FILE 19: MDA SHIELD IDIQ DECODED

The $151 Billion Golden Dome Strategy

The 60-Second Snapshot

Contract: The Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) is a Multiple Award Indefinite Delivery/Indefinite Quantity (MA-IDIQ) vehicle from the Missile Defense Agency (MDA). It has a maximum potential value of $151 billion over a 10-year period of performance. The solicitation, HQ085925RE001, operated under a full and open competition with an “all qualifying offerors” model, meaning the real competition and the largest revenue opportunity is concentrated at the task order level.

Market & Sector: SHIELD is the cornerstone contract for the U.S. government’s ambitious Golden Dome for America initiative. This represents a generational shift in homeland defense spending, moving toward a multi-layered architecture designed to counter hypersonic, ballistic, and advanced cruise missiles. The Missile Defense Agency’s total FY26 budget request, including supplemental funding, surged to $13.2 billion, demonstrating significant political and financial commitment to this expansion.

Federal Market Transformation: SHIELD consolidates acquisition strategy under one flexible vehicle to streamline contracting and accelerate capability delivery. The contract is fundamentally focused on Research and Development (R&D), using primary NAICS 541715 and PSC AC13 (Experimental Development). MDA explicitly seeks participation from “non-traditional companies” with innovative tools in areas like AI/ML, digital engineering, and open systems architectures to bypass bureaucracy and “field capabilities to the Warfighter at speed and scale.”

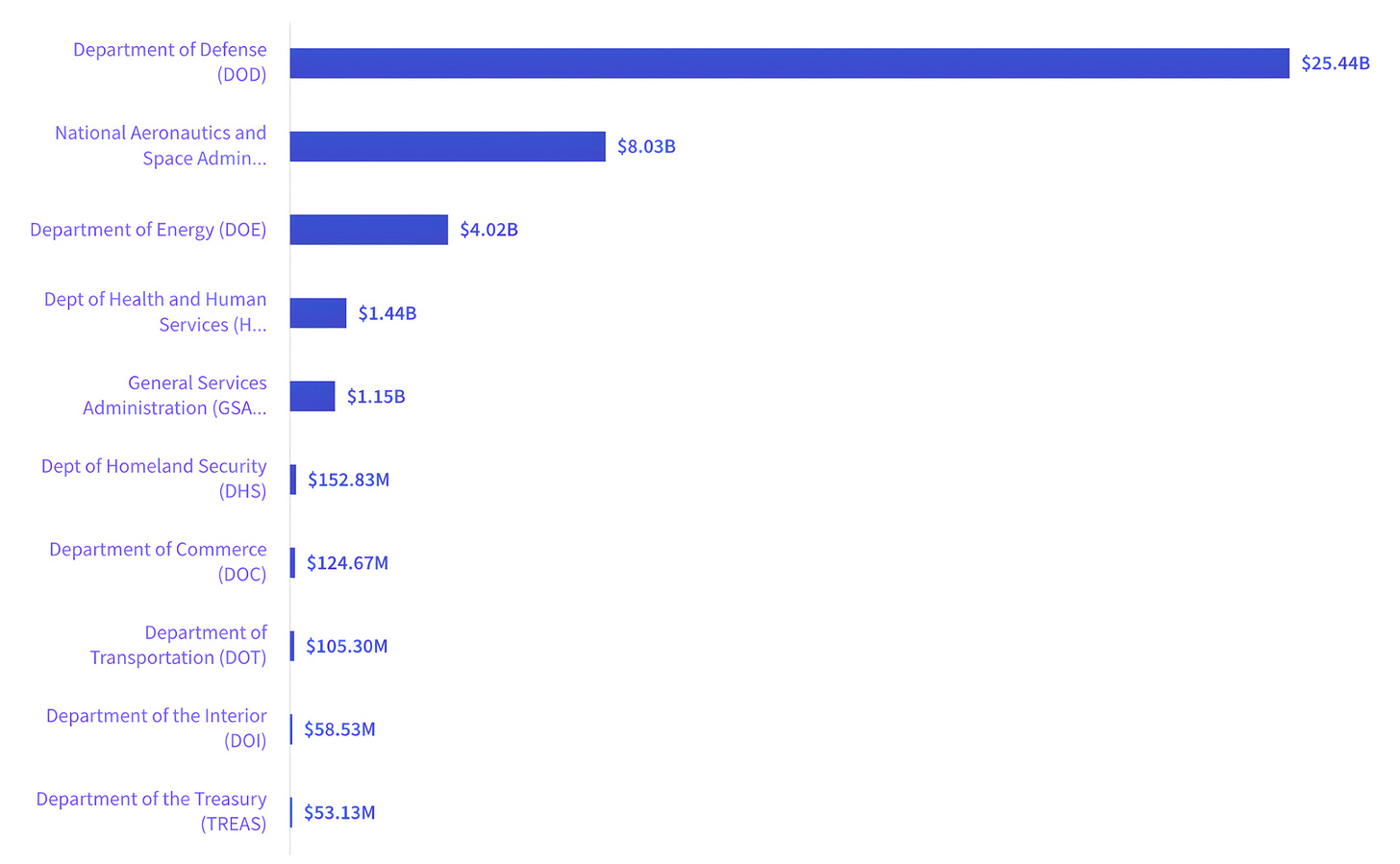

Anchor Code: NAICS 541715 (FY2024-2025) - Research and Development in the Physical, Engineering, and Life Sciences, except Nanotechnology and Biotechnology. The Department of Defense accounts for 62.5% of all FY25 federal obligations under this code ($25.44B), with MDA alone responsible for approximately 32% of all DoD 541715 spending.

Method: Analyzed FY25 USAspending data filtered specifically for NAICS 541715 and PSC AC13, FY26 budget justification documents outlining program element funding, public statements from MDA leadership including Congressional testimony and LinkedIn signals, and extensive market research detailing the strategies of prime contractors and emerging “neoprimes” like the Anduril/Palantir consortium.

