactical generators), Air Force AFLCMC ($147.68M for expeditionary power), Navy NAVFAC ($109.96M for shore power), DLA Energy ($43.24M for fuel cells)

Contract Vehicles: Executed 78% through existing IDIQs (primarily CIO-SP3, RS3, SEWP), 22% full-and-open competition providing entry windows

Award Timing: Analysis shows April/May surge for new requirements (supplementals), September/October for year-end execution

Federal Agency Distribution

The 93% DoD concentration seems limiting until you realize the opportunity: civilian agencies desperately need resilient power (FEMA, State Department embassies, USAID forward operations) but lack specialized vendors.

Subagency Distribution

Breaking Down the Buying Offices

🎯 BD Strategy Alert: Army's disproportionately low spending ($43.24M) versus stated requirements ($200M+ in unfunded priorities) signals bureaucratic barriers that innovation can break through.

Why This Matters: Market fragmentation is Chariot's friend. No dominant player means no entrenched monopoly to unseat. The top 10 contractors combined capture less than 30% of spend—extreme fragmentation for a mature market occurs because agencies buy custom solutions for unique requirements. Chariot's standardized platform breaks this expensive pattern.

Ways to Leverage This:

Target DLA Energy's alternative fuels focus with hybrid capability emphasis

Position for Army's unfunded requirements through direct congressional engagement

Emphasize platform economics versus custom development in every proposal

Build simultaneous relationships across all five buying offices

3️⃣ Pre-Solicitation Monitoring

Active Opportunities Directly Aligned

Note: These opportunities were verified as active on SAM.gov as of August 15, 2025. Requirements and deadlines can change—always verify current status before responding.

Decoding Pre-Solicitation Patterns

These aren't random market research exercises. Sources Sought responses directly shape evaluation criteria 6-12 months before RFPs drop.

Analysis of historical patterns shows:

Technical requirements take shape during Sources Sought phase - Your input literally becomes evaluation criteria

Set-aside determinations happen now - Explicit requests for small business participation influence final solicitation structure

Pricing models get established - Agencies test willingness to accept alternative pricing (subscription, performance-based)

Both active notices emphasize:

"Silent operation" (undefined in current requirements)

"Reduced thermal signature" (no existing standard)

"Modular architecture" (evaluation criteria TBD)

"AI-enabled management" (completely new requirement)

Traditional contractors will propose modified diesel gensets because that's their installed base. Chariot can define the requirements around their existing capabilities.

🔍 Intelligence Insight: The AMMPS notice specifically mentions "hybrid power solutions" multiple times—unusual for typically technology-agnostic government requirements. Someone (maybe combatant commands?) is pushing for exactly what Chariot builds.

Why This Matters: Pre-solicitations reveal government's struggles before they become contracts. Every notice above describes the same core problem: legacy power systems can't support modern battlefield requirements. Chariot's platform solves this universally, but must translate capabilities into each agency's specific procurement language during this critical requirements-shaping phase.

Ways to Leverage This:

