FILE 17: SNOWCAP COMPUTE

The $507M Federal Opportunity in Superconducting Compute Infrastructure

📊 The 60-Second Snapshot

Target Profile: Snowcap Compute recently launched with $23 million in seed funding led by Playground Global, alongside participation from Cambium Capital and Vsquared Ventures. The company is commercializing the first viable superconducting compute platform, utilizing Josephson Junctions to achieve a 25x performance per watt improvement over current AI chips. This innovation directly addresses the approaching physical limits of CMOS technology and the massive computational requirements of modern warfare. The company’s technology is critical for enabling next-generation edge AI, real-time sensor processing, and deep integration with quantum systems.

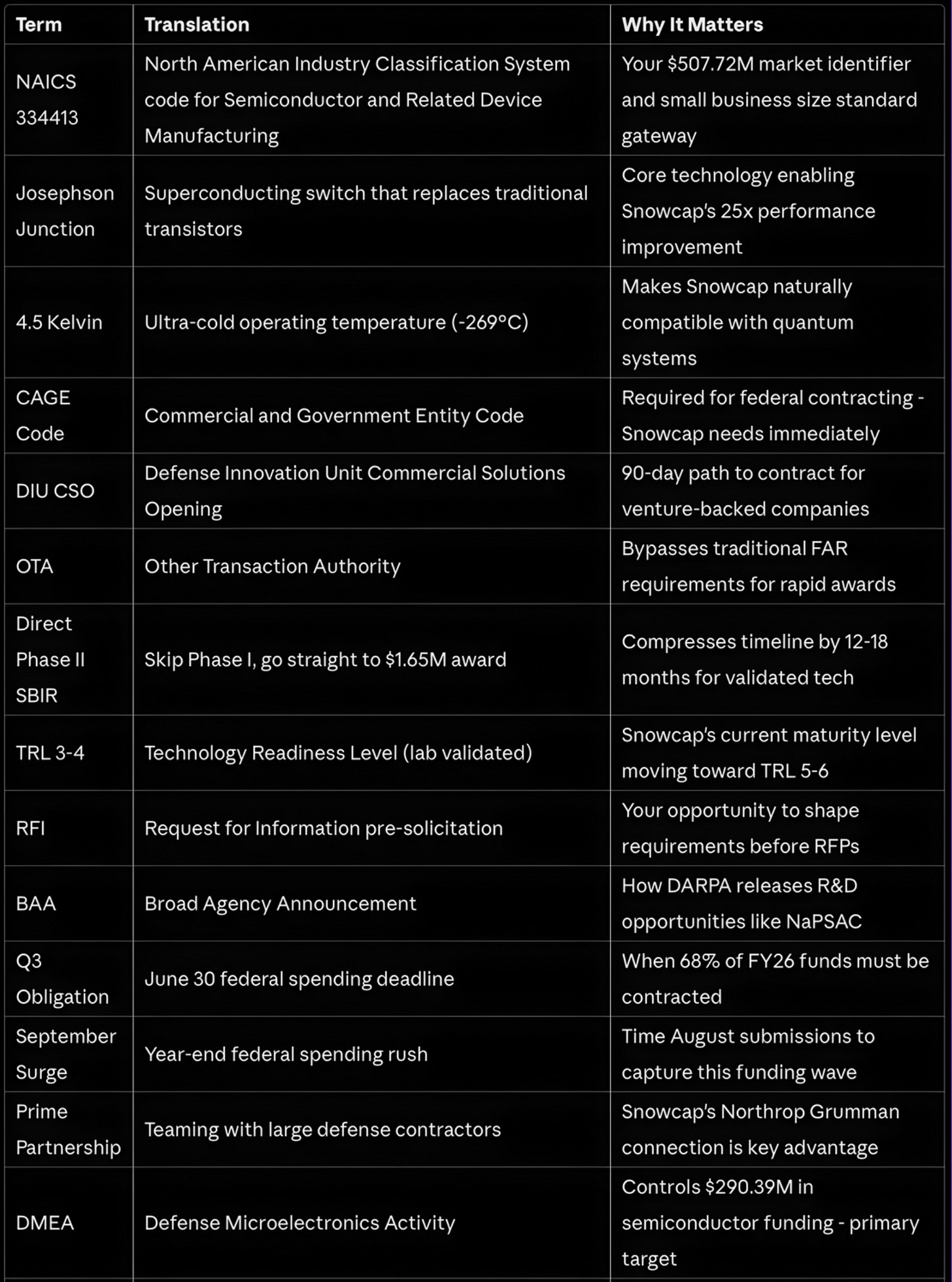

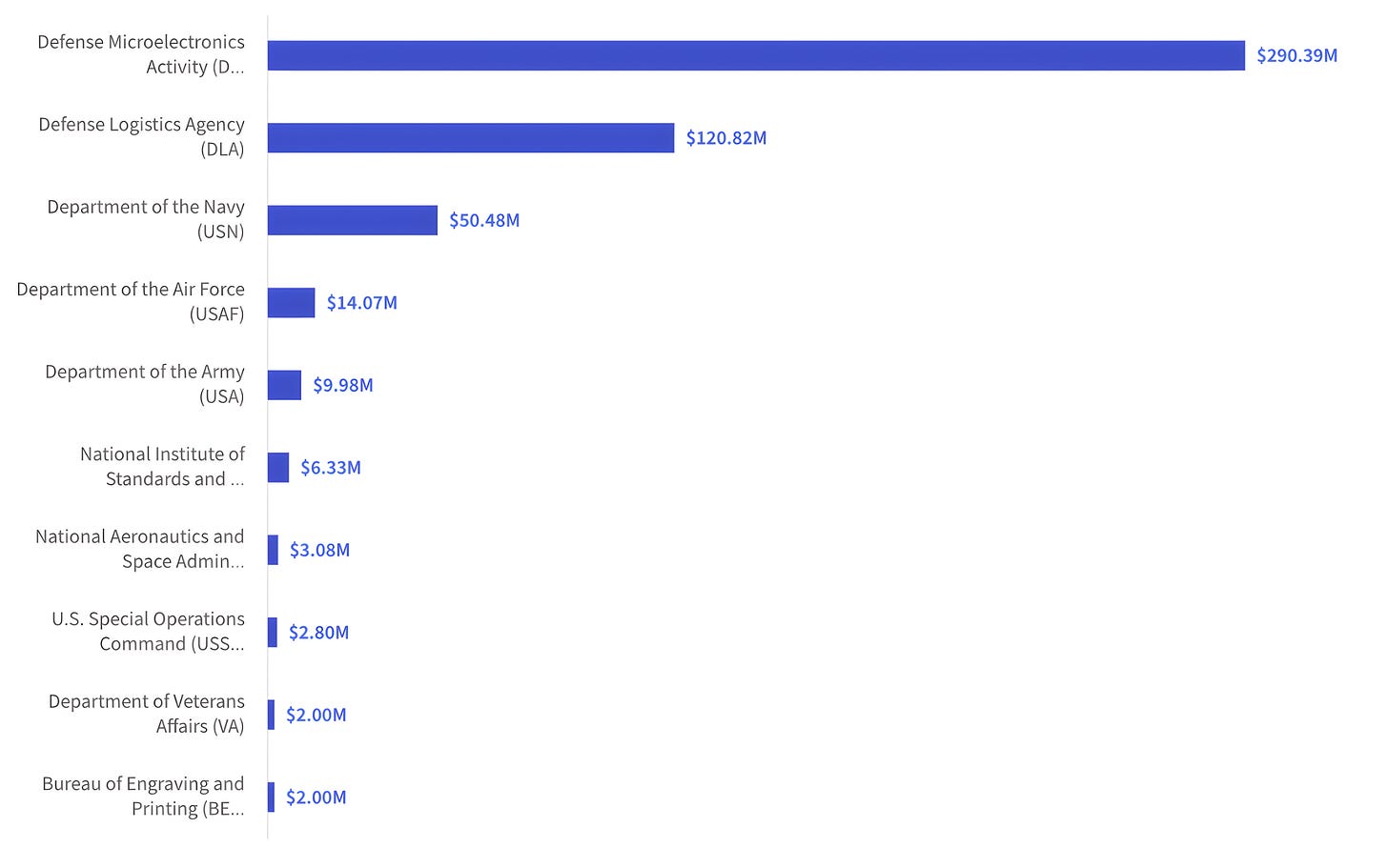

Anchor Code: NAICS 334413 - Semiconductor and Related Device Manufacturing. With $507.72M in federal semiconductor awards (FY23-25) and key opportunities under related PSCs, this sector is experiencing unprecedented investment in beyond-CMOS technologies. The concentration of funding in Defense Microelectronics Activity ($290.39M) signals urgent operational need for revolutionary compute architectures.

Method: Analyzed DoW FY26 budget documents (particularly PE 0602025E for NanoWatt Platforms and PE 0602146A for Quantum PNT), USAspending.gov contract data for NAICS 334413 (FY23-25), active SAM.gov opportunities, and Snowcap Compute’s Deep Research Profile revealing founders’ Northrop Grumman superconducting expertise.

Opportunities Uncovered: $19.99M in perfectly aligned FY26 RDT&E funding (DARPA NaPSAC and Army Quantum PNT), DIU Commercial Solutions Opening pathway for 90-day contract awards, immediate prime partnership opportunities with Northrop Grumman (founders’ connection), and first-mover advantage in commercial superconducting compute using standard 300mm fabrication.

Primary Takeaway: The technical limits in CMOS technology, exploding AI compute requirements, and DoW’s quantum initiatives creates an unprecedented opening for Snowcap Compute. Their superconducting platform isn’t just an incremental improvement – it’s the foundational shift needed to maintain strategic computing supremacy in power-constrained environments.

Who This Analysis Serves

📍 Early-stage founders: Your federal roadmap starts here

📍 Startup teams: Actionable insights for BD, Capture, Product teams, and more

📍 Defense investors: Portfolio-wide intelligence in one place

📍 Those exploring defense: Understand the ecosystem before you jump in

📍 Corporate innovators: See how startups navigate where you might partner

📍 Primes & Subcontractors: Identify partners and supply chain opportunities

How This Analysis Works

Each week, I pair one VC-backed defense startup with a specific NAICS code or PSC, then systematically decode their federal market using publicly available budget data and procurement signals. For this analysis, I filtered NAICS 334413 (Semiconductor and Related Device Manufacturing - FY23-25) to drill down into the opportunities relevant to Snowcap’s superconducting compute capabilities. The methodology remains consistent: triangulate between historical contract awards (what DoW bought yesterday), active opportunities (what they’re buying today), and future budgets (what Congress funded for tomorrow). This approach reveals procurement pathways that most companies miss when they focus on just one data source.