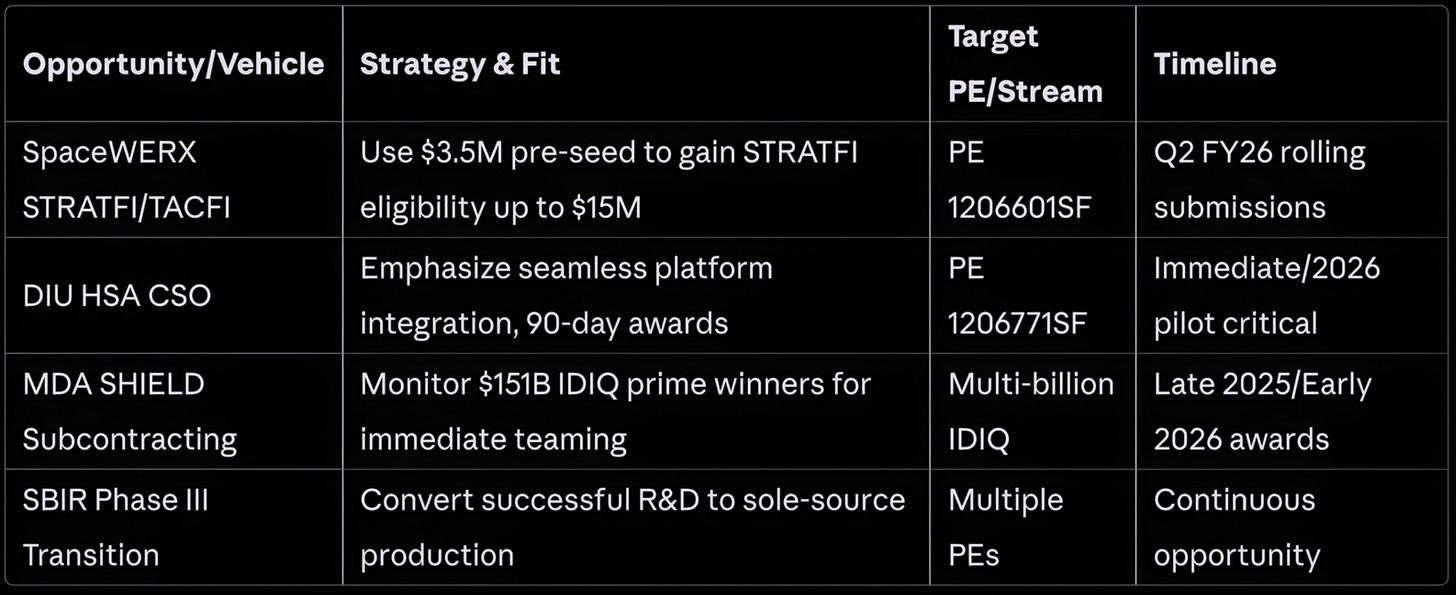

Opportunities Uncovered: The FY26 budget allocates $10.5 billion in RDT&E appropriations supporting SHIELD’s focus area. Immediate opportunities exist through rapid acquisition pathways including SBIR Phase III sole-source conversions, Other Transaction Agreements (OTAs) via DIU’s Commercial Solutions Opening process, and the MDA Multiple Authority Announcement (MAA) vehicle specifically geared toward non-traditional defense contractors.

Primary Takeaway: The SHIELD IDIQ structure effectively uses the base contract as a compliance screening mechanism, ensuring only qualified firms are awarded a slot. This shifts the financial risk and technical competition entirely to the task order level, where success depends on speed, specialized technical relevance, and established relationships. Companies lacking verifiable prime contract past performance must execute parallel credential-building strategies now to access the $151 billion opportunity.

Who This Analysis Serves

Early-stage founders: Your federal roadmap starts here

Startup teams: Actionable insights for BD, Capture, Product teams, and more

Defense investors: Portfolio-wide intelligence in one place

Those exploring defense: Understand the ecosystem before you jump in

Corporate innovators: See how startups navigate where you might partner

Primes & Subcontractors: Identify partners and supply chain opportunities

How This Analysis Works

Each week, I pair one VC-backed defense startup with a specific NAICS code or PSC, then systematically decode their federal market using publicly available budget data and procurement signals. But this week I’m breaking format just a bit. After three weeks wrestling with the data, I’ve concluded the MDA SHIELD IDIQ deserves its own deep dive - it’s not just another contract, it’s the gateway to $151 billion in homeland defense modernization and the single most important vehicle for the next decade of defense technology.

Decoding the Gateway to Golden Dome

The methodology remains consistent: I triangulate between historical contract awards (what DoD bought yesterday), active opportunities (what they’re buying today), and future budgets (what Congress funded for tomorrow). This data-driven approach reveals procurement pathways that most companies miss when they focus on just one data source.

Important Note: This analysis represents my interpretation of how companies can approach the MDA SHIELD opportunity using NAICS 541715 as an analytical lens. Many exceptional defense companies have already figured out their federal strategies; others are still navigating these complex waters. My goal is to present hard data in a transparent, systematic way that helps any company, regardless of their current federal experience, see alternative perspectives on market entry.

This week, we’re working through how any innovative defense technology company can position itself to capture a piece of the largest missile defense contract in history.

Let’s get started…

0️⃣ MARKET RESEARCH PHASE

Understanding where NAICS 541715 (Research and Development in the Physical, Engineering, and Life Sciences) dollars are flowing reveals critical patterns in the fundamental shift toward layered homeland defense architecture.

The core market driver is the geopolitical reality facing the United States: adversaries are rapidly developing hypersonic weapons, advanced cruise missiles, and other threats that our existing systems weren’t designed to counter. This necessity validates the emergence of the Golden Dome for America initiative and its primary contracting vehicle, SHIELD.

Market Sizing and Funding Profile

The immediate federal opportunity is anchored in an accelerating budget environment that makes this a “once-in-a-generation” opportunity.

