FILE 18: ORBITAL EDGE COMPUTING

Space Is the New Cloud (Here's Your Federal Roadmap to Capture It)

📊 The 60-Second Snapshot

Company: Sophia Space is pioneering Orbital Edge Computing (OEC) using the modular, ultra-thin TILE™ platform to process AI workloads directly in space, reducing latency and bandwidth constraints associated with ground systems. The architecture is built on three years of research with deep Caltech/JPL heritage.

Sector: The company is leading the transition of massive AI compute demands to orbit, capitalizing on space’s unlimited solar power and passive cosmic vacuum cooling, which solves the increasing environmental and energy consumption crises facing terrestrial data centers. Jeff Bezos noted that data centers are the ‘next step’ for space ventures, dreaming of gigawatt data centers in space in 10+ years.

Federal Market Transformation: With $3.5M in pre-seed funding led by Unlock Ventures (an early stage firm co-headquartered in Seattle), with participation from angel investors and industry leaders, plus strategic partnerships with Axiom Space (for the Golden Dome missile defense demonstration) and Armada (for Earth-to-space edge integration), Sophia Space is positioned as an early mover in delivering low-latency, resilient compute essential for contested environment operations and the U.S. Space Force’s JADC2.

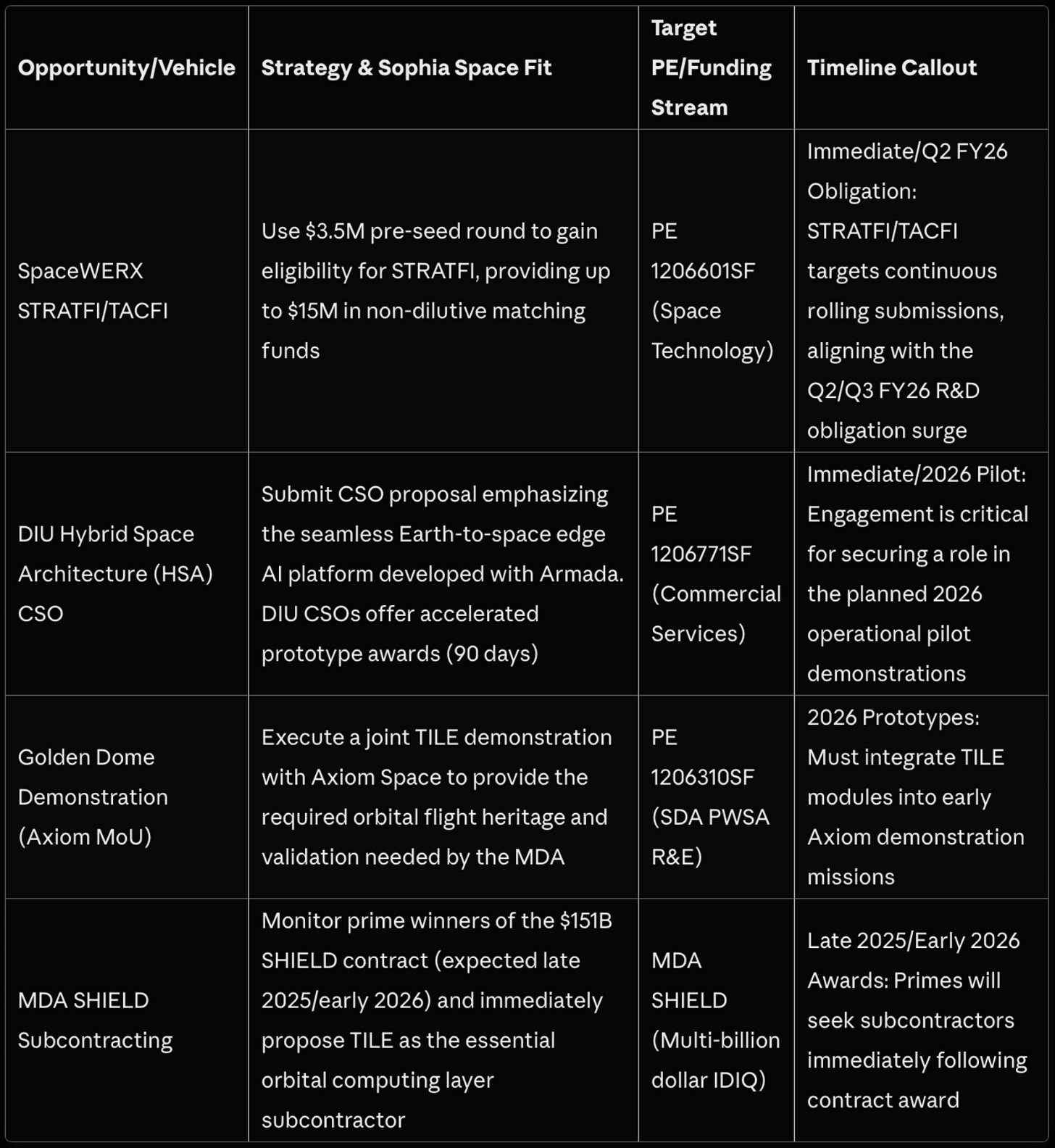

Anchor Code: NAICS 518210 (FY2024 - 2025) - Computing Infrastructure Providers, Data Processing, Web Hosting, and Related Services. Driven by the exponential demand for AI compute, particularly at the edge, the global Orbital Data Center market is projected to reach $39.09 billion by 2035 (67.4% CAGR), representing a fundamental transformation of the traditional data processing sector.

Method: Analyzed DoW FY26 budget documents (specifically focusing on PE 1206310SF for SDA PWSA and PE 1206601SF for On-Orbit Edge Processing), extensive market research reports projecting the Orbital Data Center market size, interview transcripts/quotes (from Dr. Leon Alkalai and Hon. Dan Goldin), LinkedIn posts, company public data (e.g., funding amount), USAspending NAICS code analysis, and partnership announcements with Armada and Axiom Space.

Opportunities Uncovered: Approximately $507.7 million in highly aligned FY26 Research, Development, Test, and Evaluation (RDT&E) funding focused on on-orbit sensor fusion and edge processing, including a $459.989M priority match for SDA’s Proliferated Warfighter Space Architecture (PWSA) [PE 1206310SF]. Rapid acquisition pathways are immediately available through the DIU Hybrid Space Architecture (HSA) CSO and SpaceWERX STRATFI/SBIR programs that prioritize on-orbit dual-use capability.

Primary Takeaway: Sophia Space delivers Earth-like computing performance directly in orbit, providing a critical asymmetric advantage over adversaries and traditional defense contractors by enabling real-time threat detection for the Golden Dome Missile Defense Architecture. Their software-defined, JPL-proven TILE architecture offers unparalleled resilience and scalability needed to establish U.S. orbital computing superiority as competitor nations launch their own space-based supercomputer networks.

Who This Analysis Serves

Early-stage founders: Your federal roadmap starts here

Startup teams: Actionable insights for BD, Capture, Product teams, and more

Defense investors: Portfolio-wide intelligence in one place

Those exploring defense: Understand the ecosystem before you jump in

Corporate innovators: See how startups navigate where you might partner

Primes & Subcontractors: Identify partners and supply chain opportunities

How This Analysis Works

Each week, I pair one VC-backed defense startup with a specific NAICS code or PSC, then systematically decode their federal market using publicly available budget data and procurement signals. For this analysis, I filtered NAICS 518210 (Computing Infrastructure Providers, Data Processing, Web Hosting, and Related Services) to drill down into the opportunities relevant to Sophia Space’s next-generation orbital computing capabilities.