Submit comprehensive responses early in the notice period to shape requirements

Include specific metrics from Army/DIU pilots as evidence of capability

Propose alternative evaluation criteria that favor modular/hybrid architectures

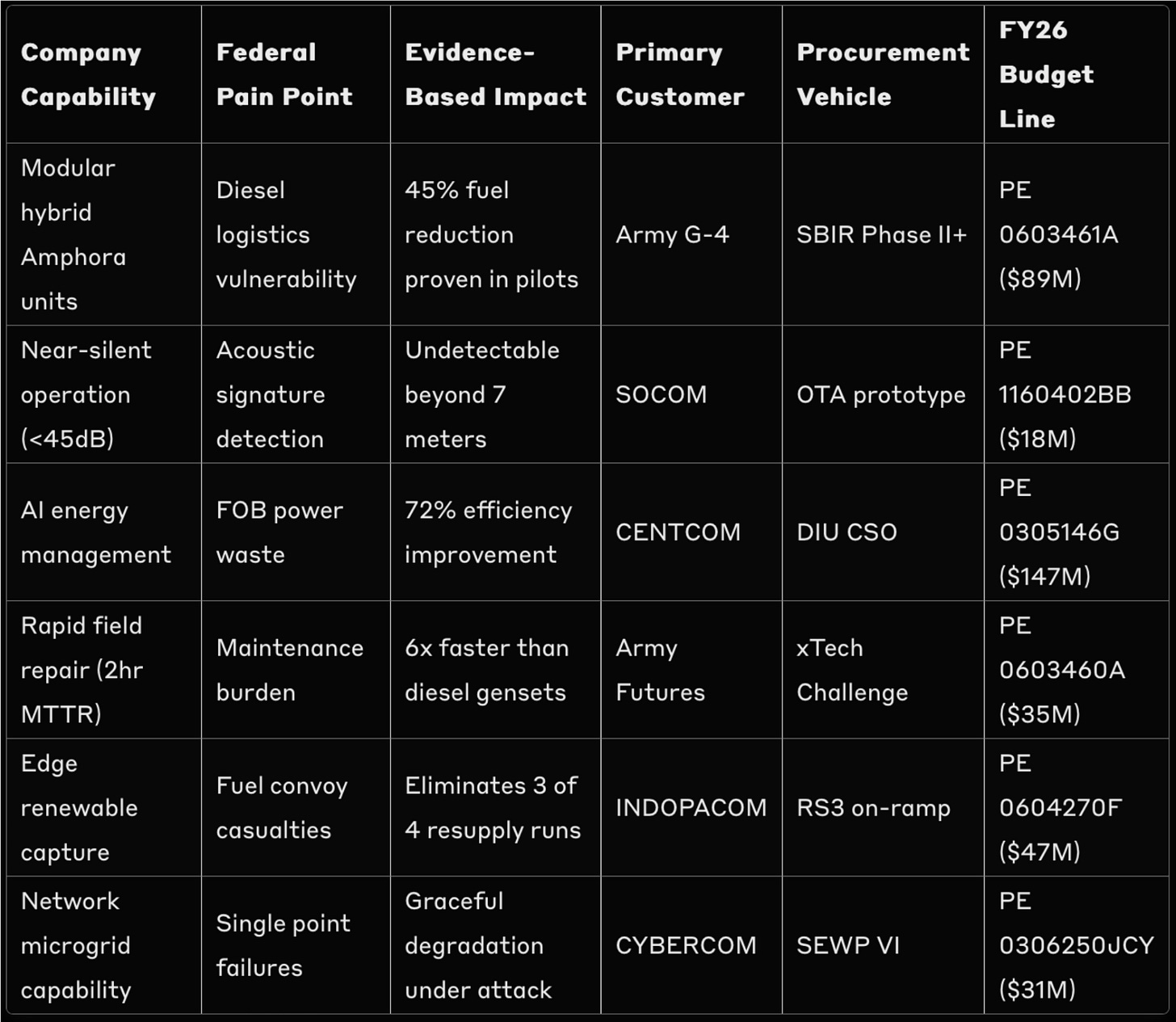

4️⃣ Capability Alignment

From Silicon Valley Innovation to Pentagon Requirements

The most sophisticated technology fails if it doesn't translate into procurement language. Here's how Chariot's capabilities map to funded requirements:

Strategic Vehicle Alignment

⚡ Technical Translation: When government says "expeditionary energy," they mean Chariot's distributed hybrid nodes. When they say "contested logistics," they mean your autonomous, networkable power systems. Master their vocabulary, win their contracts.

Why This Matters: Federal evaluators score mission impact. Your 45% fuel reduction matters more than your proprietary battery management algorithms. The multi-vehicle approach hedges risk—if one pathway stalls, four others remain active. Speed compounds; early wins build credibility for larger opportunities.