SHIELD Market Metrics

NAICS 541715 Total Federal Spending

Federal R&D spending concentration

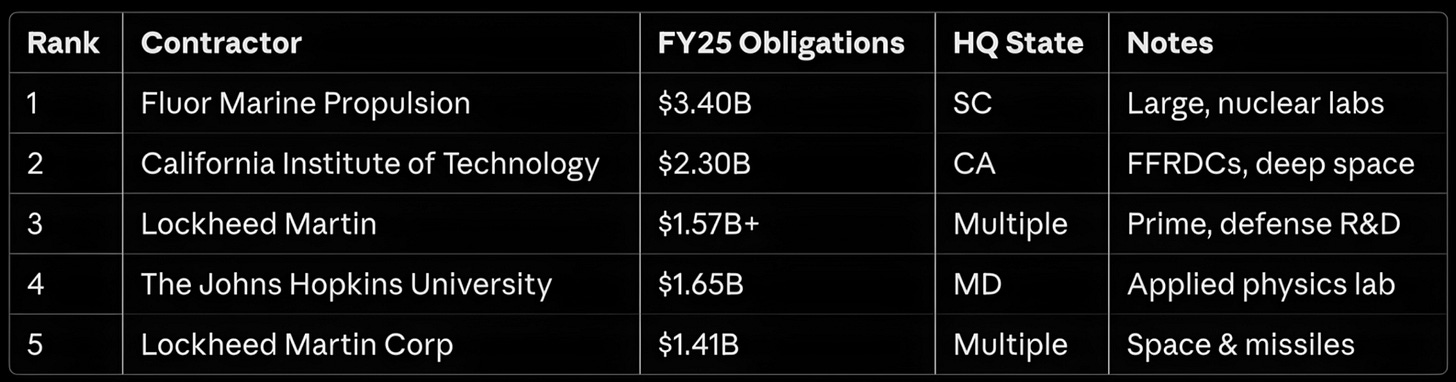

Looking at the FY25 data, we can see the Department of Defense absolutely dominates this research and development category. What’s particularly interesting is how concentrated this spending is - the top 10 contractors account for approximately 72% of all R&D obligations. This tells us something important: while the opportunity is massive, the competition is fierce and concentrated among established players.

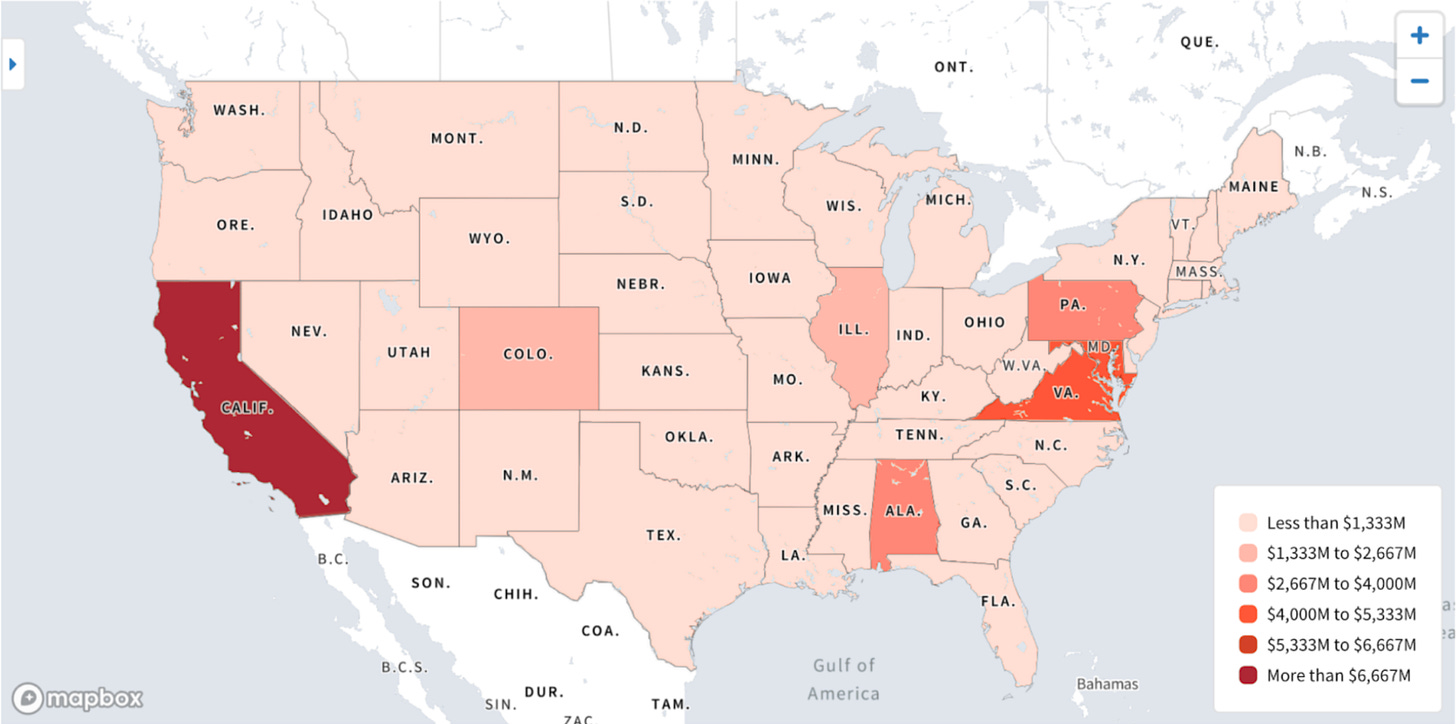

Geographic Distribution of Federal Spending

The geographic data reveals three primary clusters where R&D activity is concentrated:

R&D spending geographic distribution

California (>$6.67B): Clearly in the highest spending tier, home to major aerospace companies, FFRDCs, and non-traditional players like SpaceX

DC Metro Corridor: Virginia ($5.3-6.67B) and Maryland ($4-5.3B) form a concentrated cluster of policy and systems integration expertise

Alabama ($2.67-4B): Mid-tier concentration with Huntsville as MDA headquarters and missile defense center

What’s revealing is the opportunity in lighter-shaded states like Texas, Ohio, and Illinois. Each falls in the $1.33-2.67B range - substantial spending but without the heavy MDA concentration of the top clusters, suggesting potential whitespace for companies looking to differentiate geographically.