I’ve been working on this particular analysis for several weeks now - the orbital computing market represents such a fascinating intersection of traditional data center economics and space infrastructure that I wanted to really dig into the nuances.

Important Note: While I use Sophia Space as this week’s example, I’m demonstrating how I would approach their federal market opportunity using NAICS 518210 as an analytical lens, not prescribing what Sophia Space should do or hasn’t already figured out internally. Many exceptional defense startups have sophisticated federal strategies; others are still navigating these complex waters. My goal is to present hard data in a transparent, systematic way that helps any startup regardless of their current federal experience to see alternative perspectives on market entry.

The methodology remains consistent: I triangulate between historical contract awards (what DoW bought yesterday), active opportunities (what they’re buying today), and future budgets (what Congress funded for tomorrow). This data-driven approach reveals procurement pathways that most companies miss when they focus on just one data source.

The Computational Crisis Driving Federal Innovation

This week, we’re working through how Sophia Space can transition from a venture-backed pre-seed stage company to a foundational Department of Defense (DoW) infrastructure provider.

The defense industrial base and the global economy are facing a computational crisis: terrestrial AI infrastructure is consuming massive energy and water resources, while the demand for real-time decision-making, joint operations, and threat detection is exploding. This intersection necessitates immediate innovation beyond vulnerable ground-based systems.

“We are at the dawn of a new era where our demand for AI technology should not come at the expense of our planetary health due to energy constraints.”

-Dr. Leon Alkalai, Founder/Chairman of Sophia Space

The core question for the DoW becomes clear - how to maintain technological superiority and resilience when adversaries are actively racing to deploy large-scale orbital supercomputer networks. Sophia Space provides a critical, commercially viable answer to this challenge by pioneering the world’s first scalable Orbital Data Center (ODC) architecture. Sophia Space’s Orbital Edge Computing (OEC) technology leverages the natural advantages of space - unlimited continuous solar power and passive cooling in the cosmic vacuum - to deliver low-latency AI processing directly in orbit, near the source of data.

I’ve been reading through the company’s publicly available information, founder credibility (Dr. Leon Alkalai’s JPL background and Hon. Dan Goldin’s advisory role), and critical federal signals from the FY26 RDT&E budget documents, USAspending NAICS analysis, and the strategic Axiom Space MoU to demonstrate the foundational importance of OEC for the Golden Dome missile defense initiative.

The capabilities Sophia Space offers aren’t merely incremental improvements - they represent a foundational shift needed to secure strategic computing supremacy by eliminating the latency and vulnerability of traditional systems. CEO Rob DeMillo frames it simply - customers “just want their data processed and delivered more rapidly” and Sophia delivers by “dramatically reducing the time to insight on Earth.” Hon. Dan Goldin further emphasizes that this technology “gives America the strategic high ground to ensure the integrity of our national security to protect us from emerging threats.”

Let’s get into it...

0️⃣ MARKET RESEARCH PHASE

Understanding where NAICS 518210 (Computing Infrastructure Providers, Data Processing, Web Hosting, and Related Services) dollars are flowing reveals critical patterns in the foundational shift from terrestrial data centers to orbital compute infrastructure.

The core market driver is the computational crisis facing ground-based systems, which are increasingly burdened by massive energy consumption, water strain, and physical vulnerability. AI infrastructure demand is growing exponentially, leading industry leaders like Jeff Bezos to suggest there will be gigawatt data centers in space in ten or more years. This necessity validates the emerging market for Orbital Edge Computing (OEC).

Market Sizing and Funding Profile

The Orbital Data Center (ODC) market is set for rapid expansion, primarily driven by the need for low-latency, resilient data processing in space.