Important Note: While I use Snowcap Compute as this week’s example, I’m demonstrating how I would approach their federal market opportunity using NAICS 334413 as an analytical lens, not prescribing what Snowcap should do or hasn’t already figured out internally. Many exceptional defense startups have sophisticated federal strategies; others are still navigating these complex waters. My goal is to present hard data in a transparent, systematic way that helps any startup regardless of their current federal experience to see alternative perspectives on market entry.

The Core Question & Opportunity

This week, we’re working through how Snowcap Compute can transition from a venture-backed seed-stage company to a foundational DoW technology provider. The defense industrial base is facing a computational crisis: the physical limits of traditional CMOS technology are approaching, while the demand for advanced AI, real-time decision-making, and quantum control systems is exploding.

The core question for the Department of Defense War is how to maintain technological superiority when adversaries are also advancing deep-tech hardware, particularly in strategic computing. Snowcap Compute provides a critical, commercially viable answer to this challenge. By pioneering the first high-performance superconducting compute platform compatible with standard semiconductor fabrication processes, Snowcap is positioned to unlock unprecedented energy efficiency and performance improvements of up to 25x performance per watt improvement over current AI chips, necessary for true edge AI deployment and advanced quantum-classical hybrid systems.

The capabilities Snowcap offers aren’t merely incremental; they represent the foundational shift needed to secure strategic computing supremacy in a future defined by power-constrained environments and high-speed processing requirements.

I’ll walk you through what I’ve discovered by analyzing the DARPA RDT&E Justification Book PB 2026 and related FY26 budget documents, mapping core capabilities like AI-enabled bio-threat detection and rapid synthetic biology toolkits to explicit, funded requirements within Program Elements.

Let’s get into it…

0️⃣ MARKET RESEARCH PHASE

Understanding where NAICS 334413 dollars flow reveals critical patterns in federal semiconductor spending. The historical $507.72M in awards (FY23-25) confirms substantial market opportunity for beyond-CMOS technologies.