Why This Matters

The market intelligence confirms that SHIELD isn’t just a procurement vehicle; it’s a strategic transformation of how the Department of Defense buys missile defense capabilities. The concentration of spending among the top contractors (72% to the top 10) combined with MDA’s explicit call for non-traditional companies creates a unique dynamic. Established primes need innovative partners, and startups need prime contract credentials. This mutual dependency is the key to accessing the opportunity.

Ways to Leverage This

Secure Day-1 Subcontracting: Position immediately with likely prime winners like Lockheed Martin and Northrop Grumman before December 2025 awards

Target Geographic Whitespace: Consider establishing presence in underserved R&D markets like Texas or Ohio where spending exists but competition is less concentrated

Focus on the R&D Core: Align capabilities with NAICS 541715 requirements rather than trying to compete in traditional procurement categories

1️⃣ ACTIONABLE DEFENSE ROADMAP

For companies seeking to access the $151 billion SHIELD opportunity, the pathway forward depends entirely on your current federal status. The brutal reality is that the SHIELD solicitation required “recent and relevant” prime contract past performance, which most innovative companies simply don’t have.

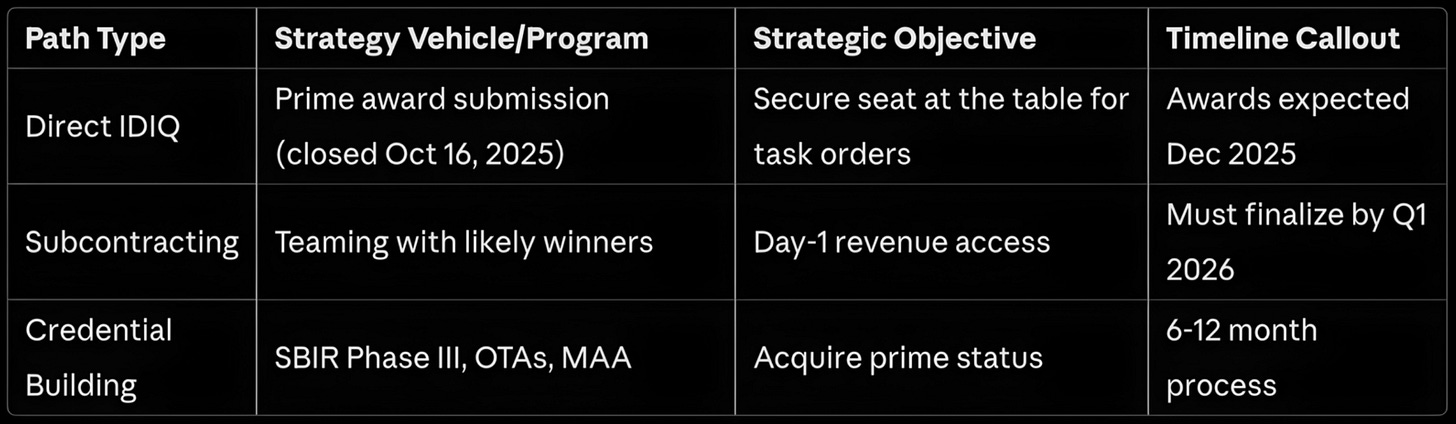

Strategic Market Positioning: Multiple Paths to Federal Revenue

I’ve identified three overlapping strategies that companies must pursue simultaneously:

SHIELD Entry Strategy Matrix

Rapid Credential Stacking via “Hidden Doors”

Here’s what can easily be overlooked: there are legitimate pathways to bypass the past performance hurdle. These aren’t loopholes; they’re intentionally designed to bring innovation into the defense industrial base.

SBIR Phase III Sole-Source Authority: If you’ve completed Phase I/II SBIR grants, you have sole-source authority for related Phase III production contracts without recompete. These count as verifiable prime experience.

Other Transaction Agreements (OTAs): The DIU’s Commercial Solutions Opening process awards prototype OTAs in 60-90 days. Successful prototypes can transition to production OTAs without recompete, and these are recognized as prime past performance.

MDA Multiple Authority Announcement (MAA): This is MDA’s own vehicle for reaching non-traditional contractors, consolidating various rapid authorities. It specifically targets “game-changing” capabilities in areas like kinetic defense and space-based sensors.