Orbital Data Center Market Metrics

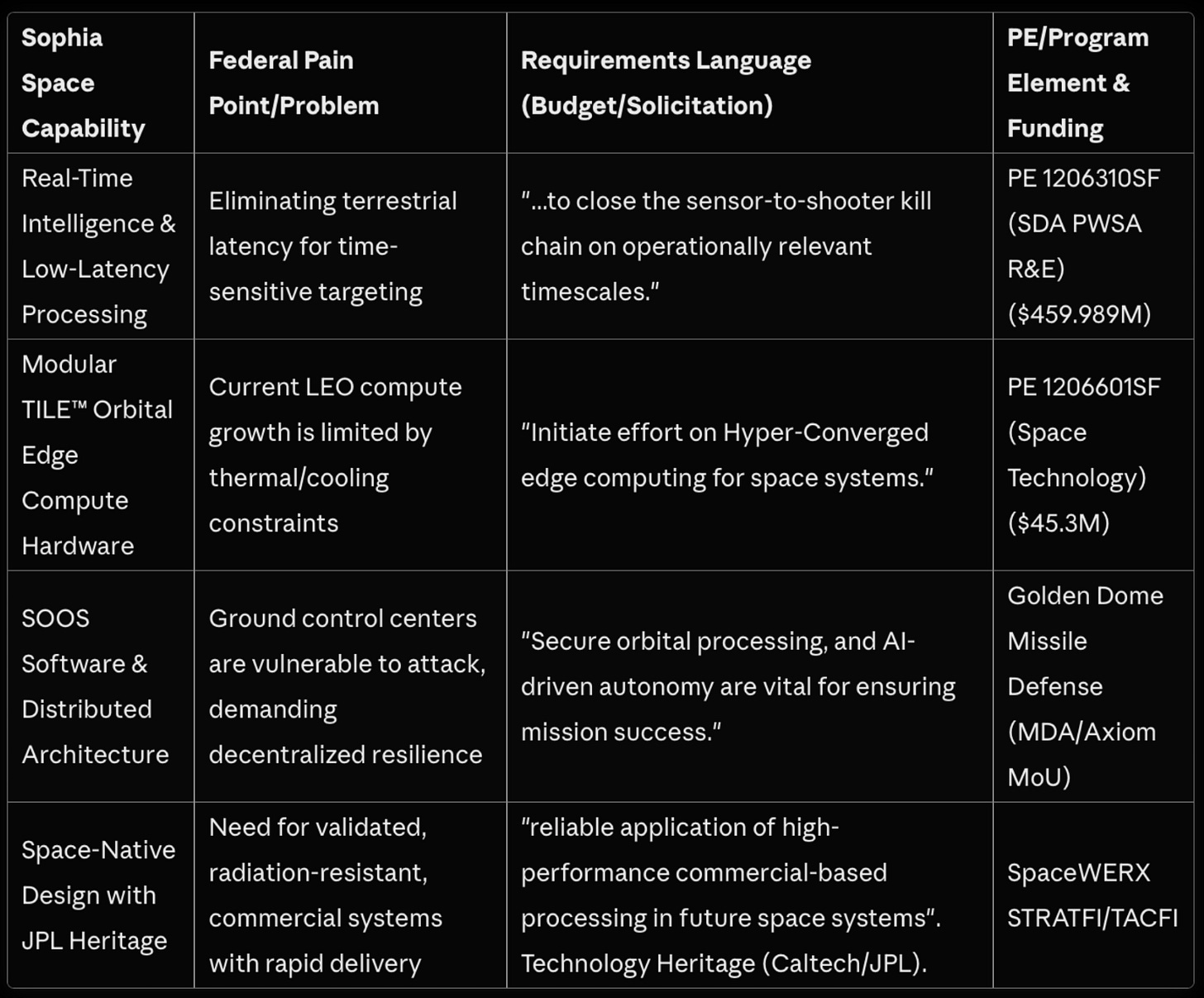

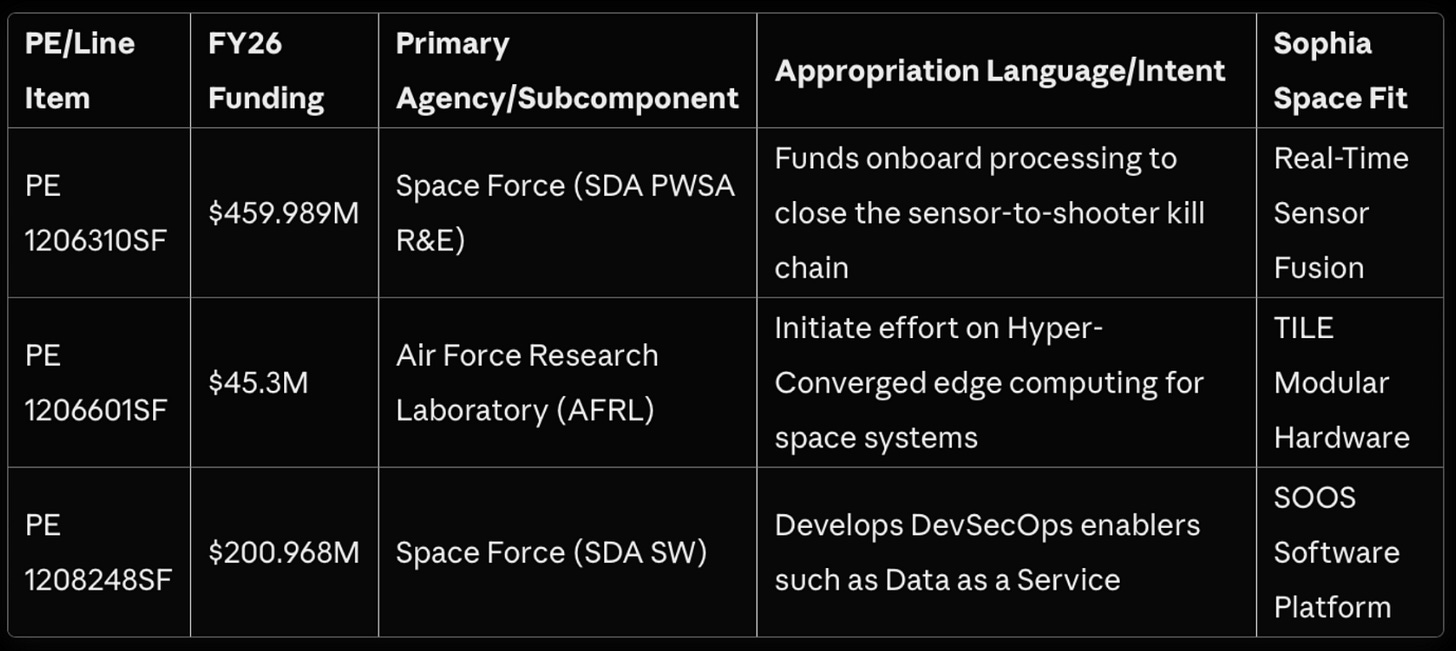

The immediate federal opportunity is anchored in Research, Development, Test, and Evaluation (RDT&E) funding streams that explicitly call for Sophia Space’s core capabilities. The FY26 budget for PE 1206310SF (SDA PWSA R&E) alone allocates $459.989M for efforts including multi-intelligence sensor fusion and algorithms necessary to close the sensor-to-shooter kill chain on operationally relevant timescales. Additionally, $45.3M is budgeted in PE 1206601SF for Space Technology, which seeks research on the “reliable application of high-performance commercial-based processing in future space systems to enable revolutionary on-orbit edge processing.”

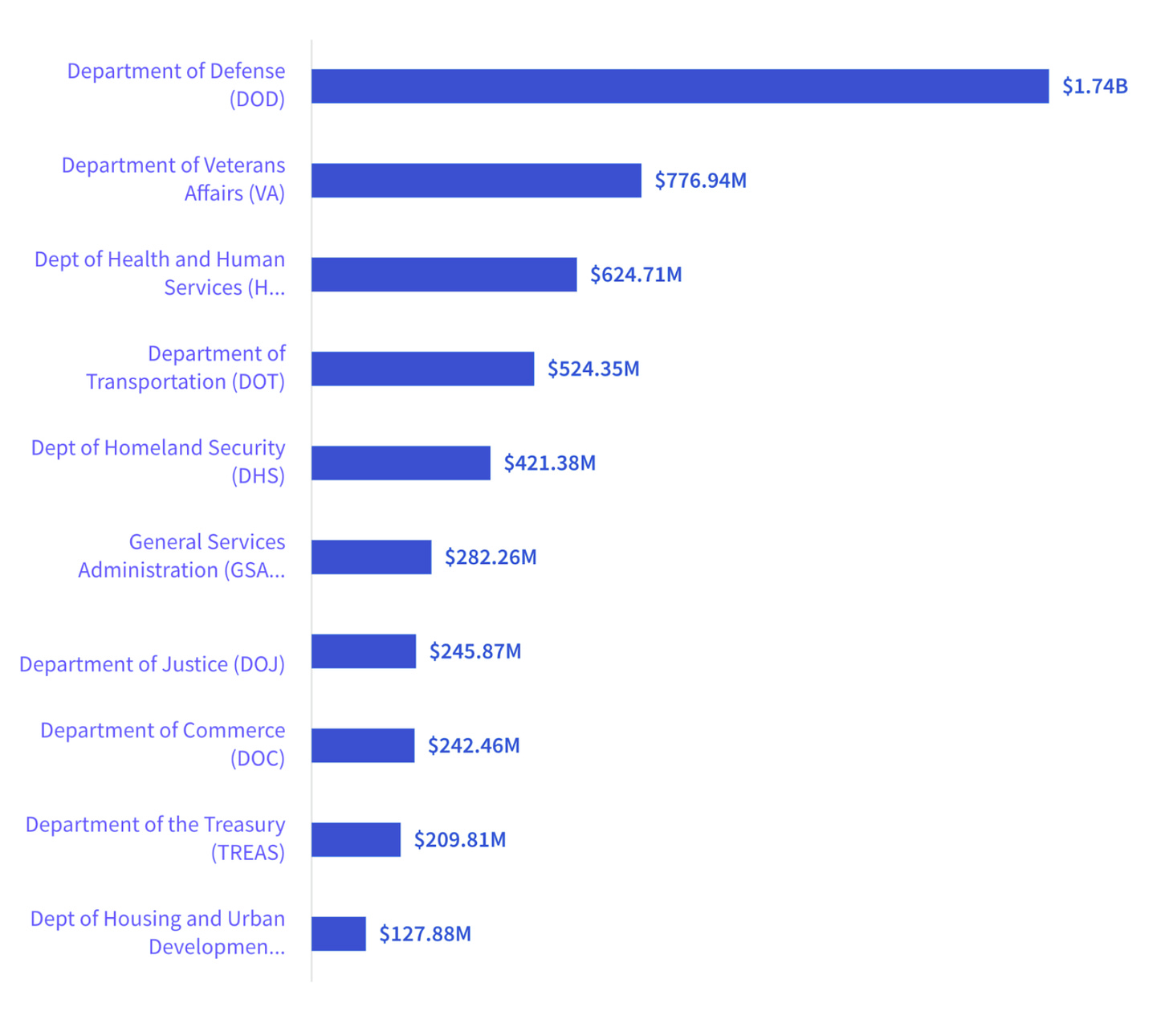

NAICS 518210 Total Federal Spending

FY24-25 USAspending data shows $5.86B in computing infrastructure spending

Agency and Contractor Concentration

The identified FY26 budget funding demonstrates clear concentration within the U.S. Department of Defense, particularly the agencies responsible for rapid, resilient space architecture:

U.S. Space Force: The primary customer, with the Space Development Agency (SDA) commanding the largest immediately relevant budget area identified ($459.989M for PWSA R&E)

Air Force Research Laboratory (AFRL): Executes the Space Technology program (PE 1206601SF), which explicitly funds on-orbit edge processing research

Missile Defense Agency (MDA): MDA is the lead for the Golden Dome architecture, Sophia Space’s primary defense use case for real-time threat detection

Sophia Space, having only publicly launched in May 2025 and announced a $3.5 million pre-seed round led by Unlock Ventures, currently has no identified federal contracts in public databases. Competitors include Ramon.Space, which has significant flight heritage, and Starcloud (formerly Lumen Orbit). Lonestar Data Holdings is focused on lunar data centers, which is a related but distinct market.