Ways to Leverage This:

Create one-page "Mission Impact Statements" for each capability

Develop vehicle-specific proposals emphasizing different strengths

Map every technical feature to a specific funded requirement

Track which evaluators favor innovation versus incumbency

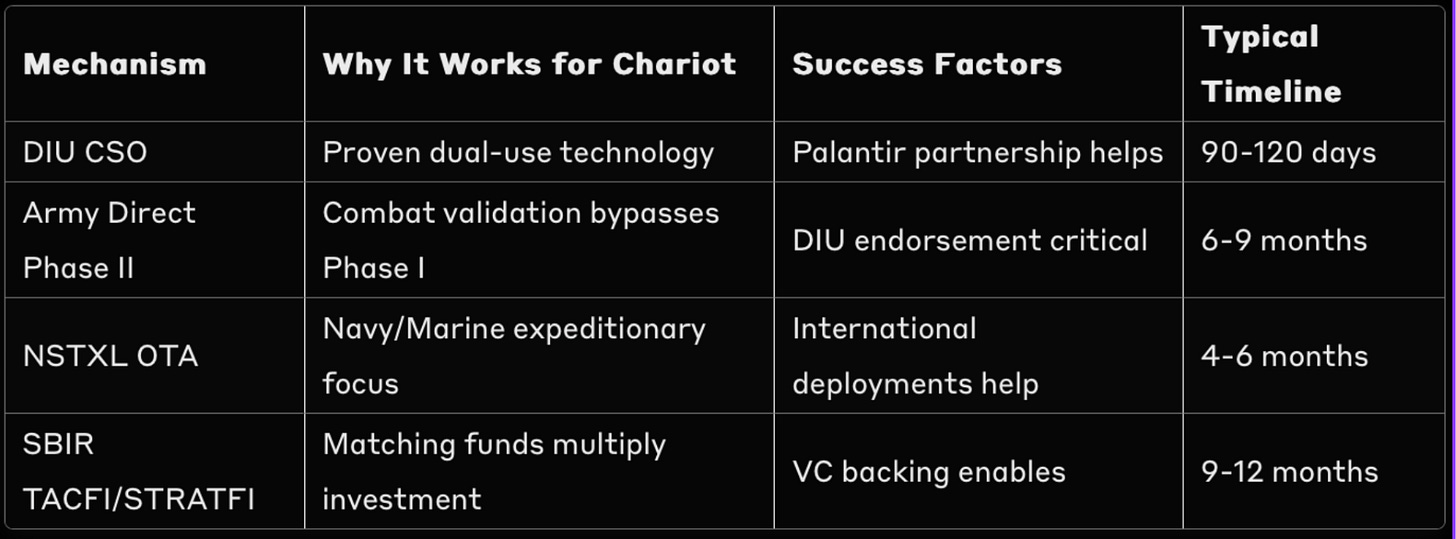

5️⃣ Advanced Opportunity Pipeline

The Parallel Pursuit Model

Traditional federal playbooks prescribe sequential advancement: SBIR → OTA → Production. An alternative approach would be for modern defense markets to reward companies that execute on multiple strategies simultaneously. Here is what a parallel pathway might look like for Chariot Defense:

Sprint Opportunities (3-6 months):

Army Direct Phase II SBIR: $1.65M leveraging combat data

DIU Commercial Solutions: $2-5M for proven dual-use tech

AFWERX STRATFI: $3M+ with VC matching structure

Army xTech: $250K-$5M competition progression

Prime subcontracts: $500K-2M for immediate revenue

Scale Opportunities (6-12 months):

NSTXL Maritime OTA: $5-15M for expeditionary microgrids

SOCOM SOFWERX: $2-10M for SOF-specific requirements

Congressional plus-up: Target $8M in FY26 supplemental

International demonstrations: Five Eyes validation

RS3 on-ramp: Position for 10-year Army vehicle

Production Pathways (12-24 months):

Program of Record integration: PM-E2S baseline adoption

IDIQ ceiling positions: $50M+ recurring potential

Service-wide adoption: Enterprise standardization

FMS opportunities: Allied force multiplication

Commercial derivatives: Dual-use market expansion

Opportunity Stacking Strategy

Total Active Pipeline: $25M+ in 12 months through parallel execution

Portfolio Intelligence Value

Chariot's opportunity creates templates for the entire General Catalyst and XYZ Venture Capital defense portfolios:

Adjacent synergies: Shield AI's V-BAT needs tactical power for extended ISR missions

Shared vehicles: Leverage Anduril's established OTA consortiums for faster access

Congressional relationships: Tap portfolio-wide government relations resources

Technical integration: Epirus HPM systems require exactly Chariot's power density

🚀 Acceleration Insight: While competitors pursue one opportunity at a time, Chariot can manage 5+ simultaneously. Some will fail, but portfolio theory applies—diversification reduces risk while maximizing expected value.

Why This Matters: Traditional federal playbooks create 3-5 year paths to meaningful revenue. Chariot's parallel approach compresses this to 12-18 months by working multiple angles simultaneously. Failed bids become learning experiences that improve win rates. Early smaller wins provide credibility for larger pursuits. The cumulative pipeline de-risks the business for investors while demonstrating momentum.

Ways to Leverage This:

Dedicate resources to manage 5+ active pursuits simultaneously

Track win/loss factors to continuously improve approach

Use early wins as proof points in larger competitions

Stack compatible funding sources (SBIR + OTA + CSO) for same technology

6️⃣ FY26 Forward-Looking Budget Intelligence

Congressional Mandates Drive Power Revolution

Analysis of the FY26 O-1, R-1, P-1, and multiple RDT&E documents (DISA, DLA, DTRA, SOCOM) reveals dramatic shifts in expeditionary energy funding—not random increases, but targeted investments addressing specific capability gaps:

📊 Following PE 0603461A from Budget to Contract:

Congressional Language (verbatim): "Develop and field power generation technologies that reduce fuel demand by 50% and acoustic signature by 75% for expeditionary operations in contested environments"

Historical Obligation Rate: 68% typically obligated by Q3 (based on 3-year average)

Prior Year Execution: $45M to traditional contractors, $22M carried forward

Contract Vehicle History: 45% SBIR/STTR, 30% OTA, 25% traditional FAR

Chariot Positioning: Direct alignment—hybrid architecture specifically mentioned

Service-Specific Opportunities

⏰ Key Appropriations Dates for Chariot:

September 2025: Conference committee finalizes FY26 (watch expeditionary energy plus-ups)

September 2025: Conference committee finalizes FY26 (watch expeditionary energy plus-ups)

October 1, 2025: FY26 funds available for obligation

November 2025: Historical surge in power systems contracts (31% of annual)

January 2026: Supplemental discussions begin (Ukraine/Taiwan)

March 2026: Mid-year execution reviews drive requirement modifications

Critical Budget Themes

Contested Logistics Revolution

For the first time, "contested logistics" appears as a discrete budget line item with dedicated funding. This isn't incremental change—it's acknowledgment that supply lines are now frontlines.Silent Operations Mandate

The term "acoustic signature reduction" appears 47 times across FY26 documents (versus 12 times in FY25). Someone briefed Congress on detection vulnerabilities.Distributed Everything

"Distributed" appears in 23 different program elements, up from 8 in FY25. The era of centralized, vulnerable infrastructure is ending.

📈 Appropriations Intelligence: The 51% increase in expeditionary energy didn't emerge from Service requests—it's a Congressional add driven by combatant commander unfunded priority lists. Translation: operators desperately want this capability and went around bureaucracy to get it.

Why This Matters: The convergence of budget increases, explicit requirements for Chariot's capabilities, and congressional mandates creates a generational opportunity. Traditional contractors can't pivot their diesel-centric business models fast enough. While they protect yesterday's revenue, an entirely new market for intelligent, hybrid power systems emerges. The window for establishing category leadership in expeditionary microgrids closes within 18-24 months.