Federal Entry Strategy Timeline

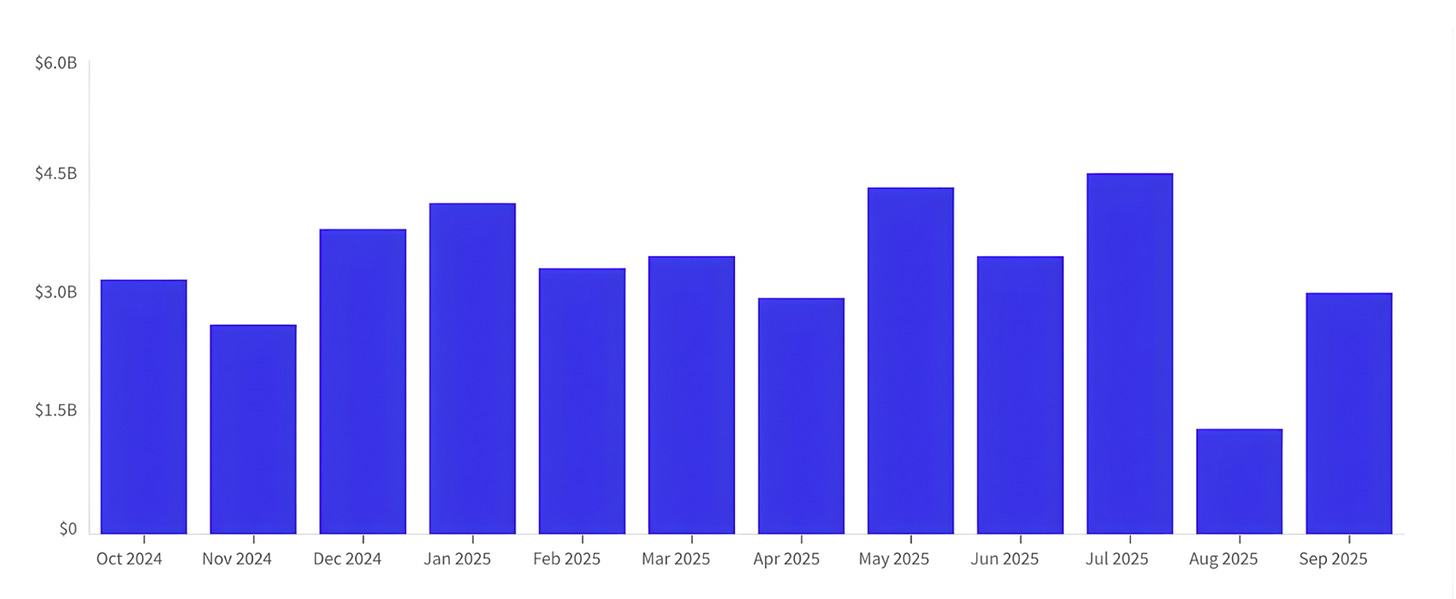

Monthly obligation trends showing Q4 surge pattern

Looking at the spending patterns, you can see the classic federal “use it or lose it” rhythm. Task orders under SHIELD will likely follow this same pattern, with major releases in Q3-Q4 of each fiscal year.

Geographic Concentration and Opportunity

The contractor landscape reveals both concentration and opportunity:

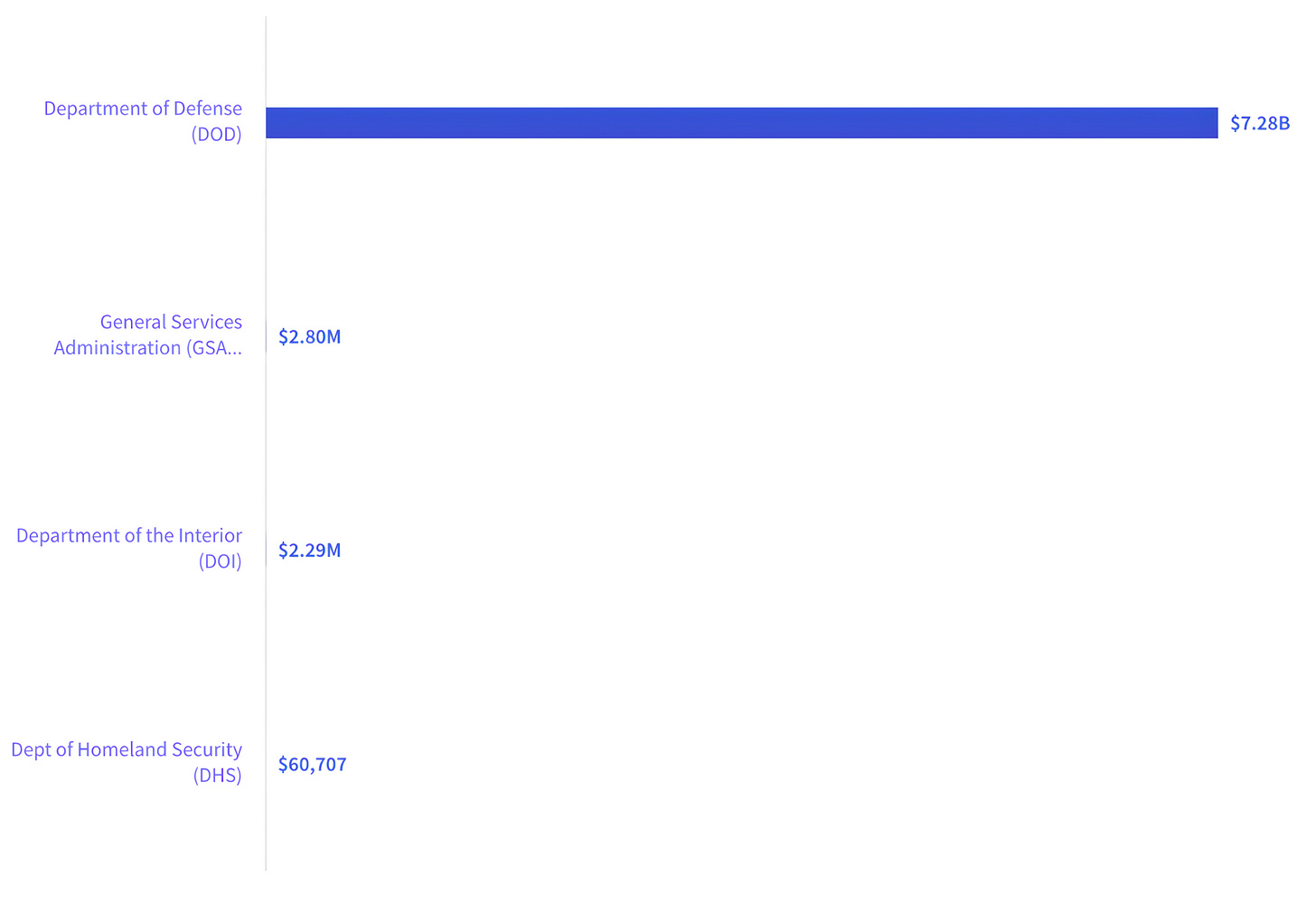

Top Federal Recipients in NAICS 541715

Why This Matters

The parallel pursuit roadmap is critical because the federal market doesn’t wait for you to get ready. The December 2025 IDIQ awards will establish the competitive landscape for the next decade. Companies that don’t have prime credentials or subcontracting relationships in place by Q1 2026 will be competing for scraps while others capture the initial wave of task orders.