NAICS Award Data - Total Federal Obligations

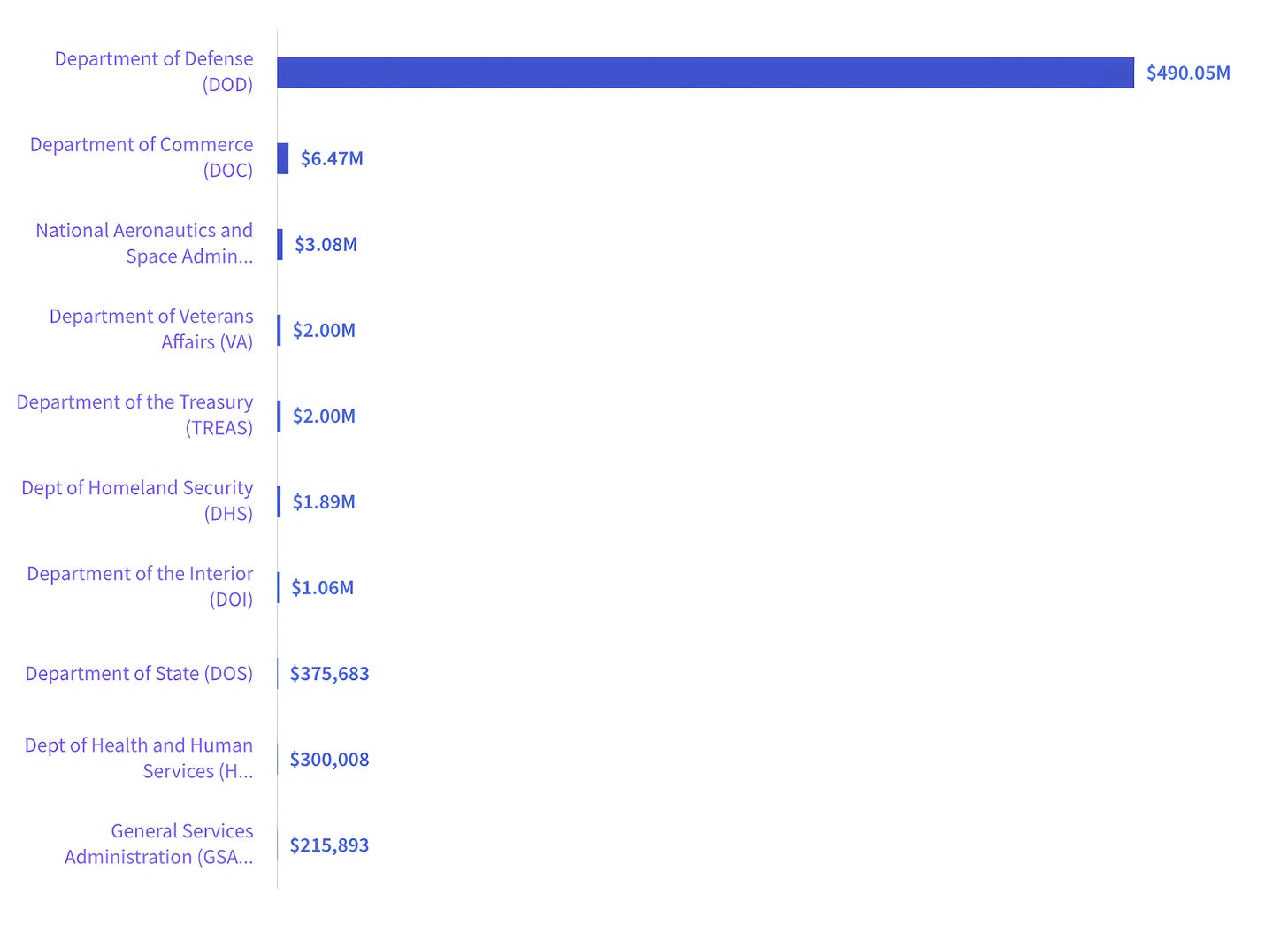

Total Addressable Funding & Agency Concentration

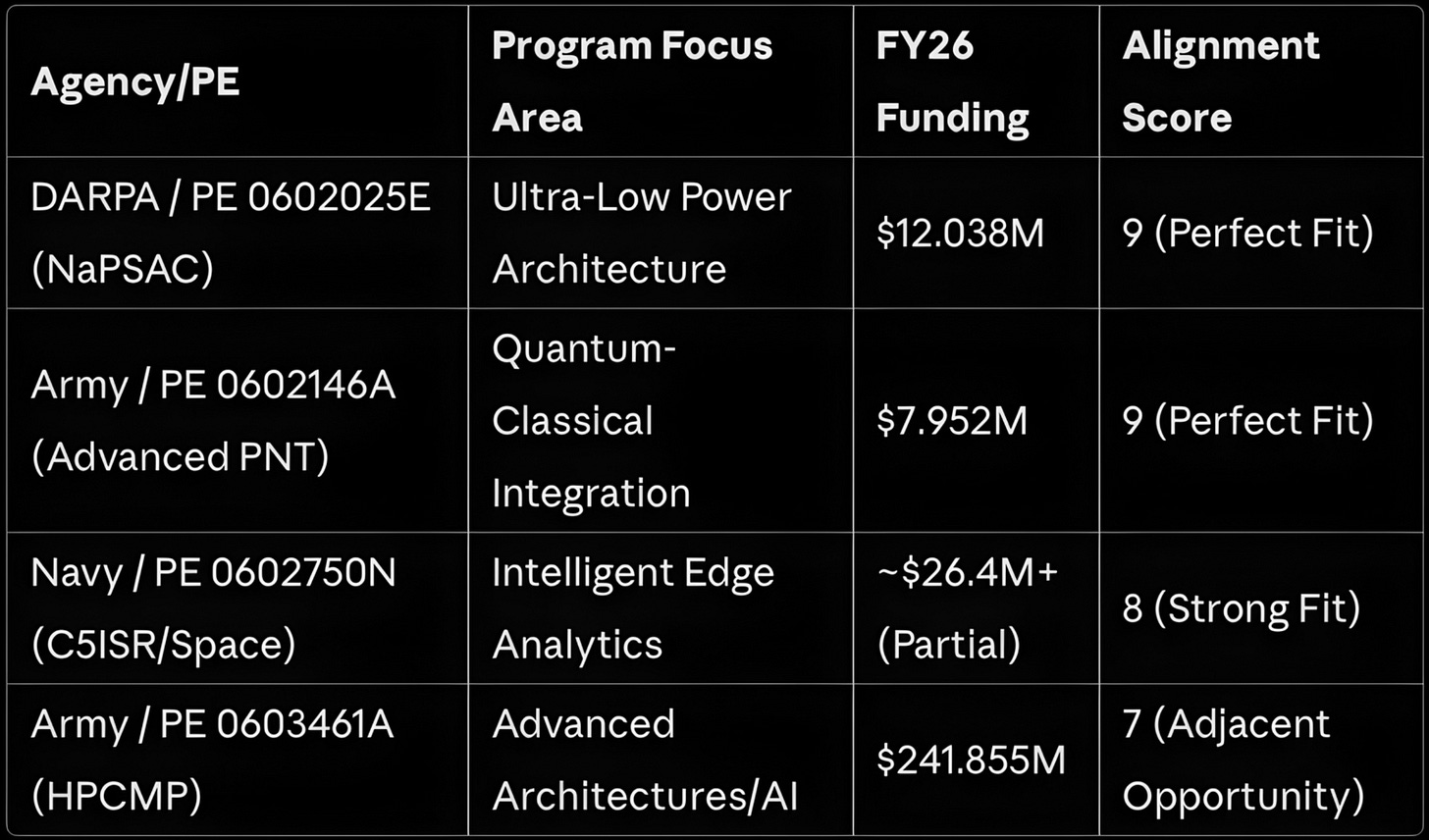

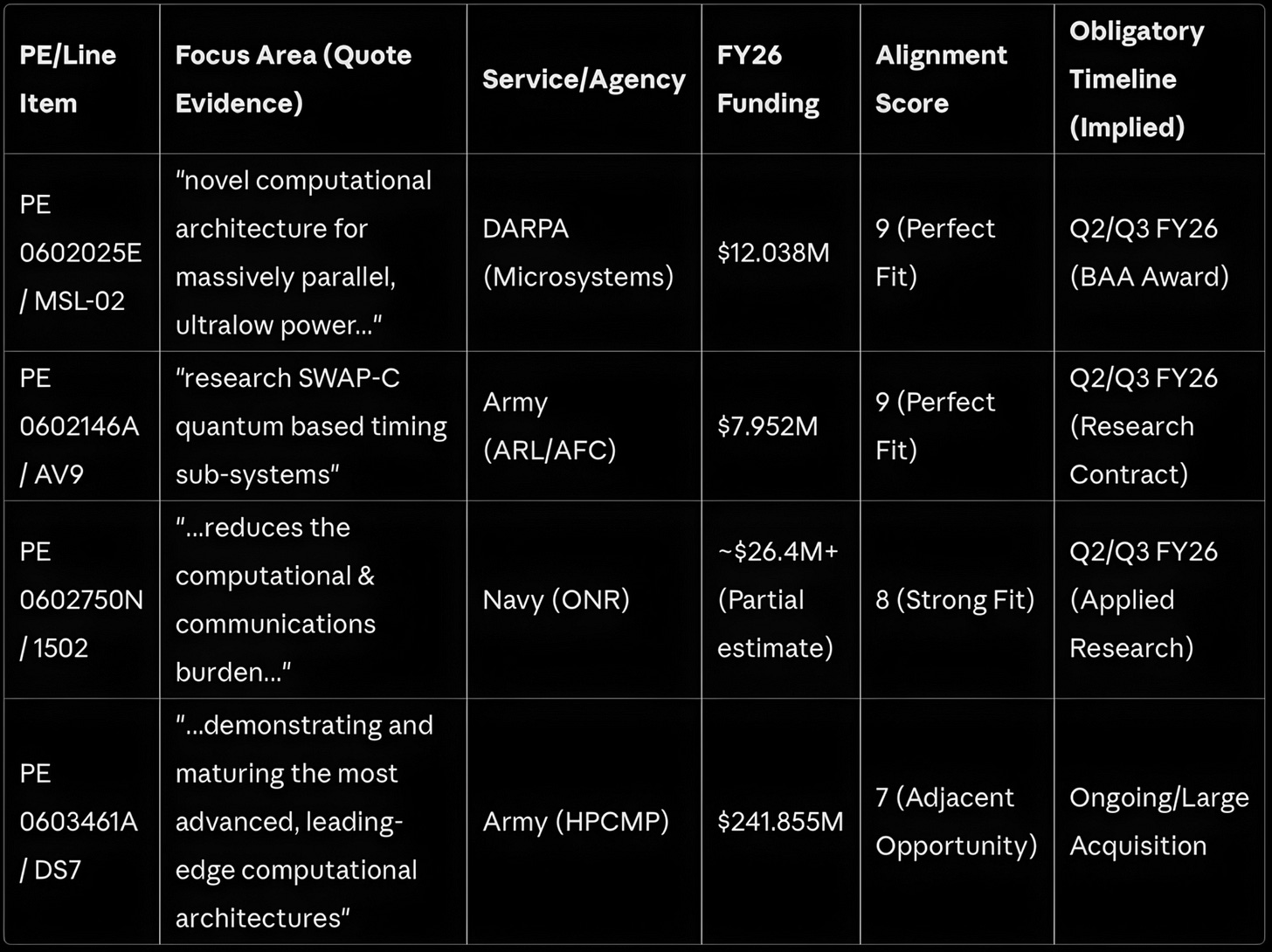

Analysis of the FY26 DoW Budget Justification documents reveals a conservative estimate of over $46.4 million in immediate, high-priority Research, Development, Test, and Evaluation (RDT&E) funding that perfectly aligns with Snowcap Compute’s core capabilities (Score 8/9 matches).

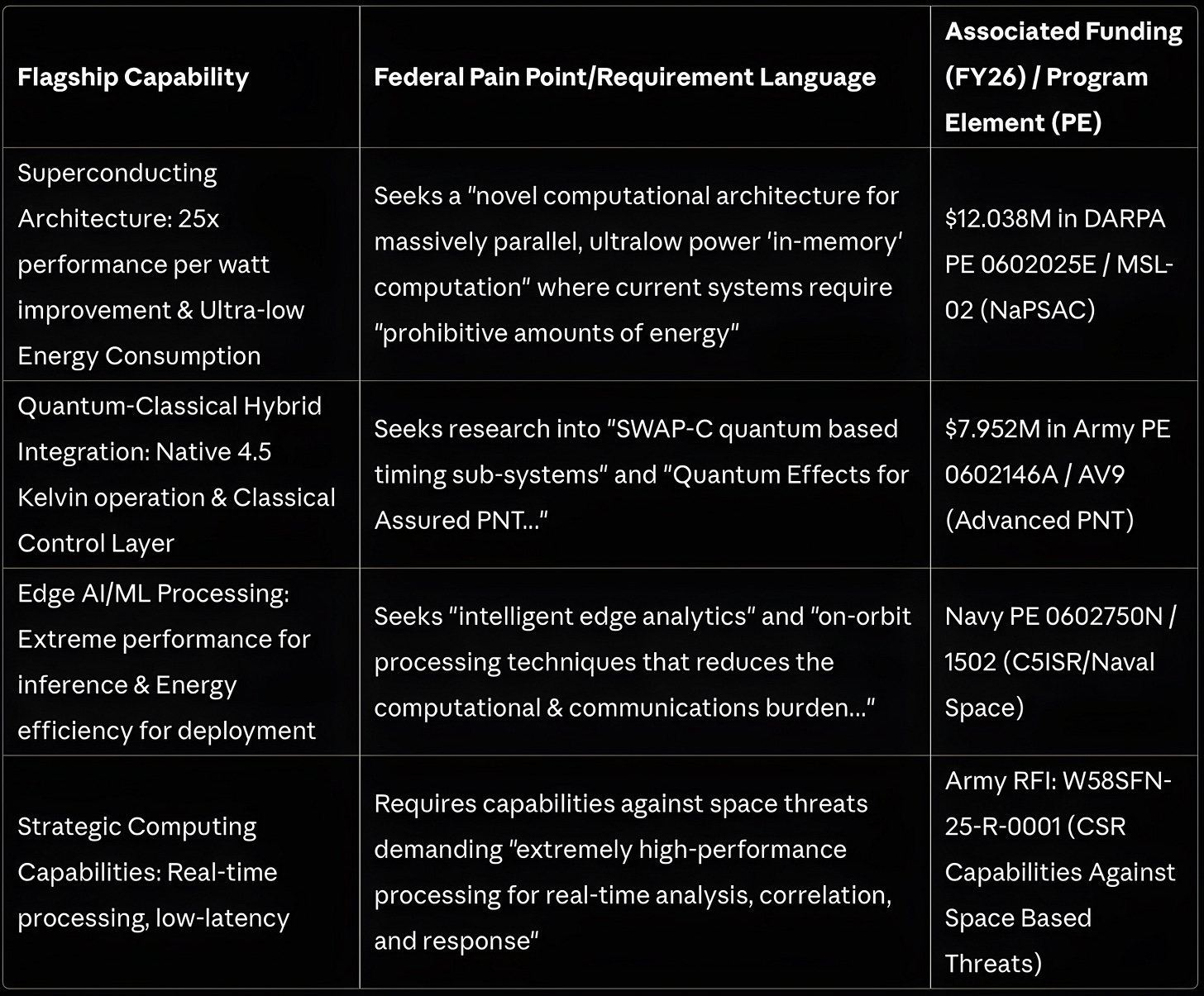

Priority FY26 RDT&E Funding Aligned with Superconducting Compute Capabilities

The most critical entry points are highly concentrated in the Applied Research (BA2) offices: DARPA’s Microsystems Technology Office (explicitly seeking “novel computational architecture for massively parallel, ultralow power” systems via NaPSAC) and the Army Research Laboratory (seeking “Quantum Effects for Assured PNT” where Snowcap’s cryogenic compatibility is a perfect technical fit).