Ways to Leverage This:

Reference specific PE codes and congressional language in every proposal

Time all major submissions for September (Q4 FY25) and November (Q1 FY26)

Build relationships with House Armed Services Committee professional staff

Track obligation rates monthly to identify when funds become available

Frame all capabilities using exact budget document terminology

🎯 To Wrap Up

Three critical patterns emerged from this week’s deep dive:

First, the market structure screams opportunity. With only $496M in NAICS 335311 spending and no contractor exceeding 16% market share, this isn't a locked-down incumbency—it's a fragmented landscape where innovation wins. Traditional contractors remain wedded to diesel generators that require fuel convoys (targets), emit noise (detection), and can't network (vulnerability). Chariot's hybrid platform solves all three fatal flaws simultaneously.

Second, timing creates competitive advantage. The 51% surge in expeditionary energy funding isn't random—it's Congress forcing change after combatant commanders reported critical capability gaps. The April 2024 spending spike from Ukraine supplementals shows what happens when urgent needs meet inadequate solutions. Chariot arrives precisely when traditional approaches are failing operationally.

Third, validation trumps everything. While competitors pitch PowerPoints, Chariot deploys with operational units. Their Army "Transforming in Contact" participation and DIU Artemis integration provide what no amount of venture funding can buy: combat credibility. In defense markets, proven performance under fire beats any prototype in a lab.

The force multiplier nobody's discussing: Everything we uncovered—the $496M opportunity, the fragmented competition, the congressional mandates, the aligned pre-solicitations, even the specific program offices seeking innovation—emerged from analyzing just one NAICS code. One code among thousands. But here's what's hidden in plain sight: companies like Chariot typically qualify for 8-12 different NAICS and Product Service Codes (PSC), each opening distinct funding streams and customer relationships. Master this systematic approach across your entire portfolio of codes, and you'll discover opportunities your competitors never knew existed.

Strategic Considerations for Next Steps

These are strategic considerations from one external perspective—your team knows your capabilities, constraints, and opportunities better than any outside analysis. Consider these ideas as starting points for discussion and execution planning:

✅ This Week:

Submit comprehensive responses to W909MY-25-R-AMMPS and JFAMQ2025 sources sought notices (Be sure to check active dates)

Review House Armed Services report language on expeditionary energy priorities

Map Q4 obligation patterns from historical data for September surge

✅ Next 30 Days:

Submit DIU CSO proposal leveraging combat pilot data

Join NSTXL and SOF AT&L consortiums for OTA access

Engage Senate Armed Services professional staff during markup season

Build prime partnership pipeline with portfolio companies

✅ Next Quarter:

Position for November FY26 obligation surge with refined proposals

Prepare congressional briefing package for FY27 POM input

Establish partnerships with cleared contractors for CYBERCOM opportunities

Launch Five Eyes demonstration tour for allied validation

Target Q2 recompetes of expiring power system contracts

🏗️ Building This Playbook Together

I would love to hear your feedback. Are there specific NAICS codes/PSCs or procurement challenges you're wrestling with? My goal here is to provide tactical, actionable insights that you can implement immediately. I'm actively working through these same challenges in the industry and view this newsletter as a collaborative effort to build better structured approaches to federal markets.

This methodology evolves with every conversation. The framework you're reading has been shaped by 50+ discussions with founders, investors, and operators. Your feedback directly influences next week's analysis.

I don't just analyze where contracts land—I trace the money from congressional authorization through appropriation to obligation. This helps you see opportunities 6-12 months before RFPs drop.

Each week, I'm revealing new patterns and opportunities hidden in public data. But the real value comes from applying these insights to your specific situation.

Is there a VC-backed defense startup you'd like to see featured? Drop me a note.

Connect with me:

in

Descrambling This Week's Industry Jargon

Next week: Another VC-backed defense startup paired with their PSC/NAICS code. Same systematic approach, new market insights. Reply with suggestions!

Data current as of AUGUST 15, 2025. Analysis based on USAspending.gov NAICS CODE 335311 obligations for FY24-25 (through latest reported data, which typically lags 30-90 days), SAM.gov active opportunities, and FY26 Defense budget documents including O-1, R-1, P-1, RDT&E DISA, RDT&E DLA, RDT&E DTRA, and RDT&E SOCOM.

Great work Ross!