Ways to Leverage This

Execute the Parallel Pursuit Portfolio: Simultaneously pursue SBIR Phase III conversions, DIU OTA prototypes, and teaming agreements

Target Neoprime Teaming: Engage the Anduril-Palantir consortium for AI/ML integration opportunities

Time for Q4 Surges: Prepare proposal resources for the July-September 2026 task order surge

2️⃣ CONTRACTOR & MARKET LANDSCAPE

The federal market for R&D under NAICS 541715 reveals critical patterns in contractor concentration and agency spending that create both challenges and opportunities for new entrants.

Historic Award and Spending Patterns

As a baseline, let me share what the current landscape looks like. The FY24-25 USAspending data shows some fascinating patterns:

PSC AC13 (National Defense R&D) Spending Distribution

The Missile Defense Agency itself has been ramping up spending dramatically. Looking at the monthly obligations, we see consistent patterns of end-of-quarter surges, particularly in Q4. This isn’t random; it’s the rhythm of federal procurement that you need to understand to time your entries effectively.

Quantifying Contractor Concentration

Here’s the reality check: the top 10 contractors control approximately 72% of R&D obligations under NAICS 541715. But here’s what’s interesting - within that concentration, there’s movement. Non-traditional players like SpaceX ($3.0B in FY25) and Blue Origin ($1.7B) are gaining ground rapidly.

The small business participation rate in MDA contracts is only 7-11%, well below the DoD-wide goal of 23.17%. This gap represents opportunity, especially through SBIR Phase III transitions and subcontracting requirements where large primes must meet 30% small business goals.

Why This Matters

This concentration data tells us that breaking into SHIELD as a prime requires either exceptional differentiation or strategic partnerships. The good news? MDA explicitly wants non-traditional companies. The challenge? You need to prove you can deliver at scale and speed.

Ways to Leverage This

Focus on Capability Gaps: Target areas where incumbents struggle, particularly AI/ML and agile software development

Leverage Small Business Mandates: Large primes must meet 30% subcontracting goals, creating guaranteed opportunities

Track Incumbent Performance: Monitor which primes are winning task orders to identify partnership targets

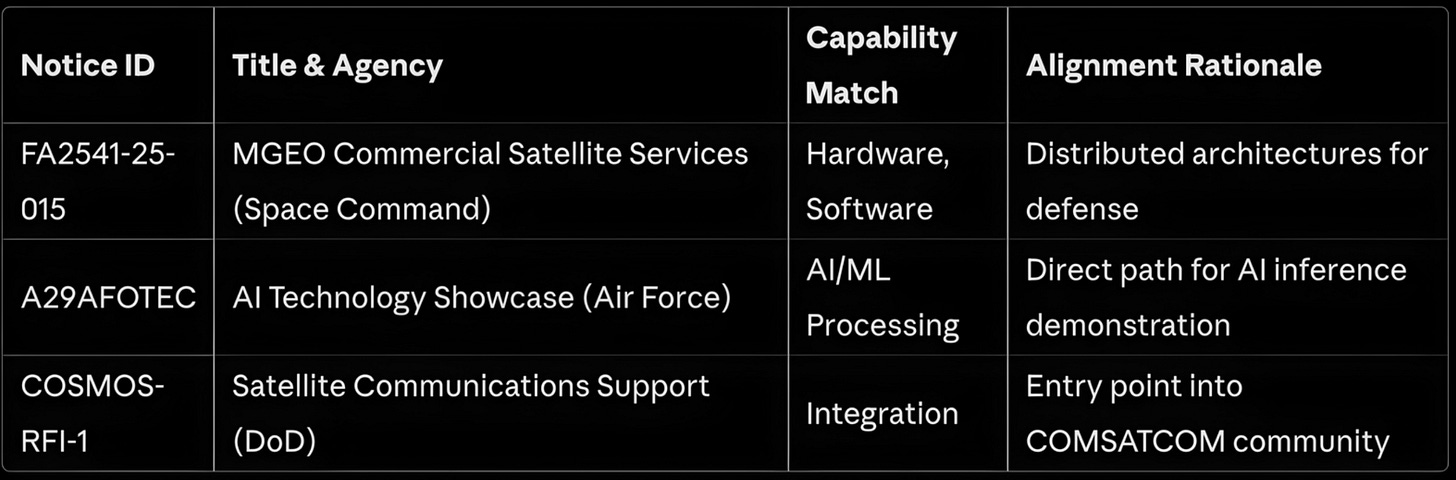

3️⃣ PRE-SOLICITATION & MARKET OPPORTUNITY MONITORING

The SHIELD solicitation closed on October 16, 2025, but the real competition is just beginning. Understanding the post-award landscape is critical for positioning.

SHIELD IDIQ Status and Core Structure

The evaluation used an “Acceptable/Unacceptable” model with awards expected in December 2025. Here’s the key insight: MDA intends to award contracts to “each and all qualifying offerors.” This means the base IDIQ is essentially a hunting license, and the real competition happens at the task order level.

Active Pre-Solicitation Opportunities

Even while waiting for SHIELD awards, parallel opportunities are flowing:

Strategic Parallel Access Vehicles

Since most companies can’t access SHIELD directly, these alternative vehicles become critical:

MDA MAA (Multiple Authority Announcement): Consolidates OTAs, CSOs, and grants specifically for non-traditionals

DIU Commercial Solutions Opening: 60-90 day prototype awards that can convert to production

SBIR/STTR Phase III: Sole-source authority for companies with successful Phase II completions

Why This Matters

The “all qualifying offerors” structure means potentially dozens of IDIQ holders will compete for each task order. Success requires not just having a seat at the table, but having the relationships, past performance, and technical differentiation to win when specific requirements drop.