Federal Agency Spending Distribution

DoW dominates with $1.74B in NAICS 518210 obligations

Why This Matters

The market intelligence confirms that orbital edge computing is shifting from a conceptual future market ($1.32B today) to an immediate national security necessity backed by over half a billion dollars in aligned FY26 RDT&E funding. This dedicated funding, concentrated heavily within the Space Force and MDA, signals that the government is funding the solution—low-latency, resilient on-orbit AI processing—that Sophia Space provides. The unique technical heritage from Caltech/JPL contrasts favorably with the lack of flight heritage, which must be overcome using rapid acquisition pathways.

Ways to Leverage This

Verify Federal Status: Since Sophia Space is already registered in SAM.gov with a CAGE code, they can immediately pursue the dedicated FY26 RDT&E funding streams identified.

Target High-Priority Budget Lines with Precision: Focus competitive proposals specifically on the SDA PWSA R&E program (PE 1206310SF) and the Space Technology On-Orbit Edge Processing effort (PE 1206601SF). Proposals should explicitly use the budget justification terminology, such as “on-orbit edge processing” and “Hyper-Converged edge computing.”

Utilize Rapid Acquisition Pathways: Leverage the DIU Hybrid Space Architecture (HSA) CSO and SpaceWERX STRATFI/SBIR programs that prioritize on-orbit dual-use capability.