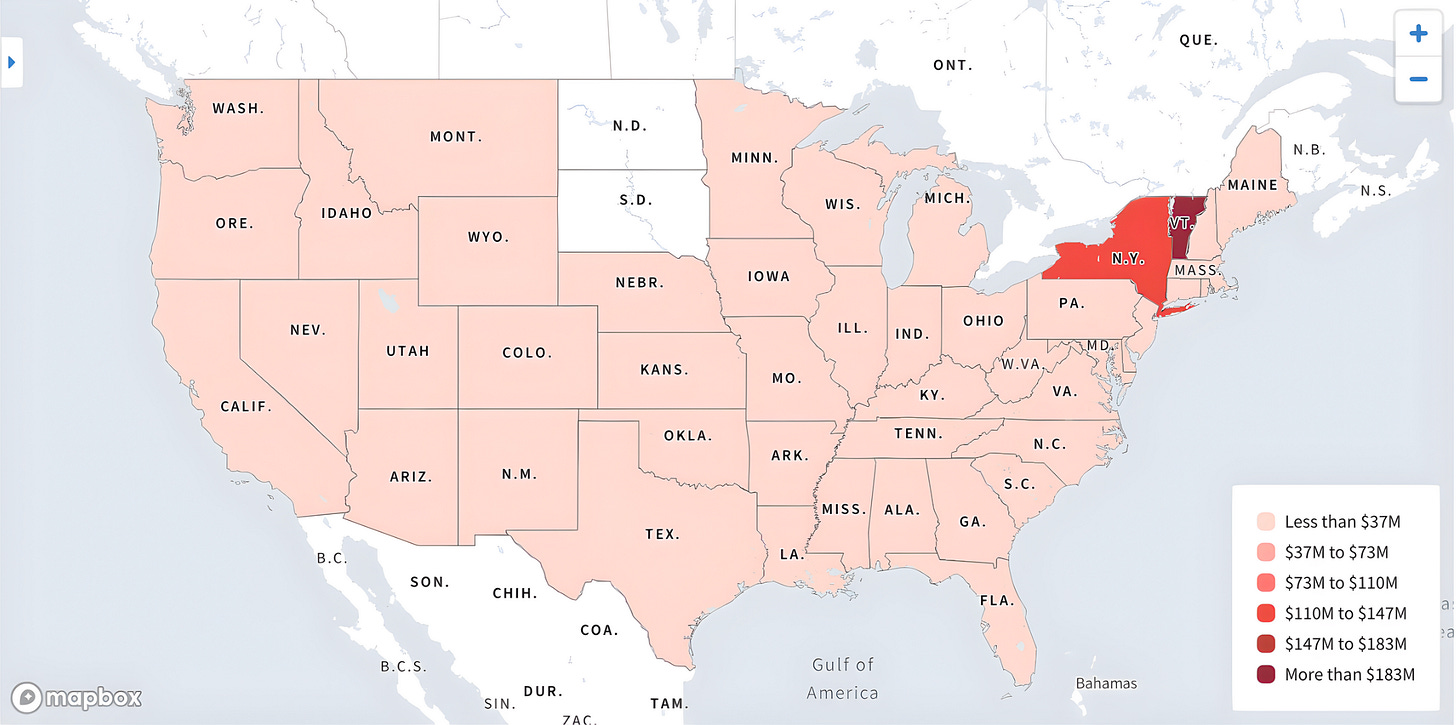

Geographic & Contractor Concentration

Snowcap Compute is headquartered in Palo Alto, California, positioning it within the high-talent corridor of Silicon Valley. The immediate opportunities are concentrated around the R&D and acquisition centers that define strategic computing: DARPA BAAs (managed primarily from Arlington, VA), Army Contracting Command-Redstone (Huntsville, AL) for CSR capabilities, and AFRL (various national locations) for AI Solutions.

Awarding Agency Distribution

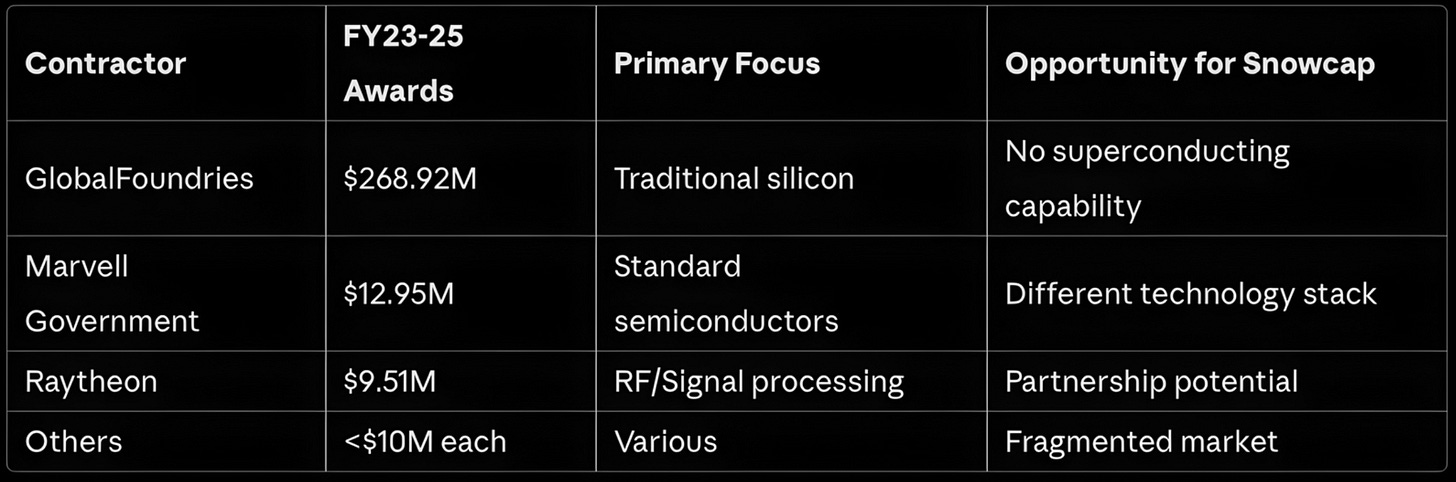

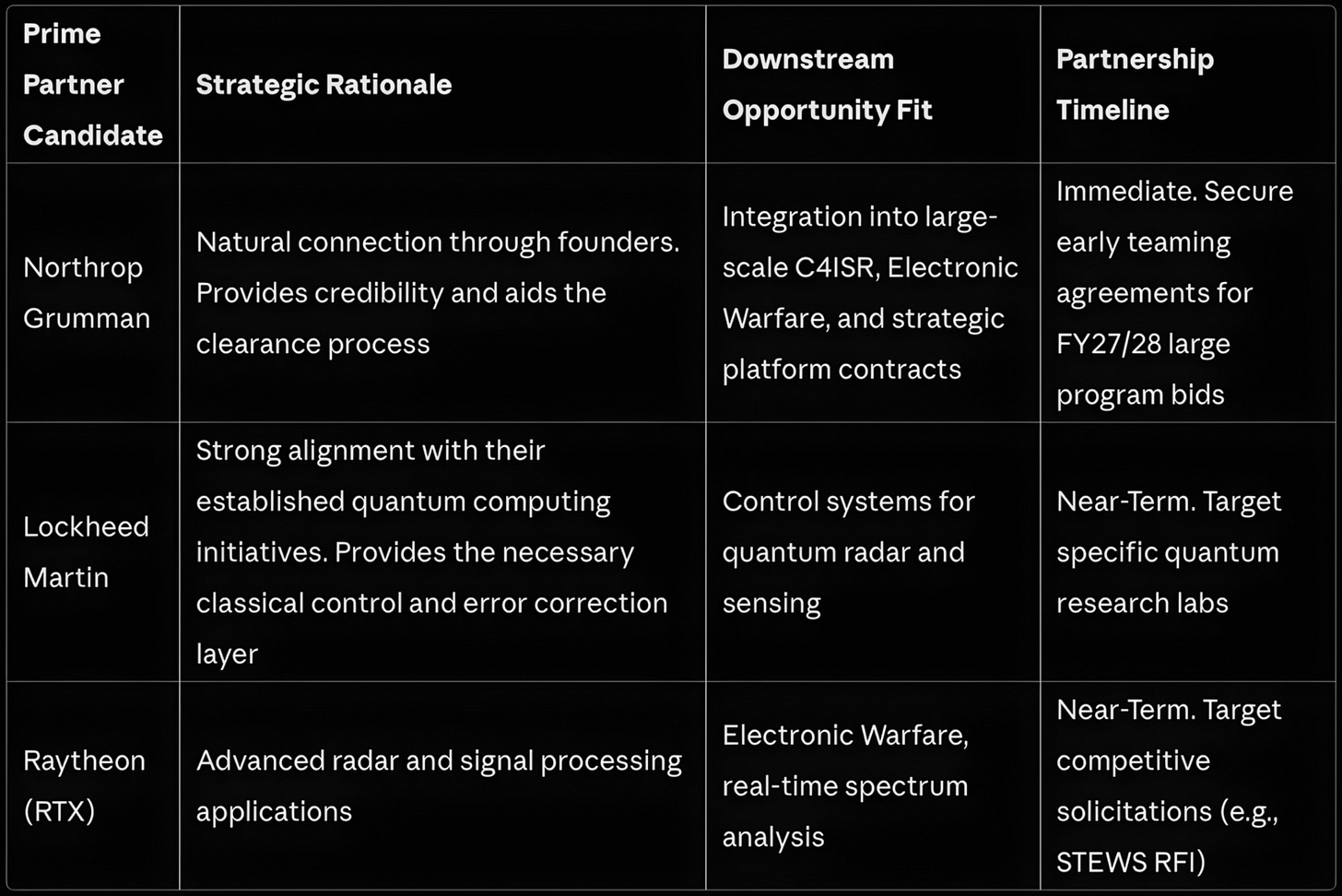

Snowcap holds a critical first-mover advantage in the commercialization of superconducting compute using standard fabrication processes (300mm fabs). The competitive landscape is defined by a massive gap: direct competitors are primarily research arms (IMEC, IBM Research focused on quantum) or utilize older technology (Hypres Inc.). This structural market gap ensures that Snowcap is uniquely positioned to partner with established Primes, such as Northrop Grumman (natural connection through founders), Lockheed Martin (quantum alignment), and Raytheon (signal processing).

Federal Award Geographic Heat Map

Key Federal Market Metrics for NAICS 334413

Why This Matters: The concentration of highly relevant R&D funding in specific Program Elements across DARPA, Army, and Navy validates that superconducting compute is shifting from a scientific novelty to an operational necessity. The explicit requirement for “ultralow power” computation and the demand for platforms compatible with cryogenic/quantum environments means Snowcap Compute’s technology is not merely an alternative, but a solution to an approaching physical crisis in defense computing. This market intelligence provides geographic and opportunity recognition by pinpointing which program offices (DARPA/MTO, Army/ARL) and mission areas (Advanced PNT, Edge AI) have immediate, dedicated capital.