Ways to Leverage This

Monitor Task Order Flow: Set up SAM.gov alerts for SHIELD task orders beginning Q1 2026

Build OCO Relationships: Identify and engage Ordering Contract Officers before task orders release

Prepare for Set-Asides: Anticipate small business set-asides for specific task order competitions

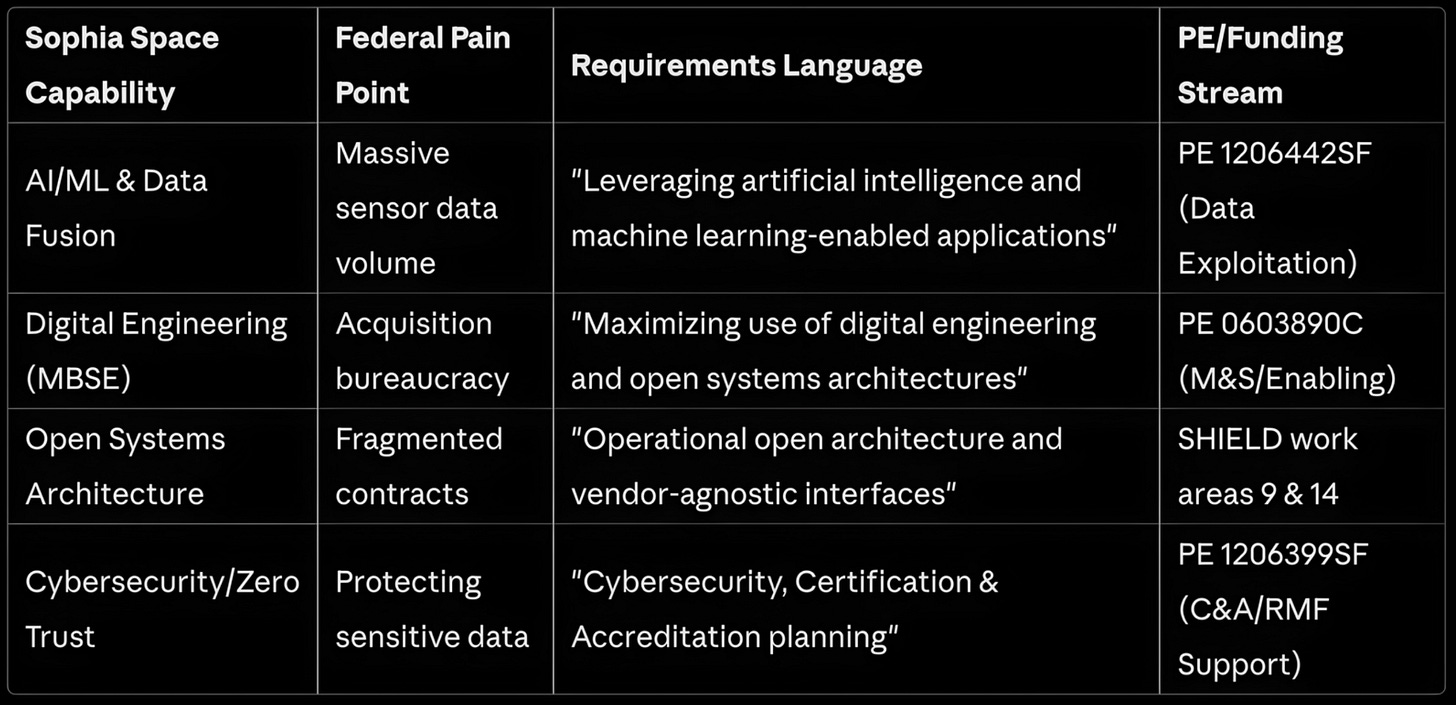

4️⃣ CAPABILITY ALIGNMENT

The $151 billion SHIELD opportunity is fundamentally about solving three critical MDA pain points: speed, digital integration, and AI-enabled decision advantage. Let me map out how innovative capabilities align with these needs.

Capability to Federal Requirement Translation Matrix

Technology-to-Requirement Mapping

Technical Translation and Opportunity Fit

What’s fascinating about SHIELD is how explicitly MDA calls for the exact capabilities that innovative companies excel at. The mandate for AI/ML isn’t buried in some sub-requirement; it’s front and center in the budget justifications. Digital engineering isn’t a nice-to-have; it’s a cultural mandate from Lt. Gen. Heath Collins himself.

The shift to Open Systems Architecture particularly interests me. MDA is deliberately trying to avoid vendor lock and enable rapid technology insertion. This architectural shift creates natural insertion points for modular, standards-based solutions.

Why This Matters

This alignment confirms that where non-traditional firms excel - AI/ML, agile development, cloud-native architectures - are precisely the capability gaps MDA is most aggressively funding. The challenge isn’t whether your technology fits; it’s articulating it in MDA’s language and proving you can deliver at their required speed and scale.

Ways to Leverage This

Reframe Commercial Technology: Use MDA terminology like “cloud-based battle management decision support systems”

Target PE-Specific Language: Align proposals with explicit terminology from highest-funded Program Elements

Emphasize Speed to Field: MDA values “fielded in 90 days” over “perfect in 2 years”

5️⃣ ADVANCED OPPORTUNITY PIPELINE

Accessing the $151 billion requires understanding not just what to pursue, but when. Federal funding follows predictable cycles, and timing your moves to these rhythms can mean the difference between winning and watching from the sidelines.

Multi-Track Pipeline: Converting IP & Partnerships into Federal Revenue

Parallel Pursuit Timeline

Advanced Opportunity Tracking

The spending data shows clear patterns you can exploit. Looking at the historical obligations, September consistently shows spending spikes of $700M+ in this category. This isn’t coincidence; it’s the federal fiscal year-end push to obligate budgeted funds.

Why This Matters

The parallel pursuit strategy is essential because no single pathway guarantees success. By pursuing multiple tracks simultaneously, you de-risk entry and maximize your chances of being in the right place when high-value task orders drop. The companies that win will be those that start building credentials now for the Q4 FY26 surge.