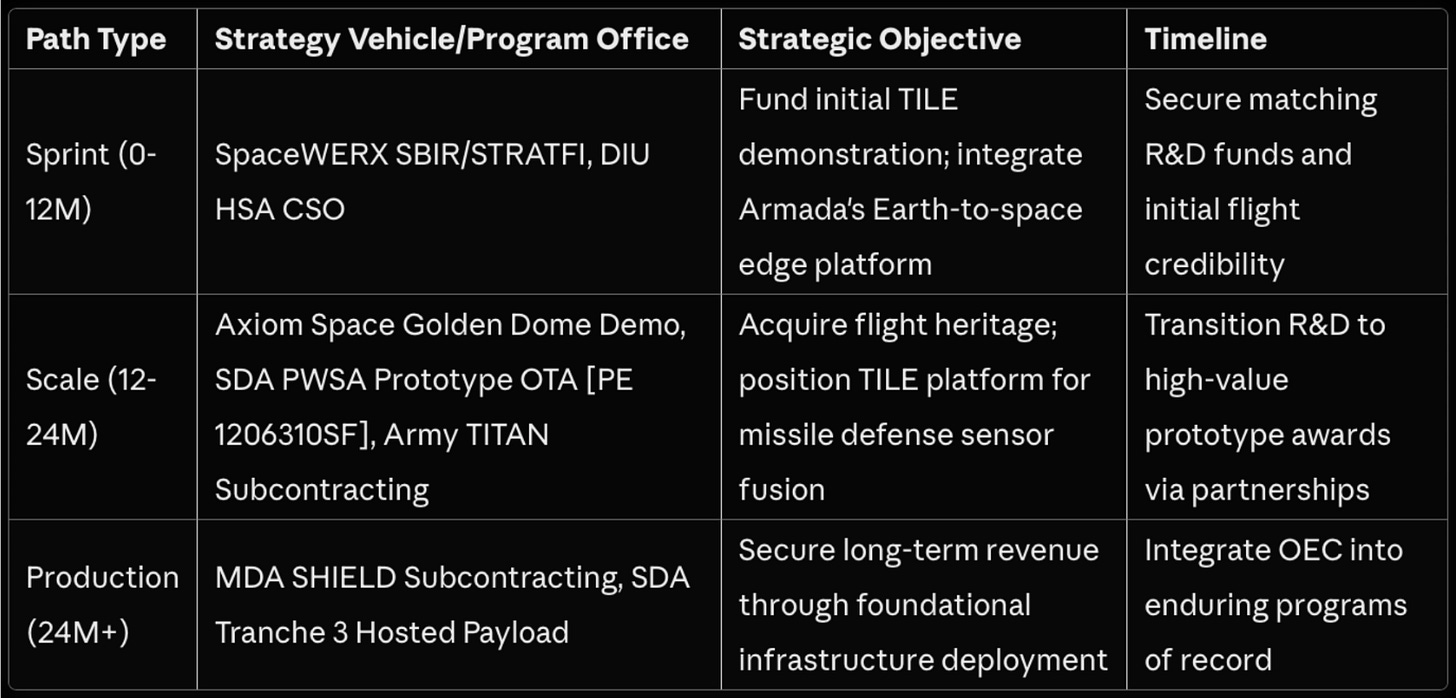

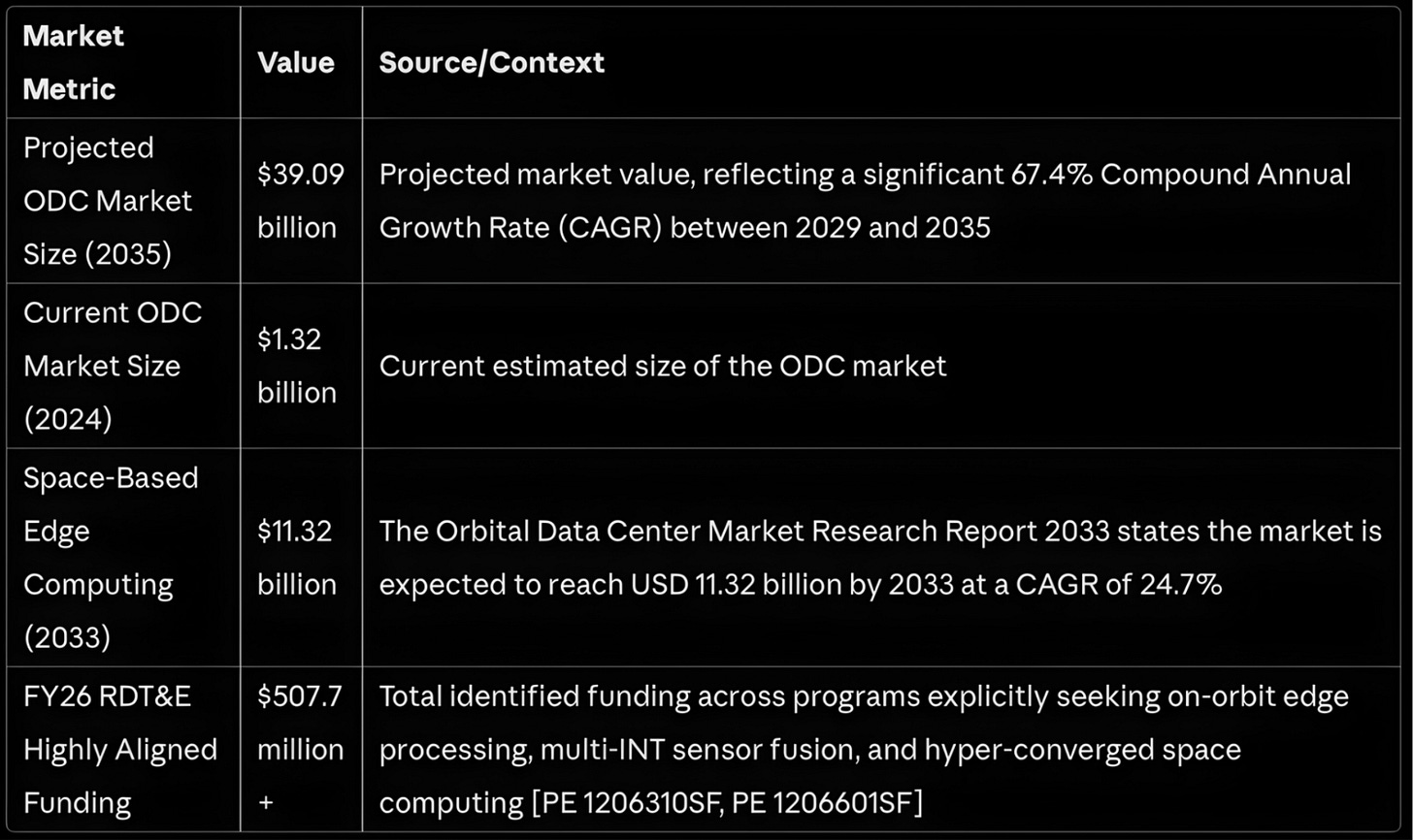

1️⃣ ACTIONABLE DEFENSE ROADMAP

For Sophia Space to transition from a venture-backed pre-seed company to a foundational defense infrastructure provider, it must execute a parallel pursuit strategy. This roadmap targets immediate engagement through rapid acquisition vehicles, leverages strategic partnerships to mitigate the lack of flight heritage, and aligns directly with highly funded FY26 Space Force R&D funding.

Strategic Market Positioning: Multiple Paths to Federal Revenue

Sophia Space’s strategy must blend non-dilutive R&D funding (SBIR/STRATFI) with high-value prototype opportunities (OTAs/CSOs), using its Axiom Space MoU and Armada partnership as key accelerators.

Federal Entry Strategy Timeline

The Axiom Space MoU is the most critical strategic partnership, positioning Sophia Space for demonstrations related to the Golden Dome missile defense architecture. This is essential for providing the necessary orbital flight heritage needed to de-risk the technology for the Missile Defense Agency (MDA).

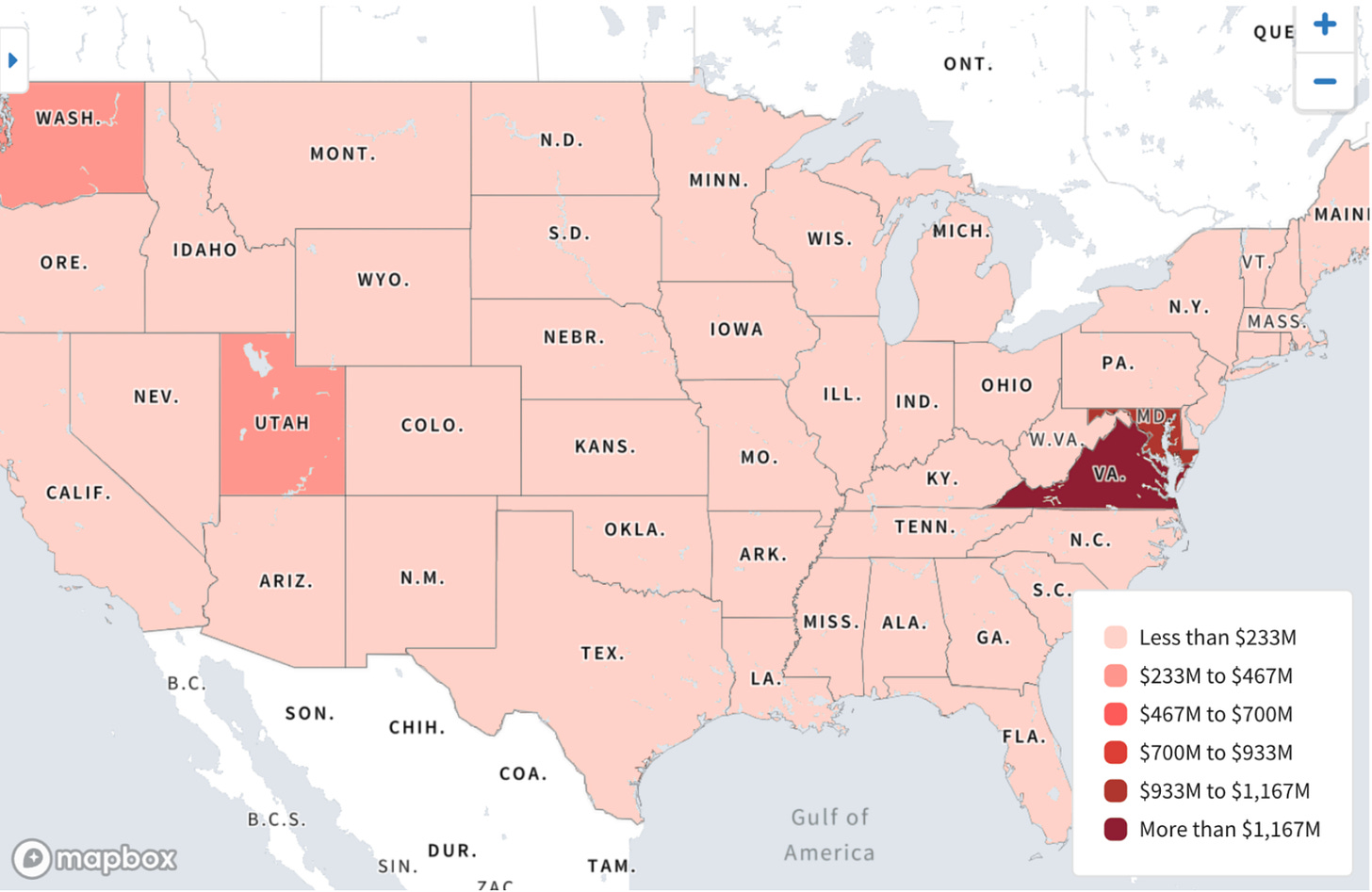

Geographic Distribution of Federal Spending

Heat map shows concentration in traditional corridors with opportunities in emerging markets

Why This Matters

The parallel pursuit roadmap is critical because the government is prioritizing the very technology Sophia Space offers. The FY26 budget includes $45.3 million explicitly for “revolutionary on-orbit edge processing” (PE 1206601SF). The urgent threat posed by competitor nations racing to deploy orbital supercomputer networks provides legislative urgency to accelerate commercial solutions. By pursuing multiple paths simultaneously (SBIR, DIU, Axiom MoU), Sophia Space can rapidly build the credibility and flight heritage needed for defense acquisition.

Ways to Leverage This

Leverage Federal Status: Since the company is already registered in SAM.gov with a CAGE code, they are eligible for all identified R&D funding streams.

Formalize Prime and Partner Teaming: Formalize a teaming agreement with Axiom Space specifically for the Golden Dome demonstration. Use the Armada partnership to jointly pursue DIU HSA and TITAN subcontracting opportunities.

Utilize Rapid Acquisition Pathways: Immediately submit applications for the DIU HSA and SpaceWERX STRATFI/SBIR pathways, leveraging the $3.5M pre-seed round for STRATFI eligibility.