Ways to Leverage This:

Establish Federal Presence Immediately: The company must complete SAM.gov registration and obtain a CAGE code immediately, as they currently lack federal contracting status

Target BAAs with Precision: Prioritize proposals specifically targeting the DARPA NaPSAC program (PE 0602025E) and the Army Quantum PNT effort (PE 0602146A). Frame capabilities using the exact budget justification terminology, such as “ultralow power computation” and “classical control and error correction layer for quantum systems”

Accelerate Partnerships: Actively engage Northrop Grumman, Lockheed Martin, and Raytheon, specifically briefing their quantum and advanced signal processing teams on the native integration of superconducting compute with cryogenic systems (4.5 Kelvin)

1️⃣ ACTIONABLE DEFENSE ROADMAP

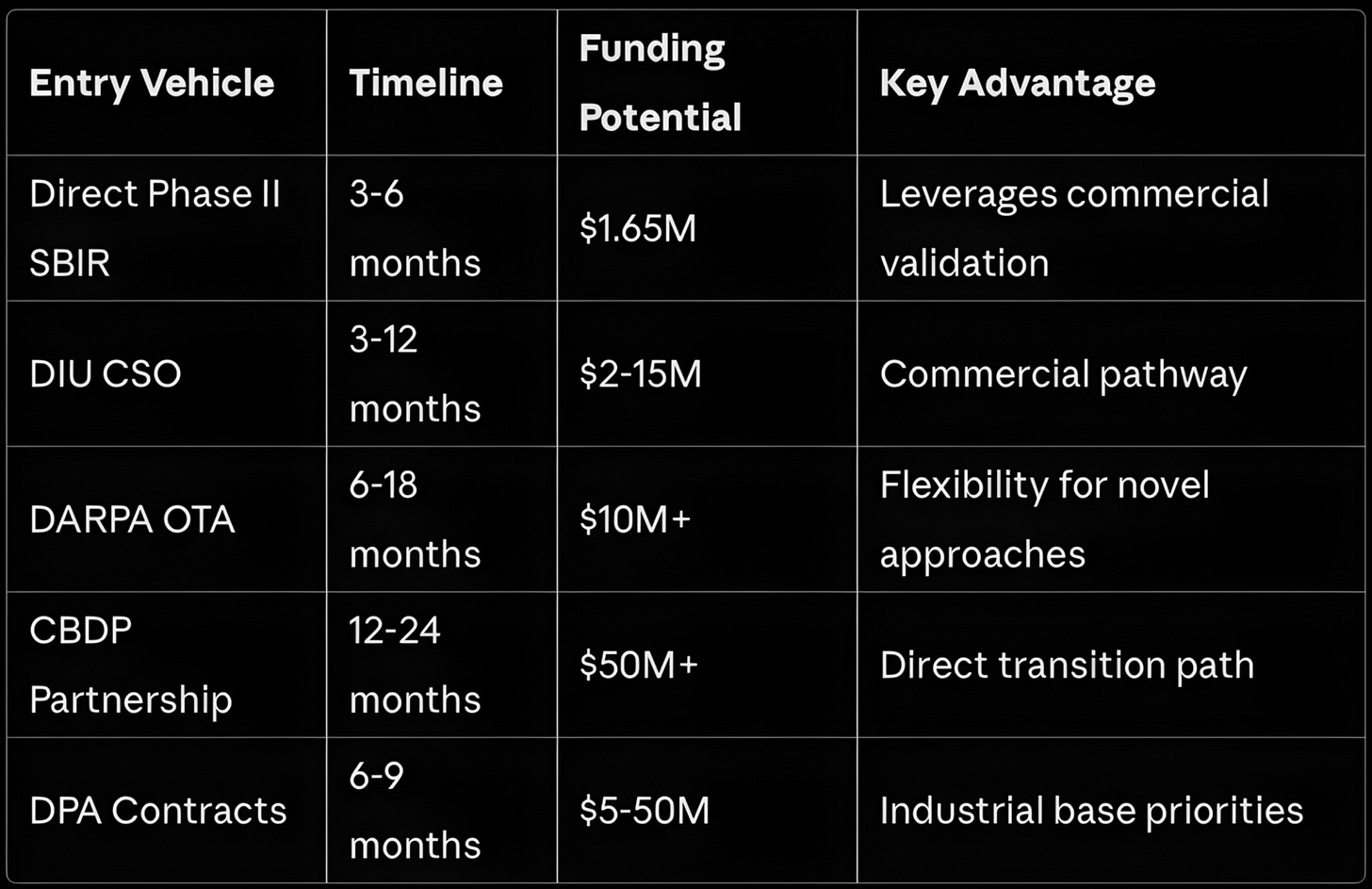

To capture the emerging federal market for superconducting compute, Snowcap must pursue a strategy of parallel execution, simultaneously leveraging direct R&D funding, strategic prime partnerships, and rapid acquisition vehicles. This roadmap focuses on compressing the typical 3-5 year federal revenue timeline to 12-18 months by targeting programs that explicitly fund ultra-low power and quantum-compatible architectures.

Path 1: Direct R&D Capture (The Funded Transition)

The most critical pathway involves immediate and precise targeting of highly aligned Program Elements (PEs) that have dedicated FY26 funding:

DARPA NaPSAC ($12.038M): Snowcap’s core value - its superconducting architecture and 25x performance per watt improvement - lines up to be a fit for the DARPA NaPSAC program (PE 0602025E), which seeks “novel computational architecture for massively parallel, ultralow power” systems.

Army Quantum PNT ($7.952M): The company could pursue the Army’s Advanced PNT effort (PE 0602146A), which researches “Quantum Effects for Assured PNT”. Because Snowcap’s platform operates at the required 4.5 Kelvin cryogenic temperature, it is foundational to serving as the classical control and error correction layer for the quantum timing subsystems.

Navy Edge AI/C5ISR: The Navy’s pursuit of “intelligent edge analytics” and on-orbit processing that “reduces the computational & communications burden” (PE 0602750N) is a strong fit for Snowcap’s energy-efficient AI inference capabilities.

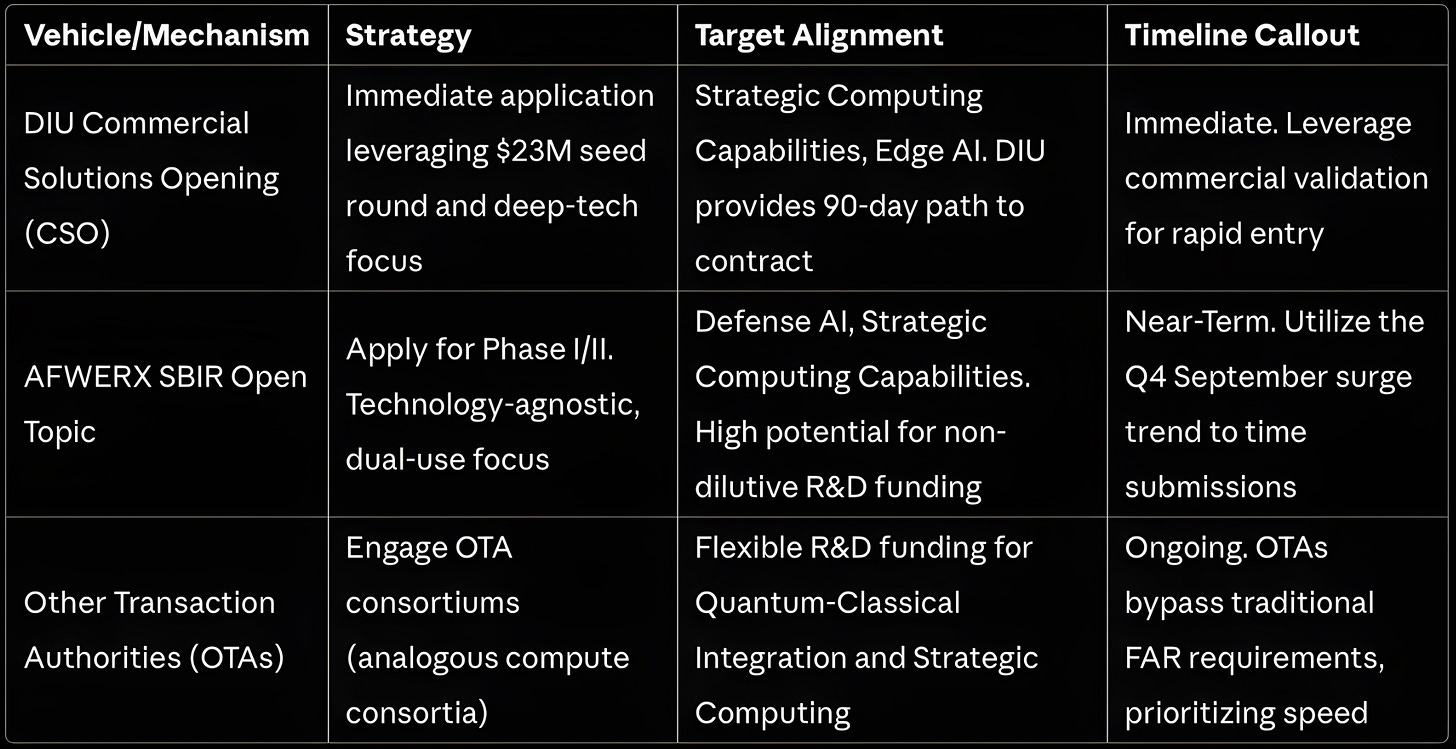

Path 2: Accelerated Solicitations & Commercial Vehicles

Snowcap could also use its disruptive technology (estimated TRL 3-4, moving toward TRL 5-6 by 2026) and commercial funding ($23M seed) to leverage rapid acquisition methods:

DIU Commercial Solutions Opening (CSO): Snowcap appears is a fit for the DIU CSO vehicle, which accelerates dual-use technology from venture-backed companies

AFWERX SBIR Open Topic: If the company hasn’t already, they should apply for SBIR Phase I through the AFWERX Open Topic to secure early, non-dilutive R&D funding

Targeting Mission-Critical Solicitations: Responses to current RFIs serve as bridge funding. The Army CSR notice (W58SFN-25-R-0001) explicitly seeks ‘extremely high-performance processing for real-time analysis’ - matching Snowcap’s core capabilities.

Rapid vehicles enabling 12-18 month federal revenue timeline

Path 3: Strategic Partnerships and Congressional Tailwinds

Prime Partner Candidates: Given the CSO (Dr. Anna Herr) and CTO (Dr. Quentin Herr) are former Northrop Grumman Fellows, Northrop Grumman is the natural primary partner candidate for subcontracting and technology integration. Lockheed Martin (quantum alignment) and Raytheon (signal processing) are also strategic targets

Investor Leverage: Pat Gelsinger’s role as Board Chair signals “serious strategic intent” and provides “unparalleled semiconductor credibility”

Congressional Support: Snowcap aligns with major policy initiatives, including the CHIPS Act (beyond-CMOS technologies) and the National Quantum Initiative Act, which are driving the mandated funding flows

Why This Matters: The intersection of specific, highly-aligned R&D funding (DARPA NaPSAC, Army Quantum PNT) provides an immediate, funded transition pathway totaling over $19.9 million in high-priority FY26 RDT&E. The first-mover advantage in commercial superconducting compute is critical, allowing Snowcap to define the next generation of classical-quantum integration hardware. Leveraging founders’ backgrounds (Northrop Grumman) and investor credibility (Pat Gelsinger/Playground Global) accelerates trust and access to critical prime partnerships required for large-scale defense integration.