Ways to Leverage This

Prioritize Q2/Q3 FY26 Obligations: Prepare for competitive RDT&E surge submissions

Formalize Partner Commitments: Lock in teaming agreements before December 2025 awards

Stack Credentials Aggressively: Use every available mechanism to build prime contract history

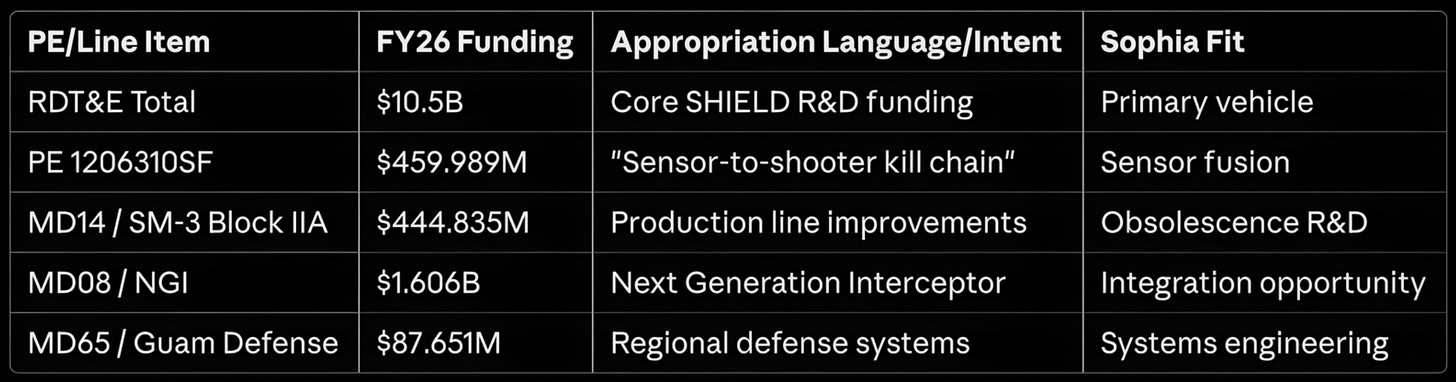

6️⃣ FY26 BUDGET INTELLIGENCE

The FY26 budget documents provide definitive proof that the U.S. government is actively funding the adoption of missile defense modernization as a strategic imperative. Let me break down where the money is actually going.

Budget Flow Analysis: Congressional Intent to Program Obligation

FY26 MDA Budget Allocation

Appropriations Cycles and Obligation Patterns

The funding surge is real and accelerating. The total MDA FY26 request of $13.2 billion represents a 27% increase over FY25. But here’s what’s really interesting: the $3 billion in supplemental funding is specifically tied to the Golden Dome initiative. This isn’t baseline spending that might get cut; it’s politically prioritized funding with bipartisan support.

Why This Matters

This budget analysis confirms that the Orbital Edge Computing sector is underpinned by a guaranteed funding stream. The explicit Congressional language using terms like “sensor-to-shooter kill chain” and “hyper-converged edge computing” proves the government is funding precisely the solutions innovative companies offer.

Ways to Leverage This

Target Explicit Budget Language: Frame proposals using exact justification language from PEs

Time Submissions to Cycles: Align with Q2/Q3 obligation patterns for maximum capture probability

Focus on Mandated Programs: Target congressionally directed programs with guaranteed funding

To Wrap Up

This week’s analysis confirms that the MDA SHIELD IDIQ represents the definitive acquisition mechanism for the $151 billion Golden Dome initiative. The fundamental challenge for innovative companies can be summarized in one key tension: MDA desperately wants innovation and explicitly calls for non-traditional companies, yet the past performance requirements effectively exclude most startups from direct participation.

The good news? There are legitimate, proven pathways around this barrier. The companies that will capture significant SHIELD revenue over the next decade are those that start building credentials now through SBIR Phase III conversions, OTA transitions, and strategic partnerships with likely IDIQ winners.

Key Lessons I Learned

Prime Status is the Ultimate Currency: Without verifiable prime contract past performance, you’re locked out of the biggest opportunities. SBIR Phase III and OTA production contracts are your fastest paths to legitimacy.

Timing Beats Technology: Having superior technology means nothing if you miss the narrow windows when funding flows. Q4 federal fiscal year surges are predictable and exploitable.

Compliance Determines Playing Field: CMMC 2.0 compliance and Facility Clearance aren’t administrative tasks; they’re operational prerequisites that take 6-12 months to achieve.

Speed is the Ultimate Capability: MDA Director Lt. Gen. Collins’s mandate to field capabilities “as absolutely fast as possible” creates competitive advantage for agile companies.

Strategic Considerations

For those evaluating SHIELD and similar opportunities, success requires systematic execution aligned with federal rhythms:

Mandate Credentialing as a Funding Milestone: Treat SBIR Phase III and OTA production contracts as non-dilutive milestones that de-risk your defense thesis.

Anchor to Budget Velocity: Focus BD efforts on capturing task orders aligned with the most accelerated PEs and Q3/Q4 obligation surges.

Master the Compliance Timeline: Start CMMC 2.0 and FCL processes now. These are 6-12 month endeavors that gate access to classified work.

Leverage the Neoprime Model: The Anduril/Palantir consortium provides a playbook for accessing large opportunities through strategic integration.

Building This Playbook Together

I would love to hear your feedback. Are there specific NAICS codes/PSCs or procurement challenges you’re wrestling with?

This methodology evolves with every conversation. I trace the money from congressional authorization through appropriation to obligation, revealing opportunities 6-12 months before RFPs drop.

Your feedback directly shapes next week’s analysis. Reply with suggestions or reach out directly.

Connect with me:

in

Data current as of November 8, 2025. Analysis based on FY26 defense budget documents, SAM.gov active opportunities, USAspending.gov & FPDS contract data for NAICS 541715 & PSC AC13 (FY24-25), and MDA public information.

Disclaimer: This analysis is not paid advice or sponsored content. The views, research, triangulation methodology, and analytical frameworks presented are solely those of Ross Facione. This newsletter represents independent analysis using publicly available data sources. All strategies and recommendations should be validated with appropriate legal and procurement professionals before implementation.

Didnt expect this take. AI for defense, huge budget.