2️⃣ CONTRACTOR & MARKET LANDSCAPE

The federal market for computing infrastructure (NAICS 518210) reveals critical patterns in contractor concentration and agency spending that create opportunities for disruption.

Historic Award and Spending Patterns (NAICS 518210)

As a recent entrant, Sophia Space has no federal contracts identified in public databases. This lack of historical performance must be mitigated through the use of rapid acquisition vehicles.

Acquisition patterns of the target customer, SDA, show a strong appetite for small business engagement: SDA made 54 awards to small businesses valued at more than $64 million in FY 2024, and manages 59 active SBIR/STTR contracts valued at more than $100 million. The SDA uses STRATFI to “bridge the gap between early small business investment and production/fielding.”

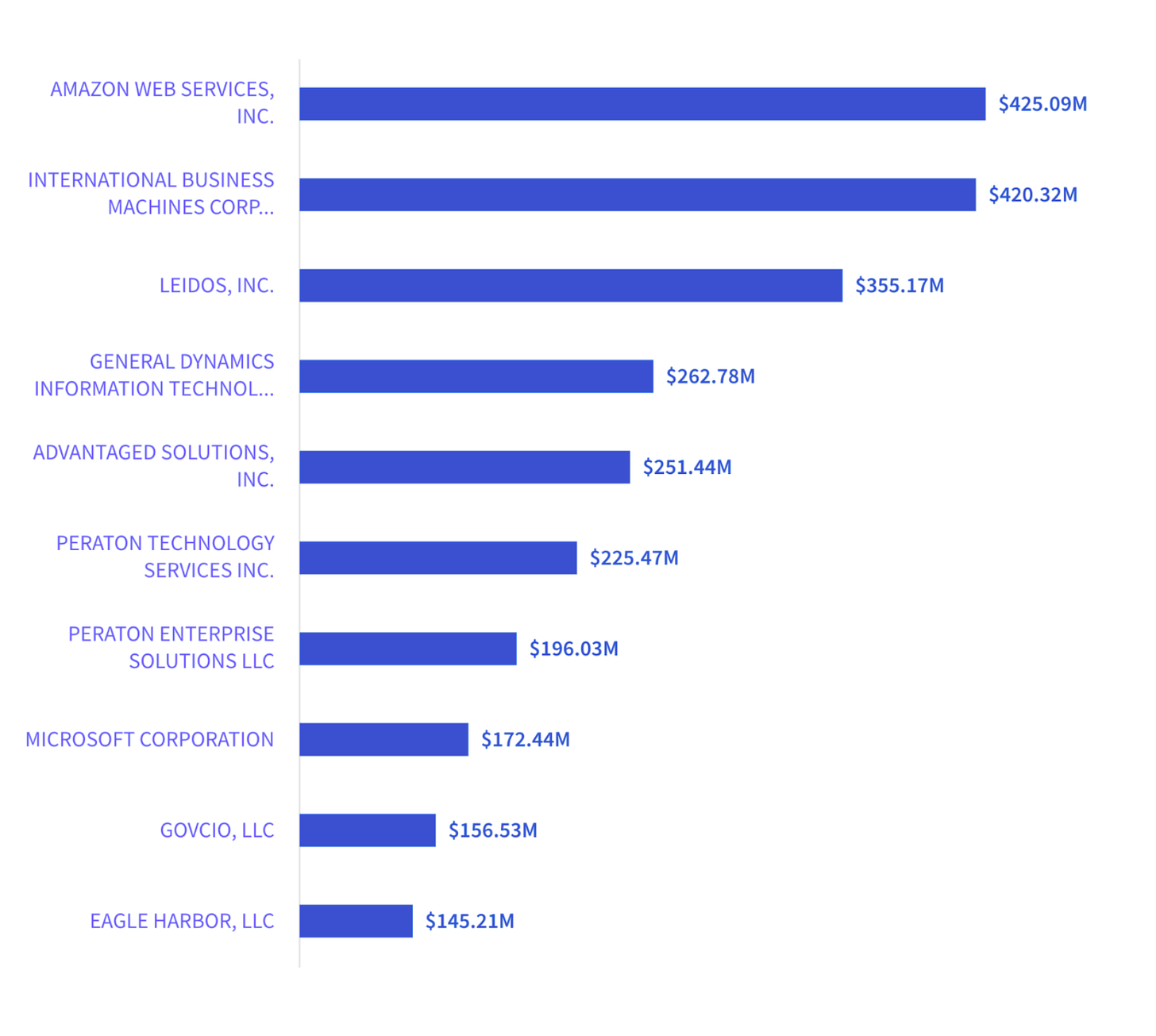

Top Federal Recipients in NAICS 518210

Amazon Web Services leads with $425.09M, showing incumbent concentration

Quantifying Contractor Concentration and Fragmentation

The market for dedicated orbital compute is highly fragmented, featuring nascent competition against Sophia Space from companies like Ramon.Space (which has flight heritage), Lonestar Data Holdings (lunar focus), and Starcloud (formerly Lumen Orbit). Government funding, however, is highly concentrated in the U.S. Space Force (SDA) and Missile Defense Agency (MDA).

Why This Matters

This budget intelligence reveals a clear, congressionally mandated demand signal for Sophia Space’s precise capabilities. The existence of $45.3 million explicitly budgeted in PE 1206601SF for “revolutionary on-orbit edge processing” confirms the government is funding the technical category Sophia Space defined. The explicit requirement in PE 1206310SF to use on-orbit processing to “close the sensor-to-shooter kill chain” provides the mission urgency necessary to position the TILE platform as a critical national security asset for the Golden Dome system.

Ways to Leverage This

Leverage Federal Registration: Since Sophia Space is already registered in SAM.gov with a CAGE code, they can immediately access the identified PE funding streams.

Target Budget Language with Precision: Frame all competitive proposals using the exact FY26 budget justification terminology, such as “Hyper-Converged edge computing.”

Pursue SBIR/STRATFI as Credentialing: Aggressively pursue the SpaceWERX SBIR Phase I to secure eligibility for the STRATFI program, a proven pathway for transition into SDA programs.

3️⃣ PRE-SOLICITATION & MARKET OPPORTUNITY MONITORING

Monitoring Requests for Information (RFIs) and Sources Sought Notices (SSNs) is the critical first step in shaping federal acquisition requirements and bridging RDT&E funding to eventual prototype contracts.

Highly Aligned Sources Sought and RFI Opportunities

The following opportunities align with Sophia Space’s TILE™ hardware (C1), SOOS software (C2), and Low-Latency Intelligence Processing (C3) capabilities:

Active Pre-Solicitation Opportunities

Summary of Requirements Shaping and Acquisition Patterns

Requirements are being shaped by the urgency of real-time threat detection and the geopolitical necessity of maintaining operational capability in contested environments.

Requirements Shaping: Requirements for Golden Dome necessitate processing data “at the source.” This drives the need for Orbital Edge Computing (OEC).

Rapid Acquisition Vehicles: Opportunities are heavily funneled through vehicles like DIU Commercial Solutions Opening (CSO), SpaceWERX SBIR/STRATFI, and Other Transaction Authority (OTA) vehicles. The DIU HSA program is actively onboarding vendors for a 2026 pilot demonstration.

Strategic Targets: The MDA SHIELD contract requires subcontractors for orbital computing capabilities related to Golden Dome. Engagement with Army TITAN prime contractors, such as Palantir USG, is also a viable indirect entry point.