Ways to Leverage This:

Secure Federal Status: Complete SAM.gov registration and obtain a CAGE code immediately

Target BAAs with Precision: Prioritize competitive proposals for the DARPA NaPSAC program (PE 0602025E) and the Army Quantum PNT effort (PE 0602146A)

Accelerate Partnerships: Formalize an early-stage teaming agreement or co-development strategy with Northrop Grumman

Utilize Rapid Vehicles: Apply for the DIU Commercial Solutions Opening (CSO) and AFWERX SBIR Open Topic to compress the federal revenue cycle

2️⃣ BUDGET INTELLIGENCE FOUNDATIONS

This section analyzes the immediate and long-term financial landscape for Snowcap Compute by triangulating specific FY26 RDT&E budget requests with the company’s capabilities and the broader defense market context.

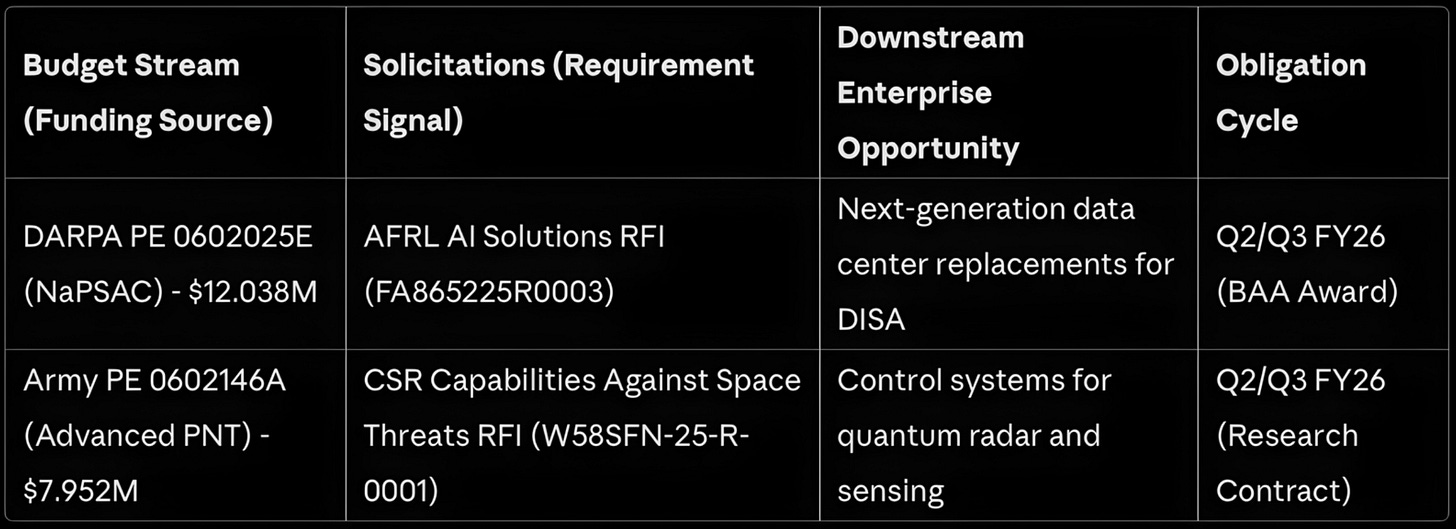

Mapping Top Funding Streams (FY26 RDT&E)

The FY26 DoW Budget Justification documents reveal $19.99 million in highly aligned, near-term RDT&E funding requests specifically matching Snowcap Compute’s core capabilities. These streams are concentrated in Applied Research (BA2) offices, indicating an urgent need for novel solutions.

FY26 Program Elements Aligned with Superconducting Compute Capabilities

These streams show that the DoW is forcing transformation. The NaPSAC program (PE 0602025E) directly addresses the need for “ultralow power” computation because current state-of-the-art computing systems require “prohibitive amounts of energy”.

Awarding Subagency Distribution

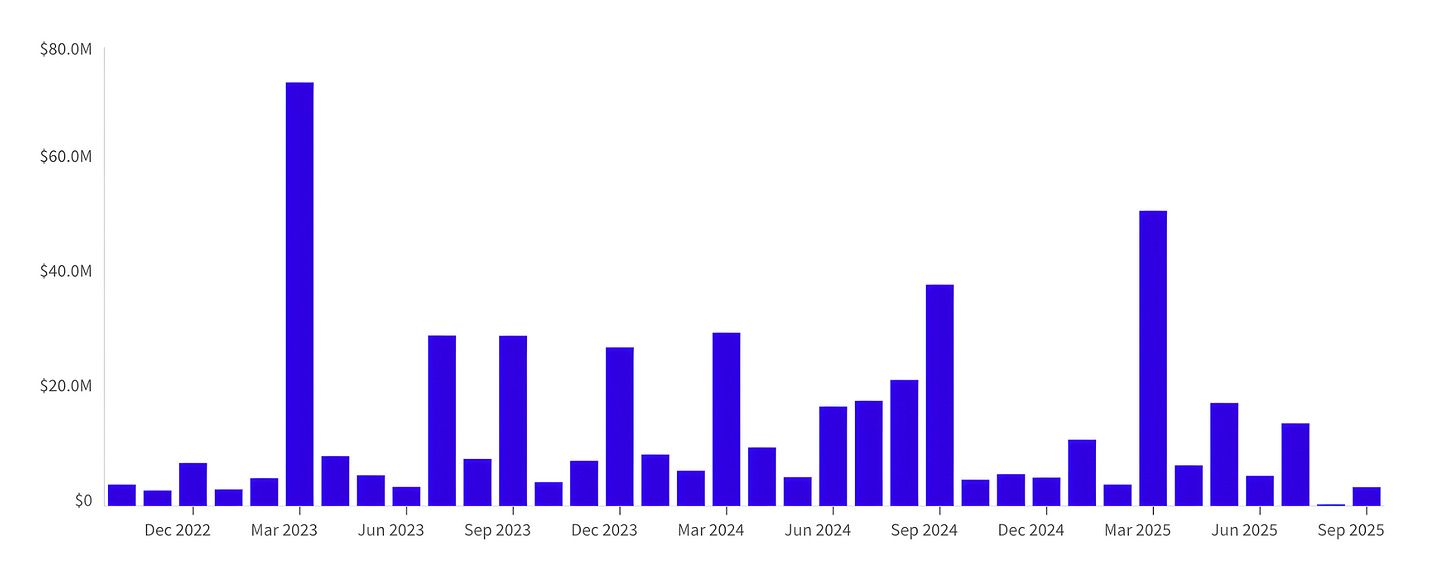

Historic Award and Spending Patterns Over Time

As Snowcap Compute is a first-time federal company, analysis of its direct historic awards is not applicable. However, the R&D funding model suggests:

Obligation Timeline: Funding obligation typically surges near the federal fiscal year-end (September). Companies should aim to time major proposals for submission in August to capture these surges

Acquisition Vehicle Preference: Funding for high-disruption technologies often flows via non-traditional, rapid acquisition methods (OTAs and innovation vehicles), supporting Snowcap’s use of the DIU CSO

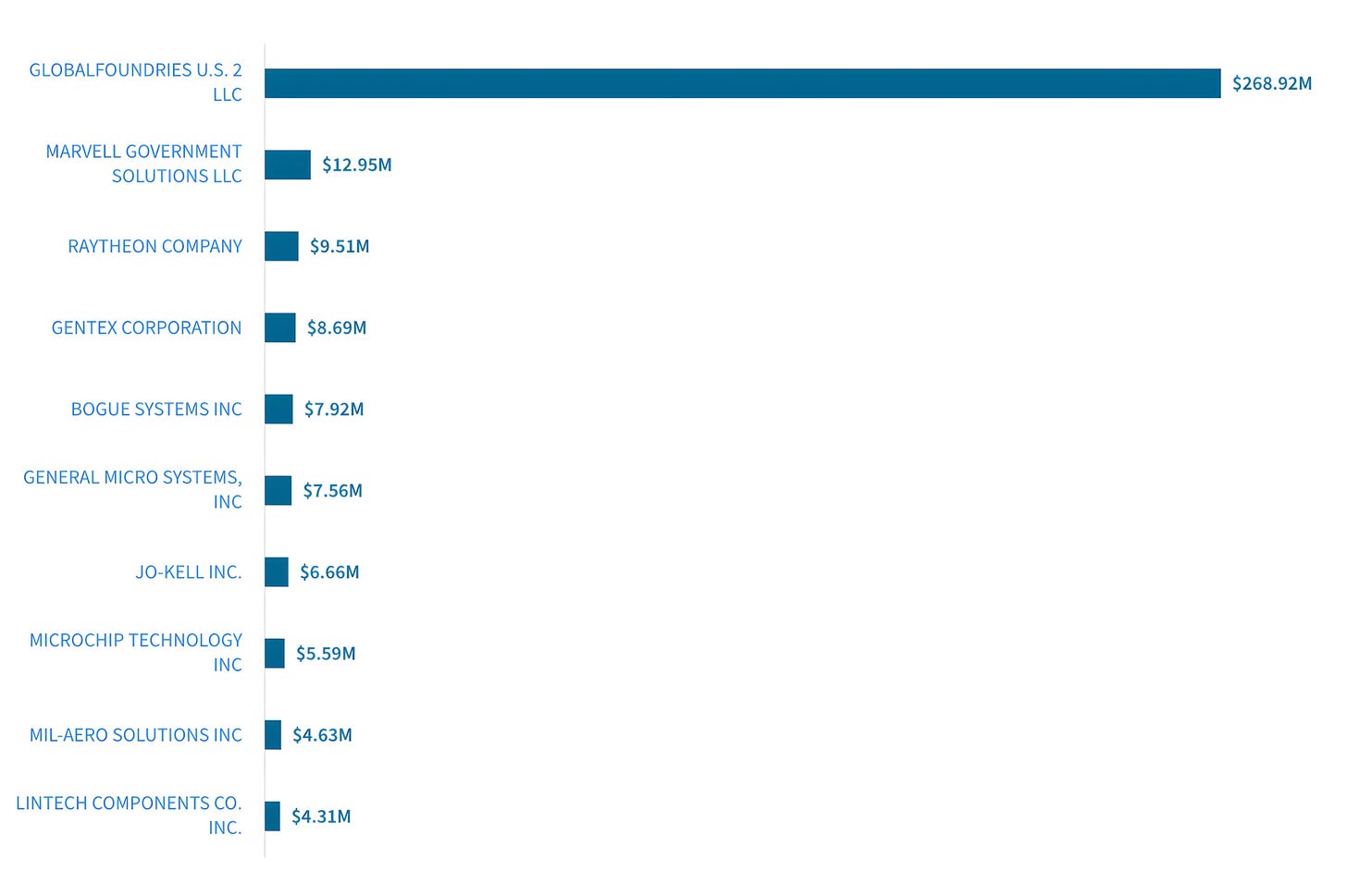

Quantifying Contractor Concentration/Fragmentation

The competitive environment for superconducting and advanced computing reveals significant fragmentation and a substantial opportunity gap:

Top Federal Recipients in NAICS 334413

Direct Competitors: Primarily research arms (IMEC, IBM Research focused on quantum) or utilize older, unscalable technology (Hypres Inc.). Snowcap holds a 3-5 year lead in viable commercial implementation using standard 300mm fabs

Talent and Ecosystem: The founders’ defense-funded research at Northrop Grumman provides a strong technical foundation

Investor Credibility: Pat Gelsinger’s role signals “unparalleled semiconductor industry credibility”, aiding discussions with government and prime partners

Strategic Computing gap analysis showing market opportunities

Why This Matters: This budget intelligence reveals a clear, funded demand signal for Snowcap Compute’s technology. The $19.99 million in high-priority RDT&E across DARPA and the Army confirms that the government is willing to invest immediately in foundational, novel architectures. The explicit program language: targeting “ultralow power” computation and “quantum based timing sub-systems” provides the exact terminology necessary for Snowcap to align its proposals and secure first-mover advantage.

Ways to Leverage This:

Target Budget Language: Frame all R&D proposals (especially for DARPA and Army BAAs) using the exact budget justification terminology

Expedite Federal Registration: Complete SAM.gov registration and obtain a CAGE code immediately

Time Submissions Strategically: Plan competitive R&D proposals and DIU CSO submissions to align with the Q2/Q3 FY26 obligation cycle, preparing materials by early August

Leverage Investor & Founder Credibility: Use Pat Gelsinger’s and the Herrs’ credibility to secure non-competitive access to program managers in the DARPA Microsystems Technology Office and Army Research Laboratory

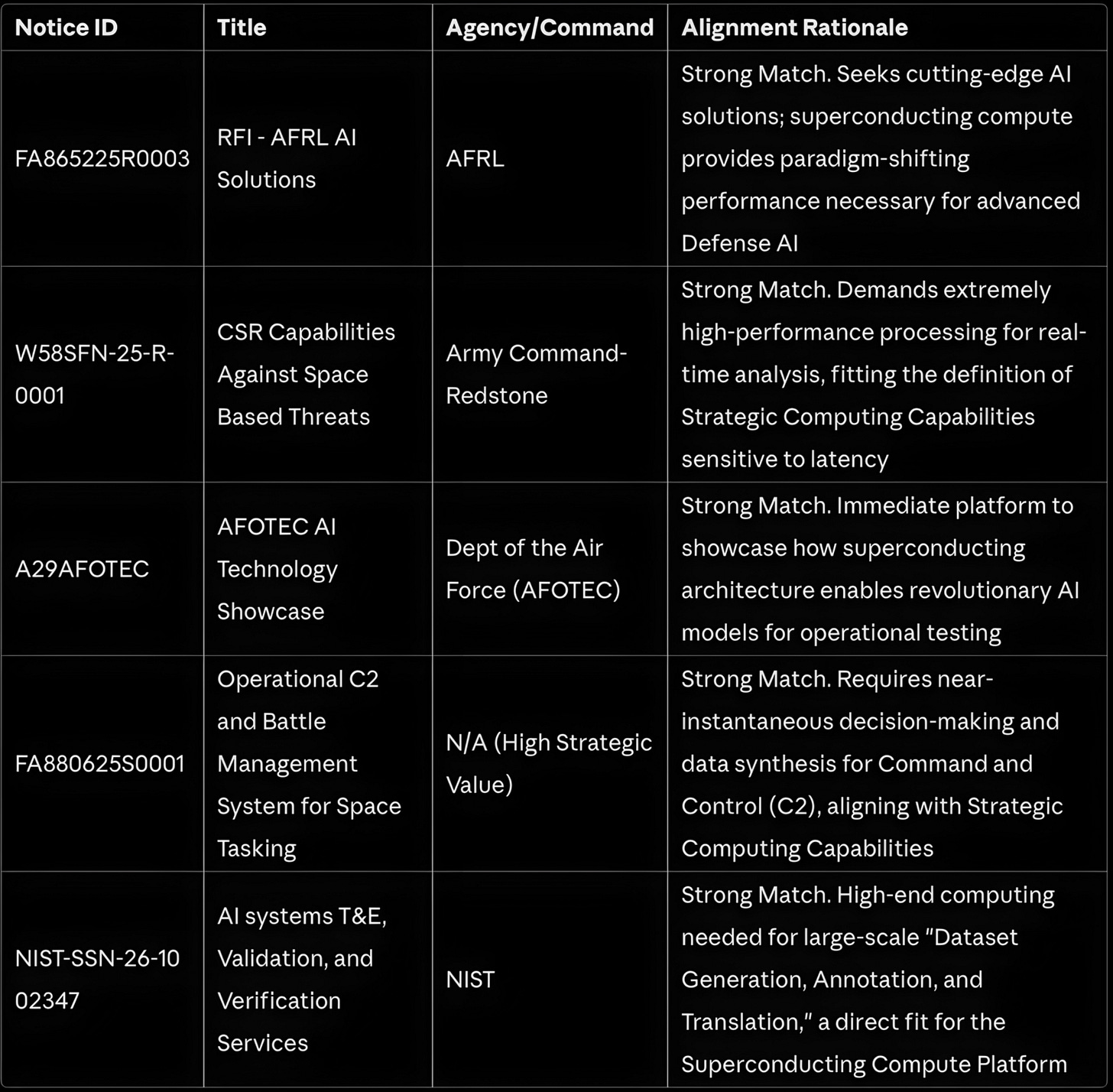

3️⃣ PRE-SOLICITATION & MARKET OPPORTUNITY MONITORING

The most direct pathway for Snowcap Compute is through aggressive monitoring and response to pre-solicitation notices (Sources Sought and RFIs). These notices reveal the specific functional requirements that high-level budget initiatives are translating into operational needs (CSR, Edge AI).

Aligning Market Opportunities

The following pre-solicitations are currently active or recently closed, providing immediate strategic intelligence and engagement points for Snowcap Compute’s superconducting platform:

Requirements Shaping and Early Engagement

Requirements for strategic computing are being shaped by the urgency of AI compute requirements and the need for quantum-compatible infrastructure.

Shaping Requirements: Solicitations show that operational commands are prioritizing solutions sensitive to latency and throughput. The Navy’s focus on “intelligent edge analytics” and reducing the computational burden (PE 0602750N) directly aligns with Snowcap’s 25x performance per watt advantage

Role of Early Engagement: Responses to RFIs are crucial because they directly influence the technical requirements written into future RFPs. The CSR notice (W58SFN-25-R-0001) is a critical, multi-phase down-select announcement, meaning early participation is essential to remain eligible

Noteworthy Patterns and Program Commands

Evaluation Focus: Evaluation is driven by transformative impact. Snowcap’s technology offers a “paradigm-shifting performance”, a key evaluation metric for advanced R&D organizations like AFRL and DARPA

Acquisition Speed: The strong alignment with these notices supports the use of rapid acquisition vehicles like the DIU Commercial Solutions Opening (CSO)

Program Offices: Key offices to engage include AFRL, AFOTEC, and the Army Contracting Command-Redstone. The founders’ background as former Northrop Grumman Fellows provides a substantial credibility advantage

Why This Matters: Pre-solicitations provide the definitive proof that the highly aligned FY26 RDT&E funding (NaPSAC, Quantum PNT) is translating into real-world operational requirements (CSR, Edge AI). These active notices offer the bridge funding and technical validation necessary to transition Snowcap’s current Technology Readiness Level (TRL 3-4) toward TRL 5-6. By responding to these notices, Snowcap can effectively influence the technical requirements of subsequent RFPs.

Ways to Leverage This:

Prioritize RFI Responses: Immediately respond to the AFRL AI Solutions RFI (FA865225R0003) and the AFOTEC AI Technology Showcase (A29AFOTEC)

Target Mission-Critical Needs: Treat the Army CSR Capabilities Against Space Based Threats (W58SFN-25-R-0001) notice as the top priority for demonstrating hardware advantage

Engage DIU and AFWERX: Use the strong fit with these pre-solicitations as evidence of mission-critical alignment when applying for the DIU Commercial Solutions Opening (CSO) or AFWERX SBIR Open Topic

4️⃣ CAPABILITY ALIGNMENT

Snowcap Compute’s core value proposition: the superconducting compute platform utilizing Josephson Junctions, provides orders of magnitude improvement in energy efficiency and performance, directly solving several existential computational constraints facing the DoW.

Capability-to-Requirement Translation Matrix

Technical Translation and Opportunity Fit

Addressing the Ultra-Low Power Constraint (DARPA NaPSAC): Snowcap’s superconducting architecture directly resolves the explicit pain point cited in the FY26 DARPA budget justification for the NaPSAC program (PE 0602025E). Snowcap is uniquely positioned to deliver the “novel computational architecture” necessary for this program, making the $12.038 million allocated to this effort a perfect technical and funding match.

Enabling Quantum Integration (Army Advanced PNT): The platform’s inherent operational requirement of 4.5 Kelvin translates into a critical enabling technology for quantum initiatives. Snowcap’s platform can serve as the classical control and error correction layer for the quantum timing subsystems sought by the Army’s Advanced PNT program (PE 0602146A), aligning perfectly with the $7.952 million funding request.

Solving Edge Processing Constraints (Navy C5ISR & Army CSR): The Navy’s PE 0602750N explicitly targets systems that “reduces the computational & communications burden”. Snowcap’s 25x performance per watt improvement directly addresses this by enabling real-time sensor fusion in power-constrained environments. Furthermore, the platform is an exact solution for the Army’s mission-critical CSR Capabilities Against Space Based Threats (W58SFN-25-R-0001), which demands extreme low-latency processing.