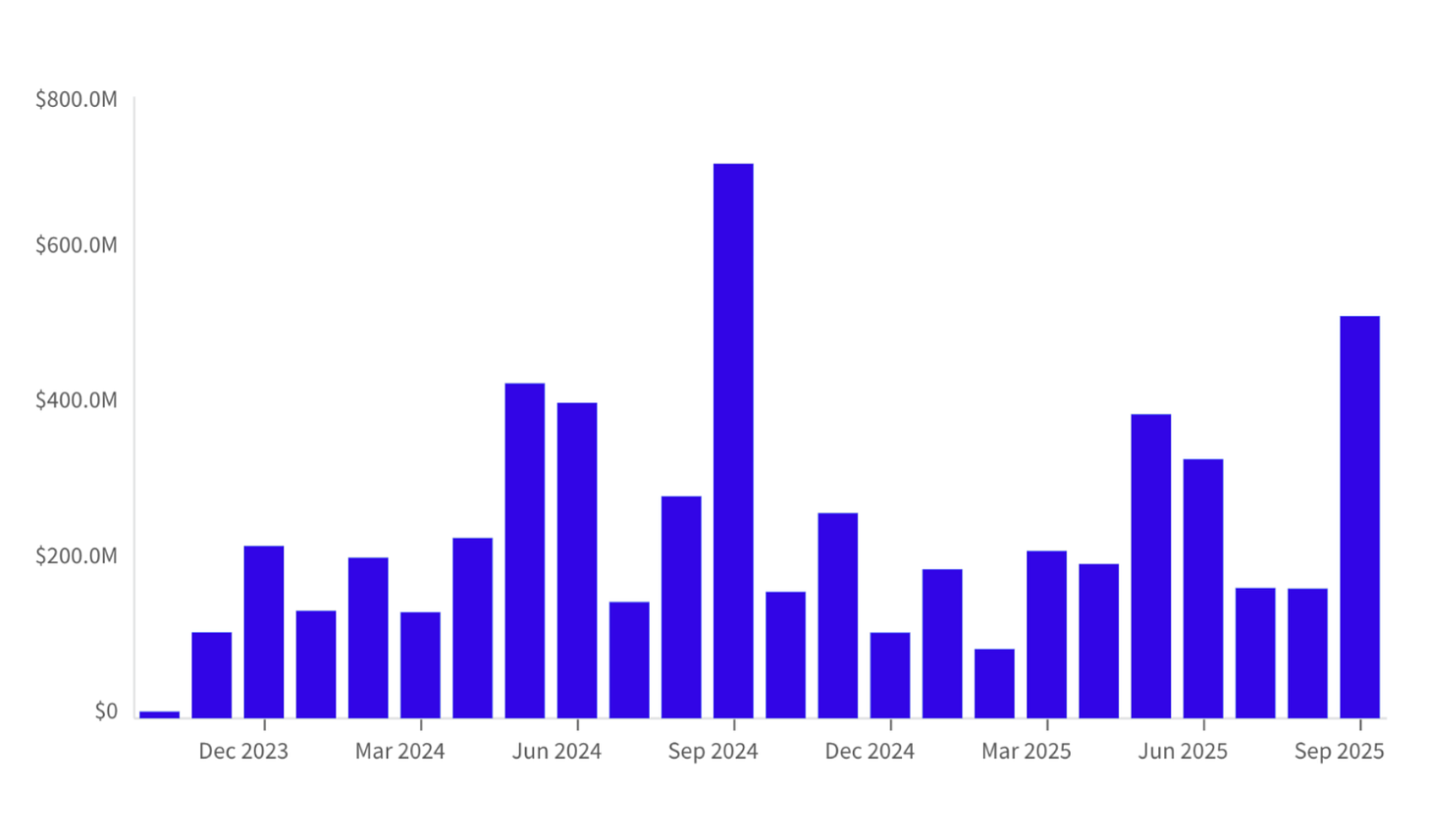

Monthly Obligation Patterns

September 2024 spike of $700M+ demonstrates fiscal year-end surge

Why This Matters

Pre-solicitations provide the definitive proof that the funded FY26 RDT&E programs are translating into real-world operational requirements, establishing that Sophia Space’s technology is a strategic imperative. The urgency of AI compute requirements, particularly for the Golden Dome missile defense architecture, necessitates commercial solutions that can deliver “real-time, around-the-clock availability, secure orbital processing, and AI-driven autonomy.” These notices serve as the bridge funding and technical validation necessary to transition Sophia Space’s JPL-derived technology toward a higher Technology Readiness Level (TRL).

Ways to Leverage This

Maximize Rapid Vehicle Use: Immediately submit competitive proposals for the SpaceWERX SBIR Open Topic and the next DIU Commercial Solutions Opening (CSO).

Target Program Offices with Product Demonstrations: Prioritize scheduling product demonstrations at the AFOTEC AI Technology Showcase and the Space Systems Command (SSC) TacSRT TAP Lab.

Leverage Partnerships for Credibility: Use the Axiom Space MoU to target MDA and Space Force discussions regarding Golden Dome hosted payload requirements. Simultaneously, use the Armada partnership to jointly pursue DIU HSA integration.

4️⃣ CAPABILITY ALIGNMENT

The competitive advantage of Sophia Space lies in the direct alignment between its core technology platforms (TILE™ and SOOS) and the explicit computational requirements defined within the FY26 defense budget and strategic acquisition forecasts.

Capability to Federal Requirement Translation Matrix

Technology-to-Requirement Mapping

Technical Translation and Opportunity Fit

Sophia Space enables Orbital Edge Computing (OEC), directly addressing the SDA’s highest priority in FY26 (PE 1206310SF) to achieve “sensor-to-shooter kill chain” closure via onboard processing. The modular, ultra-thin TILE™ platform uses passive cooling in the cosmic vacuum to solve the thermal challenges addressed by PE 1206601SF for “Hyper-Converged edge computing.” The Armada partnership delivers a resilient, seamless Earth-to-space edge AI platform, which is essential for the Missile Defense Agency’s (MDA) requirement for Golden Dome resilience.

Why This Matters

This direct capability-to-requirement mapping demonstrates that Sophia Space is an essential solution to several of the DoW’s most critical and highly funded strategic computing challenges. The alignment with the $459.989 million in the SDA PWSA program and the explicit language in the AFRL Space Technology budget (PE 1206601SF) proves that the U.S. government is funding the category that Sophia Space pioneered. Hon. Dan Goldin stressed that this technology “gives America the strategic high ground to ensure the integrity of our national security to protect us from emerging threats.”

Ways to Leverage This

Weaponize Budget Terminology: Frame the TILE platform’s value using the exact phrase “Hyper-Converged edge computing” when engaging AFRL (PE 1206601SF).

Highlight the Axiom/Golden Dome Integration: Leverage the Axiom Space MoU as evidence of alignment with the MDA’s Golden Dome initiative, emphasizing the need for “secure orbital processing, and AI-driven autonomy.”

Propose a Dedicated Sensor-to-Shooter Demonstration: Immediately propose a prototype demonstration to SDA (PE 1206310SF) showing how on-orbit processing reduces the latency required to “close the sensor-to-shooter kill chain.”

5️⃣ ADVANCED OPPORTUNITY PIPELINE

For Sophia Space to maximize its advantage as a commercial pioneer in Orbital Edge Computing (OEC), the company must execute a parallel pursuit strategy. This strategy integrates immediate, rapid acquisition vehicles with long-term, high-value prototyping partnerships, leveraging the urgency mandated by over $507.7 million in highly aligned RDT&E funding streams.