Why This Matters: This alignment analysis provides evidence-based validation that Snowcap Compute’s technology is a direct and necessary solution to specific, funded, high-priority DoW requirements. The Perfect Fits (Score 9) in DARPA NaPSAC ($12.038M) and Army Quantum PNT ($7.952M) guarantee immediate, dedicated R&D funding streams. By identifying the exact language used in budget justifications (e.g., “ultralow power,” “quantum based timing sub-systems”), Snowcap can frame its technical proposals for maximum impact.

Ways to Leverage This:

Proposal Language Optimization: Use the exact quotes and required terminology (”ultralow power,” “reduces the computational & communications burden”) from the budget documents when responding to BAAs and RFIs

Strategic Demonstrations: Prioritize demonstrations that showcase the superconducting platform’s ability to solve the mission-critical needs identified in the Army CSR Capabilities RFI (W58SFN-25-R-0001)

Targeted Program Manager Engagement: Leverage the credibility of the founders (former Northrop Grumman Fellows) and the Board Chair (Pat Gelsinger) to secure non-competitive meetings with the program managers responsible for the DARPA Microsystems Technology Office and the Army Research Laboratory

5️⃣ ADVANCED OPPORTUNITY PIPELINE

One strategic roadmap for Snowcap Compute involves a parallel pursuit strategy targeting highly funded programs, rapid acquisition vehicles, and strategic partnerships aligned with the shift to superconducting and quantum-compatible computing. Here is a three-track approach to consider:

Track 1: Rapid Acquisition Vehicles and Accelerators (0–12 Months)

Track 2: Prime Partnership Entry Points

Snowcap must leverage the defense experience of its founders, who were former Northrop Grumman Fellows.

Track 3: Correlating Funded Streams with Solicitations

Timeline Callouts (Obligation Cycles):

September Surge: Time major proposals for submission in August to capture Q4 contract trends

Q2/Q3 FY26 Obligation: Over two-thirds of FY26 funding is typically obligated by Q3 FY26 (by June 30, 2026). Perfect Fit R&D streams (NaPSAC, Quantum PNT) are expected to award in this timeframe

Why This Matters: This advanced pipeline demonstrates that Snowcap Compute can achieve rapid federal market penetration by executing a deliberate, parallel strategy. The combination of perfect-fit R&D funding ($19.99M) and immediate access to rapid acquisition vehicles (DIU CSO, AFWERX SBIR) ensures that the company can secure initial non-dilutive capital and research contracts within 12–18 months. Critically, leveraging the founders’ Northrop Grumman experience provides a crucial advantage in securing the Prime Partnerships necessary for transitioning superconducting hardware (TRL 4/5) into large, enduring acquisition programs.

Ways to Leverage This:

Maximize Rapid Vehicle Use: Immediately apply for the DIU Commercial Solutions Opening (CSO) and AFWERX SBIR Open Topic

Formalize Prime Teaming: Secure early teaming agreements with Northrop Grumman and Lockheed Martin to pursue the highly funded Army Quantum PNT (PE 0602146A) research contracts

Strategic Timing: Time competitive submissions (e.g., DARPA BAA responses) for the August/September surge window

Influence Long-Term Requirements: Actively respond to the Army CSR Capabilities RFI (W58SFN-25-R-0001) to demonstrate how the superconducting platform solves mission-critical high-performance needs

6️⃣ FY26 BUDGET INTELLIGENCE

Snowcap Compute is launching as the DoW is actively seeking “beyond-CMOS” solutions. The FY26 budget reflects this legislative urgency, translating Congressional interest in microelectronics security and quantum capabilities into specific, dedicated RDT&E funding streams that flow directly into Snowcap’s product space.

Flow of Funding and Appropriations

1. The DARPA Catalyst: Ultra-Low Power Architectures

Funding Flow: $12.038 million for NaPSAC under PE 0602025E / MSL-02

Agency & Intent: Flows directly to the DARPA Microsystems Technology Office. The appropriations language explicitly targets the development of a “novel computational architecture for massively parallel, ultralow power ‘in-memory’ computation” because current systems require “prohibitive amounts of energy”

Snowcap Correlation: Snowcap’s superconducting platform, offering 25x performance per watt improvement, is the ideal solution

Obligation Cycle: Expected BAA awards in Q2/Q3 FY26

2. The Army’s Quantum Bridge: Cryogenic Integration

Funding Flow: $7.952 million for Quantum PNT under PE 0602146A / AV9

Agency & Intent: Flows to the Army Futures Command (AFC) / Army Research Laboratory (ARL). The project seeks “research SWAP-C quantum based timing sub-systems”

Snowcap Correlation: Snowcap’s operation at 4.5 Kelvin allows it to serve as the classical control and error correction layer for the quantum PNT systems. This is a Perfect Fit (Score 9)

Obligation Cycle: Expected research contracts/OTAs in Q2/Q3 FY26

3. The Adjacent Opportunity: HPC and Enterprise Scale

Funding Flow: Army HPCMP, PE 0603461A / DS7, requesting $241.855 million for FY26

Appropriation Language: Seeks to mature the “most advanced, leading-edge computational architectures” leveraging advances in AI and quantum computing

Snowcap Correlation: Snowcap’s high-performance AI platform is a clear candidate for modernization efforts under this heavily funded program

Congressional & Policy Support

The funding stability for these initiatives is reinforced by Congressional priorities, including support for the CHIPS Act defense provisions and the push for a Quantum Computing Center of Excellence. This signals legislative intent to force technological transformation.

Why This Matters: The FY26 budget confirms dedicated, non-incremental funding to solve the precise computational deficiencies that Snowcap’s superconducting architecture addresses. The explicit budget language provides an evidence-backed roadmap, establishing that Snowcap’s solution is a strategic imperative. This guarantees specific R&D streams totaling over $19.99 million in the immediate future.

Ways to Leverage This:

Target Program Managers: Utilize the credibility derived from the founders’ defense-funded research at Northrop Grumman and Pat Gelsinger’s board role to secure direct engagement with the leadership at DARPA Microsystems Technology Office and the Army Research Laboratory

Optimize Proposal Language: Frame all competitive proposals using the exact budget justification terminology

Secure Federal Status: SAM.gov registration must be completed immediately to ensure eligibility to receive awards from the identified PE funding streams in the estimated Q2/Q3 FY26 timeline

🎯 To Wrap Up

Snowcap’s superconducting compute provides the 25x performance improvement necessary for advanced Defense AI for the defense sector, addressing the critical computational crisis caused by the approaching physical limits of CMOS technology and the explosion of AI compute requirements. The company, launched publicly with $23 million in seed funding, is developing the first commercially viable superconducting compute platform offering a 25x performance per watt improvement over current AI chips.

Analysis of the FY26 budget and active solicitations confirms an immediate, dedicated funding demand signal. Snowcap’s capabilities are an aligned fit for two critical, funded Program Elements (PEs): DARPA’s NaPSAC program (PE 0602025E - $12.038M), which seeks “ultralow power” architectures, and the Army’s Quantum PNT effort (PE 0602146A - $7.952M), which requires classical control layers for cryogenic quantum systems.

The fundamental lesson learned is that the DoW is forcing transformation rather than merely requesting incremental innovation. The deep defense-funded research from the founders (former Northrop Grumman Fellows) and venture credibility (Pat Gelsinger, Playground Global) creates a first-mover advantage that allows Snowcap to bypass traditional procurement barriers and pursue rapid acquisition vehicles like the DIU Commercial Solutions Opening (CSO).

🧭 Strategic Considerations

For Snowcap Compute and similar deep-tech hardware companies entering the defense market, the following strategic lessons are paramount:

The Urgency of Federal Status & Entry Sequencing: Snowcap must immediately complete SAM.gov registration (if not already completed) and obtain a CAGE code. Until this is done, it is ineligible for the competitive R&D funding (BAAs, OTAs) anticipated to award in Q2/Q3 FY26

Timing the FY26 RDT&E Obligation Cycle: Focus competitive proposals (DARPA NaPSAC, Army Quantum PNT) for submission by August. Precise timing is critical to capturing the $19.99 million in perfectly aligned R&D funding, over two-thirds of which will be obligated by Q3 FY26

Leveraging Credibility for Prime Partnerships: The founders’ history as Northrop Grumman Fellows provides a non-competitive advantage for securing early teaming agreements with Primes. This is essential for integrating superconducting hardware (TRL 3-4) into large, enduring programs and mitigating programmatic risks

Congressional & Policy Tailwinds: Congressional focus on beyond-CMOS technologies (CHIPS Act) and Quantum Centers of Excellence ensures that highly-aligned funding streams like NaPSAC (PE 0602025E) and Quantum PNT (PE 0602146A) are protected and mandated

Parallel Execution via Rapid Vehicles: Snowcap must immediately pursue the DIU CSO and target AFWERX SBIR Open Topic to secure early capital based on commercial traction ($23M seed round), avoiding reliance on traditional, slower FAR contracts

🧱 Building This Playbook Together

I would love to hear your feedback. Are there specific NAICS codes/PSCs or procurement challenges you’re wrestling with? My goal is to provide tactical, actionable insights you can implement immediately.

This methodology evolves with every conversation. The framework you’re reading has been shaped by discussions with founders, investors, and operators. Your feedback directly influences next week’s analysis.

I don’t just analyze where contracts land. I trace the money from congressional authorization through appropriation to obligation. This helps you see opportunities 6-12 months before RFPs drop.

Each week, I’m revealing new patterns and opportunities hidden in public data. But the real value comes from applying these insights to your specific situation.

Connect with me:

in

🧩 Descrambling This Week’s Jargon

Next week: Another VC-backed defense startup paired with their NAICS/PSC code. Same systematic approach, new market insights. Reply with suggestions!

Data current as of October 12, 2025. Analysis based on FY26 defense budget documents, SAM.gov active opportunities, USAspending.gov & FPDS contract data for NAICS 334413 (FY23-25), and Snowcap Compute public information.

Disclaimer: This analysis is not paid advice or sponsored content. The views, research, triangulation methodology, and analytical frameworks presented are solely those of Ross Facione. This newsletter represents independent analysis using publicly available data sources. All strategies and recommendations should be validated with appropriate legal and procurement professionals before implementation.