Multi-Track Pipeline: Converting IP & Partnerships into Federal Revenue

Advanced Opportunity Tracking

Why This Matters

This advanced pipeline is essential because the federal market is forcing transformation. The combination of dedicated, explicit RDT&E funding (e.g., $45.3M in PE 1206601SF for “Hyper-Converged edge computing”) and the geopolitical urgency created by competing nations provides a unique window of opportunity. By pursuing these tracks in parallel, Sophia Space leverages its established Caltech/JPL pedigree and partner MoUs to substitute for its lack of historical federal contracts and flight heritage, maintaining momentum toward the high-value Golden Dome mission.

Ways to Leverage This

Prioritize Q2/Q3 FY26 Obligations: Prepare competitive proposals for R&D contracts (PE 1206310SF and PE 1206601SF) for submission in the August/September surge window.

Formalize Partner Commitments for Prototypes: Use the Axiom Space MoU to secure a specific deployment contract tied to the Golden Dome requirement. Simultaneously, use the Armada partnership to jointly pursue DIU HSA integration.

Utilize JPL Heritage as Credential Stacking: In every early engagement, leverage Dr. Leon Alkalai’s background as a retired JPL Technical Fellow and the licensed Caltech/JPL technology to demonstrate de-risked reliability, compensating for the current lack of orbital flight heritage.

6️⃣ FY26 BUDGET INTELLIGENCE

The FY26 budget documents provide definitive proof that the U.S. government is actively funding the adoption of Orbital Edge Computing (OEC) as a strategic imperative. This analysis correlates specific RDT&E funding streams with Sophia Space’s product space, confirming over $507.7 million in highly aligned funding.

Budget Flow Analysis: Congressional Intent to Program Obligation

FY26 Budget-to-Capability Alignment

Appropriations Cycles and Obligation Patterns

Urgency: The requirement for OEC is driven by geopolitical threats, leading to support for commercial acceleration (PE 1206771SF). Hon. Dan Goldin stressed that the technology “gives America the strategic high ground” against threats.

Obligation Surge: Competitive RDT&E funds (PE 1206310SF and PE 1206601SF) are heavily obligated by Q3 FY26 (by June 30, 2026).

Rapid Acquisition Preference: SDA, which controls the largest aligned budget line, favors OTAs and the STRATFI program to rapidly transition commercial technologies.

Product Correlation: TILE and Golden Dome as Funded Requirements

The TILE platform is validated by the specific budget terminology: PE 1206601SF requesting “Hyper-Converged edge computing” directly matches Sophia Space’s modular, space-native design. Furthermore, the MDA-aligned funding in PE 1206310SF funds the realization of the Golden Dome mission via on-orbit fusion necessary to “close the sensor-to-shooter kill chain.”

Why This Matters

This budget analysis confirms that the Orbital Edge Computing sector is underpinned by a guaranteed, non-incremental funding stream of over $507.7 million in immediate RDT&E funding. The explicit use of terminology like “Hyper-Converged edge computing” proves the government is funding the precise solution Sophia Space offers. This intelligence validates that the market risk is low and the immediate procurement pathway is high-speed (STRATFI/OTAs), requiring Sophia Space to transition its Caltech/JPL technical credibility into federal acquisition status immediately.

Ways to Leverage This

Target Explicit Budget Language: Frame competitive R&D proposals using the exact justification language found in the PEs.

Maintain Federal Registration: With their SAM.gov registration and CAGE code already in place, Sophia Space can immediately pursue the identified PE funding streams in the Q2/Q3 FY26 obligation timeline.

Time Submissions to Obligation Cycles: Prepare R&D submissions to capture the Q2/Q3 FY26 obligation cycle (by June 30, 2026), and major prototype proposals for the Q4 fiscal year-end surge (August/September).

🎯 To Wrap Up

This week’s deep-dive confirms that Sophia Space is well positioned at the intersection of resilient space architecture, AI/ML at the tactical edge, and the strategic necessity to counter competitor nations. The company is the essential answer to an immediate, funded national security crisis related to computational constraints and latency.

Sophia Space holds an asymmetric advantage in the market due to its founders’ deep JPL heritage, the licensing of Caltech/JPL technology, and its space-native TILE architecture. This credibility is reinforced by the Memorandum of Understanding (MoU) with Axiom Space to demonstrate capabilities for the Pentagon’s Golden Dome missile defense architecture.

The opportunity is funded: the FY26 budget allocates $459.989 million (PE 1206310SF) for sensor fusion to “close the sensor-to-shooter kill chain” and $45.300 million (PE 1206601SF) explicitly for “Hyper-Converged edge computing.”

🗝️ Key Lessons I Learned

Flight Heritage is the Ultimate Constraint: Sophia Space’s technology heritage (JPL) is STRONG, but its Flight Heritage is NOT YET DEMONSTRATED. The immediate execution of the Axiom MoU is the necessary step to transition the technology from validated IP to proven orbital hardware.

Federal Status Unlocks Capital: With Sophia Space’s SAM.gov registration and CAGE code in place, they have access to the identified $507.7M in RDT&E funding streams.

Venture Capital Must Be Leveraged for Non-Dilutive Funds: The $3.5M pre-seed funding should be immediately leveraged to apply for the SpaceWERX STRATFI program, a proven pathway that matches private investment up to $15 million, funding the expensive transition to orbit.

♟️ Strategic Considerations

For Sophia Space and similar deep-tech entrants, success requires systematic execution aligned with federal budgeting and acquisition velocity.

De-risk Hardware to Unlock Series A Capital: From what I have looked into - Sophia Space could consider using non-dilutive funds (STRATFI/SBIR) and partnership resources (Axiom MoU) to fund the critical first orbital demonstration. This successful demonstration, which achieves flight heritage, drastically reduces technical risk, positioning the company for a significantly larger, de-risked Series A round ($20-40M range).

Align Technical Roadmaps to Congressional Budget Language: The company could consider abandoning generic commercial pitches and adopt the precise language of the funding PEs. Framing the TILE module as the solution for “Hyper-Converged edge computing” (PE 1206601SF) and for “closing the sensor-to-shooter kill chain” (PE 1206310SF) ensures immediate mission relevance and maximizes the chances of winning competitive awards.

Execute the Parallel Pursuit Strategy: Sophia Space should concurrently manage 3-5 active pursuit tracks (e.g., SBIR, DIU CSO, Axiom/Golden Dome Demo, TITAN Subcontracting). This portfolio approach de-risks entry by ensuring that if one path slows (e.g., traditional MDA SHIELD subcontracting), faster pathways accelerate revenue and validation.

Credential Stacking: Convert Heritage to Status: Actively use the founders’ extensive mission experience (e.g., Dr. Leon Alkalai’s 32 years at JPL) to gain non-competitive access to program managers (PMs) and military innovation offices (AFRL, SSC TacSRT TAP Lab), effectively trading institutional IP heritage for trust and access that substitutes for lacking federal past performance.

🧱 Building This Playbook Together

I would love to hear your feedback. Are there specific NAICS codes/PSCs or procurement challenges you’re wrestling with?

This methodology evolves with every conversation. I trace the money from congressional authorization through appropriation to obligation, revealing opportunities 6-12 months before RFPs drop.

Your feedback directly shapes next week’s analysis. Reply with suggestions or reach out directly.

Connect with me:

in

Next week: Another VC-backed defense startup paired with their NAICS/PSC code. Same systematic approach, new market insights. Reply with suggestions!

Data current as of October 23, 2025. Analysis based on FY26 defense budget documents, SAM.gov active opportunities, USAspending.gov & FPDS contract data for NAICS 518210 (FY24-25), and Sophia Space public information.

Disclaimer: This analysis is not paid advice or sponsored content. The views, research, triangulation methodology, and analytical frameworks presented are solely those of Ross Facione. This newsletter represents independent analysis using publicly available data sources. All strategies and recommendations should be validated with appropriate legal and procurement professionals before implementation.